FREE DOWNLOAD Forex GBP-USD Trading Systems. As the GBP USD is one of the most fickle, volatile, and unpredictable currency pairs, it also is known to raise many a false and bogus alarms, fake breakouts and wild movements.

This is one of the main reasons that traders are often warned that unless he or she is an experienced currency trader and has seen several seasons in the trading market he should not even try trading this currency..

Best 5 Forex GBP USD Trading Systems

Without meaning to sound discouraging it is advised that it will actually do an aspiring professional a lot of good if she/he doesn’t start her/his career as a Forex trader trading GBP USD. Below are Best 10 Forex GBP USD Trading Systems and How to Trade GBP USD Wisely and Properly.

1 – QQE Advanced ADX Trading System

Forex QQE Advanced ADX Trading System – is a trend following trading system filterd by QQE new histo alerts indicator and Advanced ADX.The purpose of this method is to filter the most number of false signals to increase the profitability of the Trading System.

Advanced ADX – This is an advanced version of the Average Directional Movement Index (ADX) indicator. This indicator shows ADX indicator in another easy way. Buy when Bars is Green, Sell When Bars is Red.

The advanced ADX indicator is based on the Average Directional Movement Index (ADX). ADX basics: +DI above -DI means positieve trend. -DI above +DI means negative trend. ADX values above +23 suggest strong trends.

2 – London Session Forex CCI Fibonacci Retracement Trading System and Strategy

Forex CCI Fibonacci Retracement Trading – The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

[sociallocker]

[/sociallocker]

Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period.

Understanding the CCI Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average (MA), or, more specifically, normal deviations from that average. The actual CCI calculation, shown below, illustrates how this measurement is made.

3 – Forex MA-RSI Filter Trading System and Strategy With Flat Trend Indicators

Forex MA-RSI Filter Trading System is trend following trading method. These Templates are also good for trading with Binary Options.

Forex MA RSI Filter Trading System Metatrader Indicators:

- 2 sets of exponential moving averages, divided by three3(EMA) moving averages, the first 3 periods (orange red line), the second of 21 periods (magenta line) and the third of 55 periods (yellow line).

- Forexinn Anatoly a modified version of 3 Level ZZ Semafor, more a little dashboard of the trend direction;

- Dyamic Wave of Moving average arrow.

- Pivot Points Levels.

- RSI Filter

- Flat Trend

- FX Trend

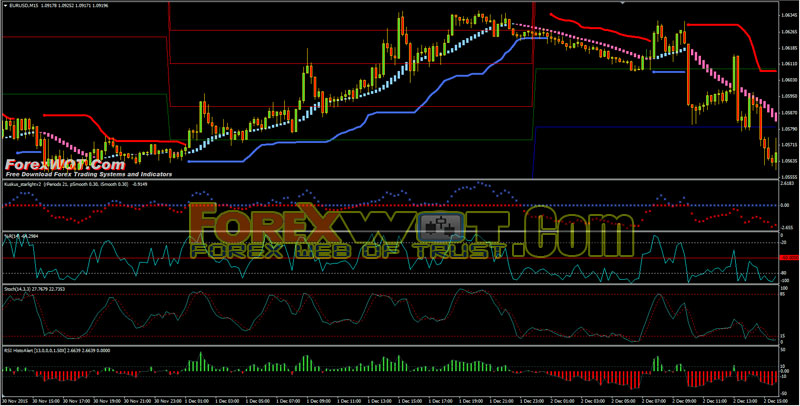

4 – Forex Kuskus Heiken Ashi Moving Average Trading System and Strategy

High Profits Forex Trading System and Strategy – This Forex Kuskus Heiken Ashi Moving Average Trading System is a trend-momentum forex strategy because it is composed of trend indicators and momentum indicators.

[sociallocker]

[/sociallocker]

Best Time Frame: 15 min or higher.

Currency pair: any.

Forex Kuskus Heiken Ashi Moving Average Indicators:

- Bollinger Bands Stop indicator (15, 2);

- RSI histo Indicator (14 period) + 2 levels (+12, -12);

- William’s percent range (14 Period);

- Starlight indicator (rperiods 21, p.smooth 0.30, ismooth 0.30);

- Hama (Heiken Ashi Moving Average) pad V.2 (3 ,21,3) optional;

- Stochastic indicator (14,3,3,);

- Pivot Points Daily.

The main indicators in this trading system are Kuskus, HAMA, and RSI Histo. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength.

5 – Forex Moving Average CCI Trading System

Simple, Powerful and Effective Forex Trading System – Forex Moving Average CCI Trading System With Trend Reversal Indicator. This is trend following strategy based on retracement trading method. Time Frame M15, M30, H1 ,H4 and Daily rime frame.

Forex Moving Average CCI Trading Metatrader Indicators:

- SFX MLC (5,6,2,0,);

- Signal Bars – its one of the best indicators that is always on my charts

- CM;

- LC-FX Sipers

- FXST3 CCI indicator (14,4).

How to Trade GBP USD Wisely and Properly

There is no such method or formula or situation that can guarantee to bring trading GBP USD risk to zero. Especially more so in this pair particularly because trading in GBP USD and involves reasonable risk and this pair is hardly suitable for all types of forex traders.

7 Questions to Ask Yourself Before Trading GBP USD:

- Find out the present market Sentiment in GBP USD

- Identify the immediate Strongest Resistance for GBP USD

- Identify the immediate Strongest Support for GBP USD

- Check out consequences of a day pair closing below the certain expected level

- Identify an ideal position for taking Short Position

- Identify position for taking Long Position?

- What will be trader’s action plan if stop loss is triggered for long position and what would be the next step?

Understanding & Benefiting From Co-relation of Currency Pairs:

To become a winner at Forex, one’s insight into portfolio’s sensitivity vis-à-vis market movement and volatility is crucial. This sounds particularly relevant when one is trading currency, because currencies are priced in set of twos’ called pairs, and the investors have to understand that no matter what the market condition is – it is not possible for any single currency of the currency pair to get traded independent of the other.

Once a trader becomes aware of these interdependence intricacies and correlations and how one is likely to impact the other, and once he understands how situations can become absolutely different as market takes a sudden turn, shot, sway, or a dip – a trader will feel more in control and sync which will help to make the best use of correlation concept.

Since the Swiss Franc, Euro, and the British pound Sterling share a positive/favorable vibe or correlation with each other the result is that EURO/USD currency pairs develops a positive leaning with our pair. On the other hand GBP USD shares a negative leaning or correlation with the USD/CHF.

Regardless of trader’s trading style or strategy and irrespective of whether he is looking to branch out or expand his positions or find alternate or more pairs of similar nature to leverage the view, it is important to remember the correlation that exists between various currency sets or currency pairs and their ever changing movements and leanings.