Best high profits trading with the 50 & 200 EMA for H4 and Daily time frame trading strategy – For traders looking for a trend following strategy, there is nothing better and simpler than using the 50 & 200 Moving Average.

One of the commonly used indicators, the Moving Averages form the basis for many different trends following strategies.

In this trading strategy, we make use of the 50 & 200 periods Exponential Moving Average applied to the 4-hour and daily charts. This strategy does not rely on the moving average cross over but rather enters the trend after it is established and exists for a quick profit.

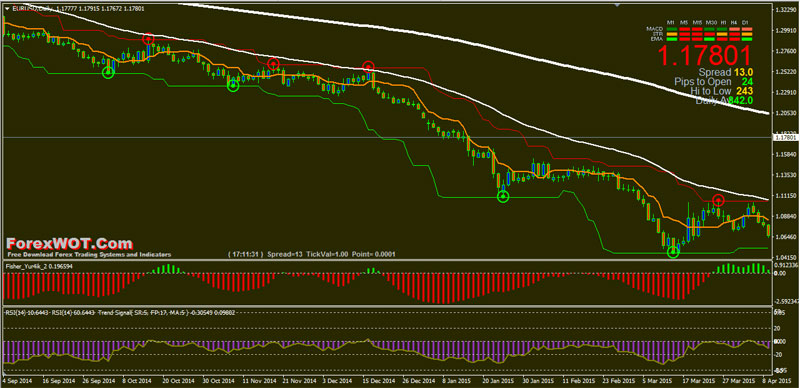

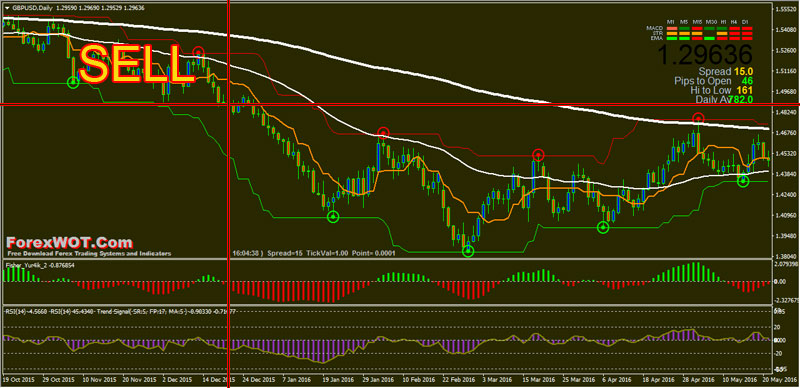

The chart above shows the set up for this trading system and strategy. Once the chart is set up, we look for the following criteria:

- SELL Bias: 50 EMA must have recently crossed over below the 200 EMA

- BUY Bias: 50 EMA must have recently crossed over above the 200 EMA

The trading strategy is very objective but requires a bit of practice to identify the trade set ups.

- Best Time Frames: H4 and Daily

- Recommended Currency Pairs: GBPUSD, EURUSD, USDJPY, and All Major Pairs

- 50 Exponential Moving Average

- 200 ExponentialMoving Average

- Renko Street Channel

- Tenkan-Sen Ichimoku Kinko Hyo

- Signal Trend

- Fisher

- RSI

- Trend Signal

- 50 EMA upward and above 200 EMA

- Price must be trading at or above the 50 EMA

- Price must make a high and then retrace back to make a low but stay above the 50 or 200 EMA

- Fisher Yu4rik Green bars and above 0 level

- RSI upward above 50 level

- Green circle below the previous swing low

- 50 EMA downward and below 200 EMA

- Price must make a low and then retrace back to make a high, contained within the 200 and 50 EMA

- Fisher Yu4rik Red bars and below 0 level

- RSI downward below 50 level

- Red circle above the previous swing high

- Using the two Exponential Moving Averages and entering after the trend is established offers a low-risk trading strategy

- The inbuilt risk management means that all the trades come with a minimum of 1:2 risk/reward trading strategy

- Because the strategy is based on H4 chart or daily chart interval, the average holding period for the trades can be between a few days to a week at the most

- The trading strategy is very objective but requires a bit of practice to identify the trade set ups

[sociallocker]

[/sociallocker]

interest with this system.. gonna learn this for a couple week