FREE DOWNLOAD Bill Williams Alligator Multi Trend Signal Trading System and Strategy. The Alligator indicator is a trend indicator which was created by Bill Williams and is thus classified as a Bill Williams indicator under the MT4 indicator suite.

The indicator was created as a means to identify trend changes using the behaviour of each of the three components of this indicator.

The indicator was discussed in Bill Williams’ book known as “Trading Chaos“.

The Alligator is made up of the following components:

- 13-day Simple Moving Average with a shift setting of 8 (blue colour)

- 8-day Simple Moving Average with a shift setting of 5 (red colour)

- 5-day Simple Moving Average with a shift setting of 3 (green colour)

The colours used in the moving average settings serve to distinguish them for clarity.

This is one of the few indicators that employs a triple moving average in-built strategy.

Bill Williams Alligator Multi Trend Signal Trading Rules

The alligator indicator can be used in the following ways:

- To trade the change in the trend of the asset as a result of the cross of the red SMA component of the alligator over the blue moving average component.

- The alligator can also be used in conjunction with other indicators, especially the momentum indicators, to detect the strength of the new price action.

Forex MetaTrader Indicators

- Bill Williams Alligator

- Colored Candles

- Signal Trend

- TMS Osc Cross

- Multi Trend Signal

- Relative Strnght Index

- Woodies CCI

Best Time Frame :

- H1 for IntraDay trading

- H4 or higher for Short Term Swing Trading

BUY Rules

- Alligator BUY. How to get Alligator BUY signal?…

We will search for buy entry when price moves above alligator indicator. Then we will wait for retrace of the price.

When price will touch alligator and form bullish candle, then we will get buy signal.

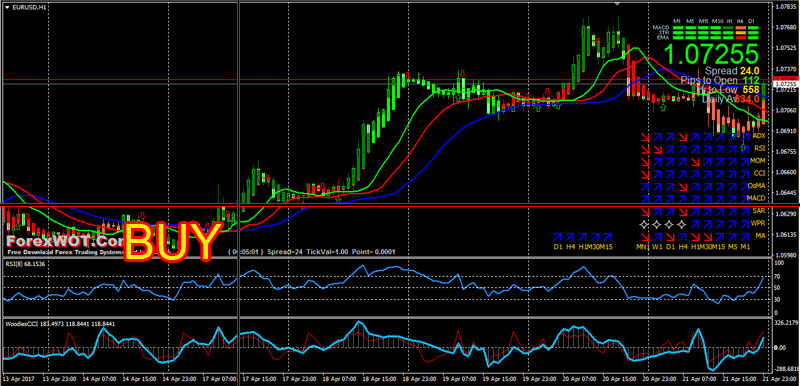

Look at the example of buy signal setup in the above chart example.

Price touched yellow moving average and at the point we will take buy entry. Thus we will find buy entry until price stays above alligator.

- Colored Candles green color

- Signal Trend green color

- TMS Osc Cross green arrow

- Multi Trend Signal blue color

- Relative Strnght Index line upward and above 0 level

- Woodies CCI above 0 line

SELL Rules

- Alligator SELL. How to get Alligator SELL signal?…

We will search for sell entry when price falls below alligator indicator. Then we will wait for retrace of the price to move up.

When price will touch alligator and form bearish candle, then we will get sell signal.

Look at the example of sell signal setup in the above chart example.

Price touched alligator and at the point we will take sell entry.

Thus we will find sell entry until price stays below alligator

- Colored Candles red color

- Signal Trend red color

- TMS Osc Cross red arrow

- Multi Trend Signal red color

- Relative Strnght Index line downward and below 0 level

- Woodies CCI below 0 line

Take profit and Stop loss

Take profit should be 50-120 pips. When any signal hits 50 pips, then you need to move your stop loss at entry point and wait for final take profit.

Stop loss should be placed above swing high for sell signal and below swing low for buy signal.

Risk Warning

Don’t use this strategy on ranging market and avoid news time trading.

You have to follow money management theory for following this strategy. Use this strategy on demo account and then apply this on real account.