FREE DOWNLOAD 5 BEST Forex Trading Systems – The Most Effective Ways to Manage Your Open Forex Trades Better. In forex trading, actively managing open positions is just as important as coming up with your plan. Here are FREE 5 BEST Forex Trading Systems and three tips to help you manage your active trades.

1. Stay in touch with the market.

Whether you’re a hardcore technical or fundamentals trader, or maybe a little bit of each, you can’t deny that economic reports influence price action. This is why it pays to keep tabs on the events that pose risks to your trades.

Some say that the market’s reaction to the news is more important than the news itself. But how can you make the most out of a reaction if you have no idea about the news event?

Don’t forget to always pay attention to potential game-changers that might invalidate or at least divert from how you expect your trade to play out.

2. Be flexible with your trading plan.

If you have read the School of Pipsology then you should already know how important it is to be flexible with your trading plan. Of course, being “flexible” doesn’t mean being totally spontaneous and not following your initial plan at all. It just means that you’re making adjustments based on factors that have changed since you made your initial plan. Below are 5 recommended forex trading systems foryour trading plan…

2.1 Forex Trading Strategy Based on The ADX Currency Strength Indicator

Best and High Profitable Forex Trading Strategy Based on The Currency Strength – This scalping system is a strategy based on the currency strength (JPY, USD, CAD, EUR, CHF, AUD, GBP, NZD). The best time frame 15 -60 min but this method can also be configured on other time frames.

Average Directional Index (ADX) is used to quantify trend strength. ADX calculations are based on a moving average of price range expansion over a given period of time. The default setting is 14 bars, although other time periods can be used.

ADX can be used on any trading vehicle such as stocks, mutual funds, exchange-traded funds and futures. (For background reading, see Exploring Oscillators and Indicators: Average Directional Index and Discerning Movement With The Average Directional Index – ADX.)

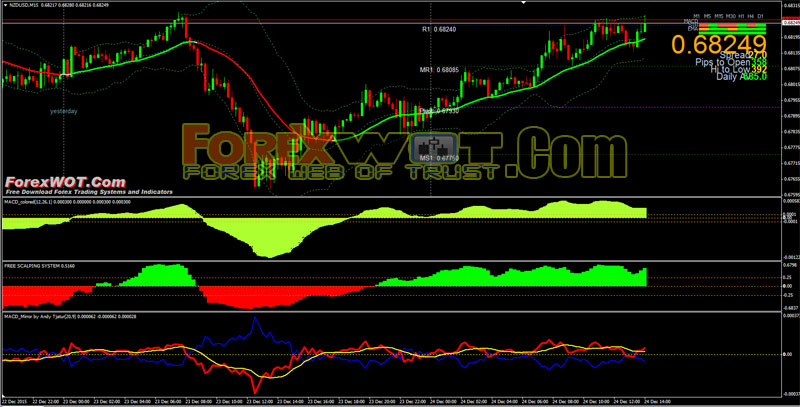

2.2 Very Profitable Forex MACD Scalping System and Strategy

Forex MACD Scalping System is a very profitable trend-momentum system. This settings for MACD is awesome. It´s very accurate! And easy to follow the rules..!

As a versatile trading tool that can reveal price momentum, the MACD is also useful in the identification of price trend and direction. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Used with another indicator, the MACD can really ramp up the trader’s advantage.

2.3 Trading Strategy Based on High Accuracy Different Signals

Forex Trend Magic Intraday Trading is a Simple and Effective Forex Intraday Trading Strategy Based on High Accuracy Different Signals.

Trend Magic is a custom indicator that combines CCI and ATR in what turns to be quite similar to a moving average in the chart. Simple, the line turns red when CCI readings are below -50 (which points for a dominant bearish trend) and blue, when CCI is above 50, suggesting then a bullish continuation in the pair. The ATR indicator is added to step the line towards the price.

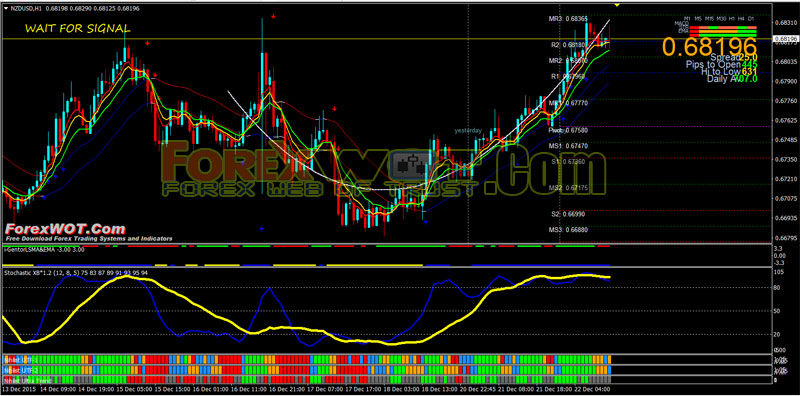

3.4 Forex Nihilist Stochastic Oscillator Trading System

Forex Nihilist Stochastic Oscillator Trading System – is trend following and price action strategy based on the Nihilist, Stochastic Oscillator, and MA Trend with I-regression indicator.

[sociallocker]

[/sociallocker]

‘Stochastic Oscillator‘ – A technical momentum indicator that compares a security’s closing price to its price range over a given time period. The oscillator’s sensitivity to market movements can be reduced by adjusting the time period or by taking a moving average of the result. This indicator is calculated with the following formula:

%K = 100[(C – L14)/(H14 – L14)]

C = the most recent closing price

L14 = the low of the 14 previous trading sessions

H14 = the highest price traded during the same 14-day period.

%D = 3-period moving average of %K

2.5 Simple Trend Following Forex Relative Vigor Index

Forex Relative Vigor Index with Profit Suprame Custome Indicators is a trend following strategy for trading intraday based on trend indicators.

[sociallocker]

[/sociallocker]

‘Relative Vigor Index – RVI’ – An indicator used in technical analysis that measures the conviction of a recent price action and the likelihood that it will continue. The RVI compares the positioning of a security’s closing price relative to its price range, and the result is smoothed by calculating an exponential moving average of the values.

So….

Being flexible requires you to constantly check the validity of your setups as time passes by. Also, keep in mind that the longer you keep your trade open, the more you expose it to different event risks. How long did you initially plan to keep your trade open? Is your setup still valid after a few hours, days, or even weeks?

Let’s say you spot a potential double top on AUD/USD as an intraday trade. You shorted at the “top” and wait for the price action to go down. But after a few trading sessions you see that the pair is just ranging near your entry level. Is your “double top” still valid, or should you take your profits early?

3. Update your orders and position sizes.

Just because you have the ideal reward-to-risk ratio and the “fool-proof” trading plan doesn’t mean that you shouldn’t also tweak your order levels and position sizes. Remember, you want to minimize your risk.

If one or two factors in your trading plan don’t go your way but you think your idea still has merit, you might want to cut back on your position sizes. On the other hand, if you find that the price action turned out to be better than what you expected, you could also consider adjusting your stop losses or taking partial profits. It would be a lot better if these adjustments are included in your initial trading plan in the first place, but better late than unprofitable, right?

Keep in mind these three simple tips when you trade so you don’t end up wasting your well-thought of trading plans. Before you know it, these practices will have already turned into habits!