FREE DOWNLOAD Best and Simple Forex Strong Trade Setups : Tenkan-Sen Kijun-Sen Reversal Trading System and Strategy. The Tenkan-Sen is generally used in combination with the Kijun-Sen to create predications of future momentum.

A BUY signal is created when the Tenkan-sen line moves above the Kijun-Sen, while a SELL signal is created when the Tenkan-Sen line moves below the Kijun-Sen line.

Many technical traders use the Tenkan-Sen as a tool for predicting levels where the price of the asset will find short-term support.

When reading Ichimoku Kinko Hyo charts, investors should note that the Tenkan-Sen line leads the Kijun-Sen, and tracks price with more sensitivity because it covers a shorter period of time.

When the Tenkan-Sen line crosses and moves above the Kijun-Sen line, this is generally considered a bullish signal. Alternatively, when the Tenkan-Sen line crosses below the Kijun-Sen line, it is considered a bearish signal.

Tenkan-Sen Kijun-Sen Reversal Trading Rules

Tenkan-Sen : The Tenkan-Sen, as indicated earlier, is most commonly used in conjunction with the Kijun-Sen to generate buy and sell signals.

The formula for its calculation takes the highest high and the lowest low and divides it by two. It is calculated over the past seven to eight time periods.

Kijun-Sen : The Kijun-Sen is typically viewed as a trigger line for traders that implement the Ichimoku cloud method.

Its calculation is identical to that of the Tenkan-Sen, except for the fact it accounts for the past 22 time periods, allowing for a much more accurate gauge on long-term momentum.

Tenkan-Sen Kijun-Sen Reversal Trading System and Strategy is an easy reversal trading system but highly effective to make profits.

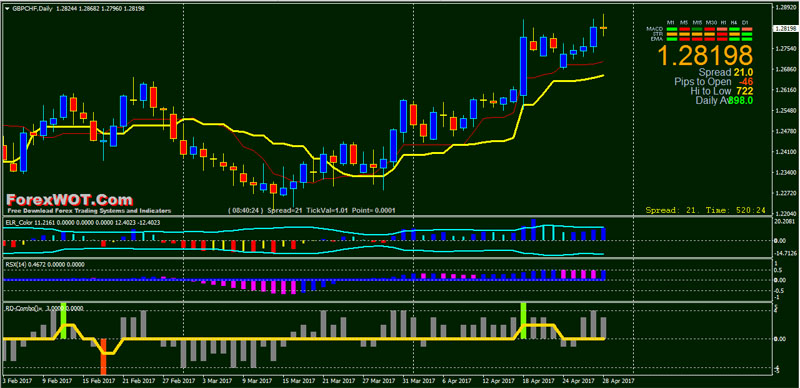

- Best Time Frame : 60 min or higher;

- Recommended Markets : Forex and Indicies.

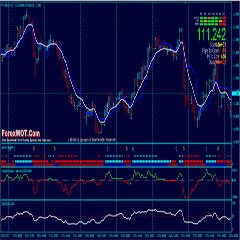

Metatrader Trading Indicators

- Ichimoku Tenkan-Sen Kijun-Sen

- ELR color modified version

- RSX(14 periods)

- RD Combo

- Signal Trend

BUY (Reversal) Rules

- When the price upward above BUY signal Tenkan-Sen Kijun-Sen, wait that RSX has blue bar and ELR color retraces into the the bands and has Aqua bar. If these conditions are agree buy call at the opening of the next bar.

- RD Combo bars above 0 level.

- Signal Trend green bars.

SELL (Reversal) Rules

- When the price downward below SELL signal Tenkan-Sen Kijun-Sen, wait that RSX has magenta bar and ELR color retraces into the the bands and has Yellow bar. If these conditions are agree sell call at the opening of the next bar.

- RD Combo bars below 0 level.

- Signal Trend red bars.

EXIT Rules

For exit positions you have these options:

- Place initialt stop loss on the previous swing;

- Profit Target predetermined with ratio 1:2 or 1:3 stop loss.

Trading Note

How do I build the confidence to trade a system in real account?…

Fortunately, that’s an easy answer.

There’s just one way to know: TESTING.

Before I ever use a strategy, I will have tested it for weeks.or for months. It’s not an extremely difficult process but it does involve a lot of works.

[sociallocker]

[/sociallocker]