CCI Trading Strategy – Double CCI Forex Trading Method with Heiken Ashi Smoothed. The CCI has seen substantial growth in popularity amongst technical investors; today’s traders often use the indicator to determine cyclical trends in not only commodities, but also equities and currencies.

The CCI, when used in conjunction with other oscillators, can be a valuable tool to identify potential peaks and valleys in the asset’s price, and thus provide investors with reasonable evidence to estimate changes in the direction of price movement of the asset.

CCI measures the statistical variation from the average. It is an unbounded oscillator that generally fluctuates between +100 and -100. Traders use the CCI in a variety of ways. Three common uses are:

- CCI in retracements

- CCI on breakouts

- CCI in divergent trades

This article will be the first of three regarding common uses of CCI and will focus on how to use this oscillator in retracements.

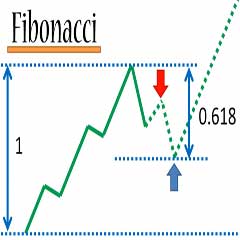

CCI in Retracements

Approximately 70-80% of the values tend to fall inside the +100 to -100 range. Above the +100 value is considered overbought while below the -100 value is considered oversold.

As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels.

Therefore, if values stretch outside of the above range, a retracement trader will wait for the cross back inside the range before initiating a position.

Rules to trade a CCI retracement

First identify the direction of the prevailing trend. If you are trading off of a 4 hour chart, determine the direction of the daily trend. If you are trading off a 15 minute chart, determine the direction of a trend on the 1 hr chart.

Forex Trading Method with Double CCI is an trading method based on the CCI two CCI indicators with asctrend and 4X sema indicator (alias 3 level zz semafor indicator).

Forex indicators

- WSS,

- CCI Bars,

- 4X sema indicator,

- 5 Days BreakOut,

- Smoothed Heiken Ashi,

- Asctrend indicator,

- CCI indicator periods 66,

- CCI indicator periods 133.

Lets go to the rules for Double CCI Retracement Forex Trading Method with Heiken Ashi Smoothed.

- Price above blue Smoothed Heiken Ashi;

- Sema signal (green circle);

- ASCtrend signal indicator (yellow arrow) appear;

- CCI indicator periods (66) >100;

- CCI indicator periods (133) >0.

- Price below blue Smoothed Heiken Ashi;

- Sema signal (red circle);

- ASCtrend signal indicator (pink arrow) appear;

- CCI indicator periods (66) <-100;

- CCI indicator periods (133) <0.

- At he opposite arrow of Asctrend Indicator;

- Profit Target predetermined 20-25 pips that depends by currency pairs.

- Initial stop loss on the previous swing.

CCI Retracement NOTES:

Up Trends

If the trend is up, wait for the CCI to move below -100 (oversold territory) and cross back above -100 to create a buy signal. Place your stop loss just below the swing low. Look to take profits at least twice the distance to your stop loss so you are maintaining at least a 1: 2 risk to reward ratio.

Down Trends

If the trend is down, wait for the CCI to move above the +100 (overbought territory) and cross back below +100 to create a sell signal. Place your stop loss just below the swing high. Look to take profits at least twice the distance to your stop loss so you are maintaining at least a 1: 2 risk to reward ratio.