There are some awesome features in the Bollinger Bands that can not be found in any other indicator. Before talking about the the way we can use Bollinger Bands, lets see what kind of indicator it is, and how it looks like. If you don’t have Bollinger Bands on your chart, please add them and let the settings to be the default settings which is 20, 0, 2.

Bollinger Bands are consist of three lines: Bollinger Upper Band, Bollinger Lower Band and Bollinger Middle Band.

Bollinger Middle Band is nothing but a simple moving average. Bollinger Upper and Lower Bands measure deviations. I can bring their formula here, but it will not have any usage for your trading. The only thing we should know is that they are so strong in locating the trends and reversals.

Combining the candlesticks patterns with Bollinger Bands, creates a great trading system that shows the strongest continuation and reversal trade setups. And below are 10+ Best Forex Tricks : How to Use Bollinger Bands in Forex Trading.

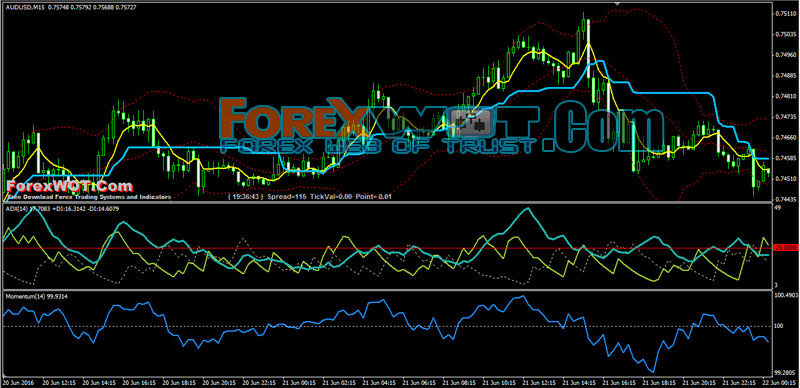

Forex Bollinger Bands Momentum ADX Technical Analysis Trading

Forex Bollinger Bands Momentum ADX Technical Analysis Trading. Technical analysis is a trading tool employed to evaluate securities and attempt to forecast their future movement by analyzing statistics gathered from trading activity, such as price movement and volume.

Unlike fundamental analysts who attempt to evaluate a security’s intrinsic value, technical analysts focus on charts of price movement and various analytical tools to evaluate a security’s strength or weakness and forecast future price changes.

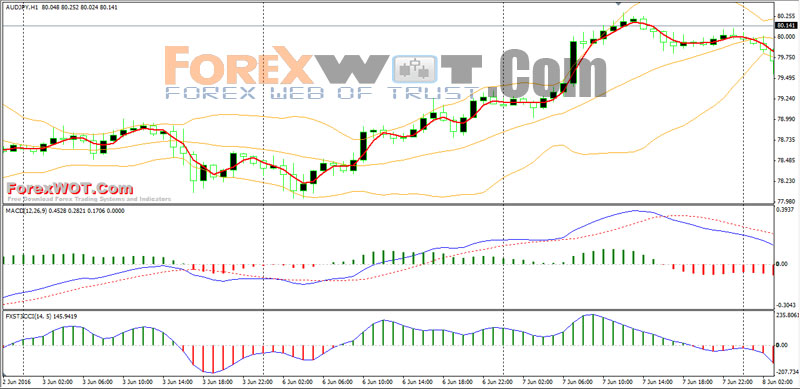

Trading Forex With Bollinger Bands and MACD (BB-MACD Trading System)

DOWNLOAD BBMACD Trading System – Bollinger Bands® consist of a center line and two price channels (bands) above and below it. The center line is an exponential moving average; the price channels are the standard deviations of the stock being studied. The bands will expand and contract as the price action of an issue becomes volatile (expansion) or becomes bound into a tight trading pattern (contraction).

[sociallocker]

[/sociallocker]

At the core, Bollinger Bands® measure and depict the deviation or volatility of the price. This is the reason why they can be very helpful in identifying a trend. Using two sets of Bollinger Bands® – one generated using the parameter of “1 standard deviation” and the other using the typical setting of “2 standard deviation” – can help us look at price in a different way.

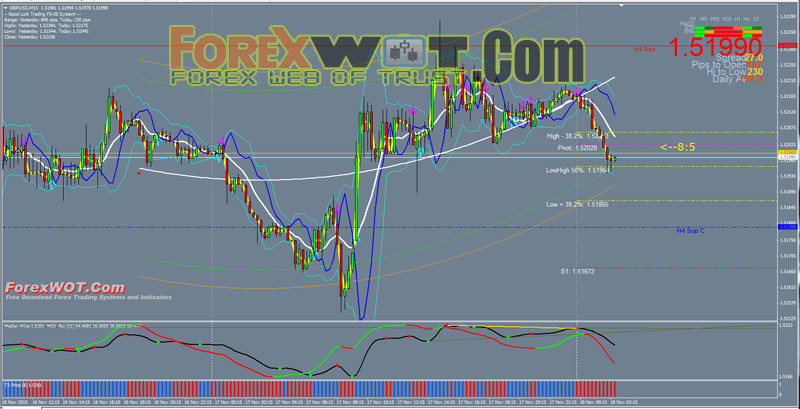

Bollinger Bands Forex Trading Strategy With Trend Power Curve Custom Indicator

Bollinger Bands Forex Trading Strategy – Bollinger Bands® are a technical chart indicator popular among traders across several financial markets. On a chart, Bollinger Bands® are two “bands” that sandwich the market price. Many traders use them primarily to determine overbought and oversold levels.

One common strategy is to sell when the price touches the upper Bollinger Band® and buy when it hits the lower Bollinger Band®. This technique generally works well in markets that bounce around in a consistent range, also called range-bound markets. In this type of market, the price bounces off the Bollinger Bands® like a ball bouncing between two walls.

Trend Power System is an indicator strategy with dynamic channel support / resistance levels. Can be used on any currency pairs and all time frames. But I would still prefer the H1. There, I think, more reliable signals.

Forex Bollinger Bands Stop Intraday Trading System and Strategy

How to made 1380 pips in just three weeks trading. Forex Bollinger Bands Stop Intraday Trading System and Strategy – As usually we use very primitive entry rules (nothing fancy).

[sociallocker]

[/sociallocker]

If you do not know where to place your SL (Stop Loss) of the trade Bollinger Bands Stop Indicator is the right place for you!

When trading you should always set SL (Stop Loss) to some position where price can retrace and continue in your profit. If you set SL too close to your order then PA wont have necessary space to retrace and your SL will get hit. If you set it too far away then you risk vs reward is too big to bother with the order. So Bollinger Bands Stop Indicator will help you with all of the above issues.

Forex Bollinger Bands Super Reversal Trading System With Supporting ADX Indicator

Forex Bollinger Bands Super Reversal Trading System – This Forex Bollinger Bands Super Reversal trading system is a momentum reversal strategy. This trading system is good for trading also for binary options high/Low and One touch.

Forex Bollinger Bands Wave Trading System

Decided to share how I trade. Few things about me.I was a degenerate sport gambler for 5years betting from collage hoops,football,baseball mostly. I would be up one week in thousands and be down next week in thousands.Had no real understanding of % wagered vs account size until I lost all my money.

[sociallocker]

[/sociallocker]

Stopped completely. As faith would have it I somehow end up trading forex. Made all the rookie mistakes blown few accounts and my 3rd year finally started to make money.

Before I continue I like to emphasize knowledge and experience are important. Reading trading books helps on weak areas specially on psychology subjects like unable to take a small loss and letting it to become massive loss,unable to let profits run,moving stops etc.

This is critical because without work on one’s self no system irregardless of profitability will make you money because you are dealing with not just the market but your own demons.

How to Get 200 Pips A Week Easily Use Bollinger Bands in Forex and Stock Trading

200 Pips A Week Easily – How to Use Bollinger Bands in Forex and Stock Trading. You may experiment with other currency pairs, but in general it works on the H1 timeframe with all major pairs.

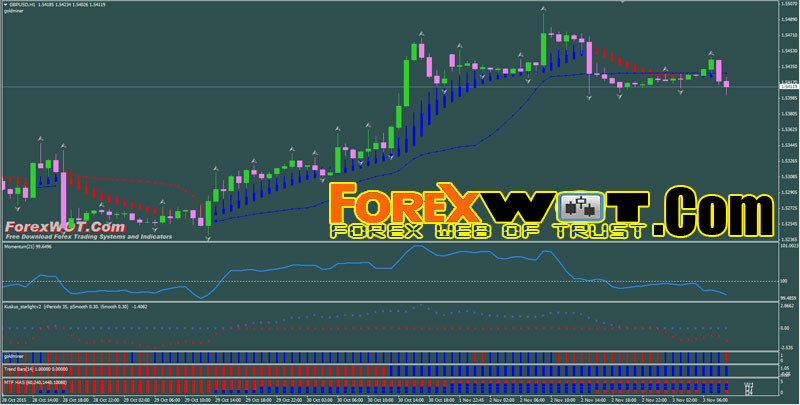

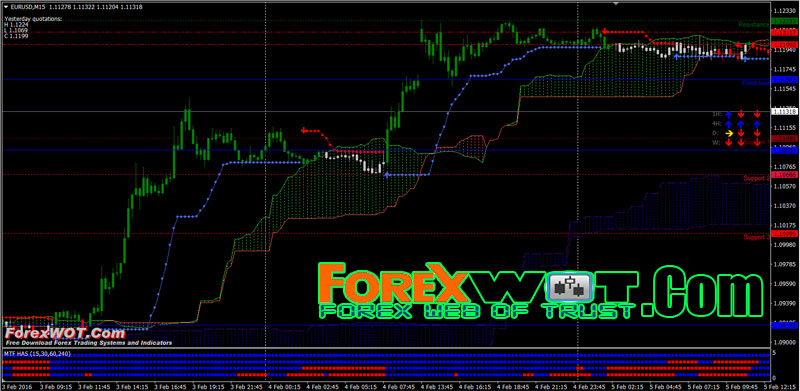

M15 Double Ichimoku Cloud Forex Trend Trading System with BBands Stop and 4 MTF HAS Bars Indicator

Advanced High Profits M15 Double Ichimoku Cloud Forex Trend Trading System. Ichimoku splits the chart clearly into buying and selling momentum so that you can identify and trade in the direction of overall momentum and avoid those career-ending large losses.

In the beginning, the same new forex trader, i tried a lot of indicators and systems, but i ended up with ichimoku cloud indicator which you can find at any MT4 indicator. ichimoku cloud attracted me and gave me a consistent signal and profit.

This double Ichimoku Cloud system works well on any market, any timeframe. I use it to trade forex on the M15.

The Ichimoku system is a moving average based trade identification system. It is quite elaborate and novice traders might find it difficult to read. However, in this trading system we are only using two core components which is Ichimoku Kumo and BBands Stop, since the information they provide is sufficient for the kind of market conditions we want to identify.

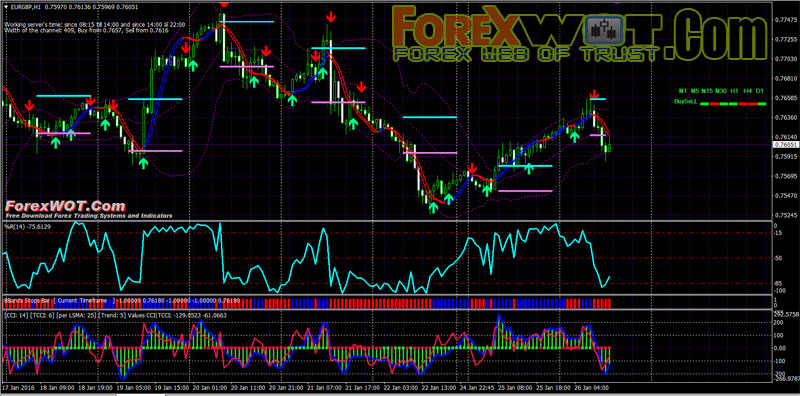

Forex Williams Percent Range Trading Strategy with Bollinger Band Stops Bars and TriggerLines Indicator

Forex H1 Williams Percent Range Trading Strategy – In technical analysis, this is a momentum trading system measuring overbought and oversold levels, similar to a stochastic oscillator. Williams %R was developed by Larry Williams and compares a stock’s close to the high-low range over a certain period of time, usually 14 days.

[sociallocker]

[/sociallocker]

Williams %R is used to determine market entry and exit points. The Williams %R produces values from 0 to -100, a reading over 80 usually indicates a stock is oversold, while readings below 20 suggests a stock is overbought.

Successful Forex Triple CCI Trading System and Strategy With BBands Stop Indicator

Forex Triple CCI Trading Strategy – Forex Triple CCI Trading System and Strategy With BBands Stop Indicator is based on the CCI and Fisher function with other indicators trend following.

Commodity Channel Index (CCI) – Developed by Donald Lambert and featured in Commodities magazine in 1980, the Commodity Channel Index (CCI) is a versatile indicator that can be used to identify a new trend or warn of extreme conditions.

Lambert originally developed CCI to identify cyclical turns in commodities, but the indicator can successfully applied to indices, ETFs, stocks and other securities. In general, CCI measures the current price level relative to an average price level over a given period of time.

CCI is relatively high when prices are far above their average. CCI is relatively low when prices are far below their average. In this manner, CCI can be used to identify overbought and oversold levels.

Forex Bollinger Band Stop with RSI Filter Trend Following Trading Strategy

Bollinger Band Stop with RSI Filter is a trend following multi time frame strategy based on the Bollinger Band Stop indicator and RSI Filter.

How to use Bollinger Band Stop:

- The first stop is when there is a trend change, the stop is set to the same as the opposite side bb. Then it stays the same as the band as long as the band is going in the direction of the trend, but then when the bb changes direction, it stays level, just like any other trailing stop. Look at the first blue dot in your picture, the close of that bar is above the previous bars red line = trend change. Then it stays level as the bottom bb goes down.

Time Frame: 15 min or higher.

Markets: Currency pairs (majors), Indicies (S&P 500, Nasdaq, Dow Jones, DAX, FTSE) Commodities (Silver, Gold and Oil).