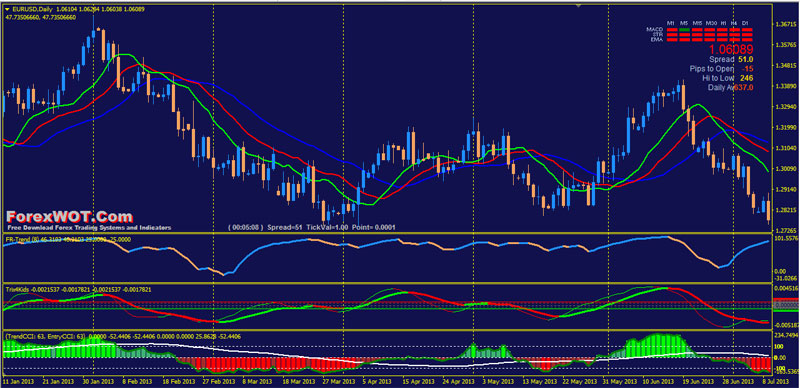

High Accuracy Forex Alligator System and Strategy – Bill William’s Alligator Indicator provides a useful visual tool for trend recognition and trade entry timing, but it has limited usefulness during choppy and trendless periods. Market players should confirm buy or sell signals with a MACD (Moving Average Convergence-Divergence) or another trend identification indicator.

The Alligator indicator uses three smoothed moving averages, set at five, eight, and 13 periods, which are all Fibonacci numbers.

The initial smoothed average is calculated with a simple moving average (SMA), adding additional smoothed averages that slow down indicator turns.

Three moving averages comprise the Jaw, Teeth, and Lips of the Alligator, opening and closing in reaction to evolving trends and trading ranges:

- Jaw (blue line on examples) – starts with the 13-bar SMMA and is smoothed by eight bars on subsequent values.

- Teeth (red line on examples) – starts with the eight-bar SMMA and is smoothed by five bars on subsequent values.

- Lips (green line on example) – starts with the five-bar SMMA and smoothed by three bars on subsequent values.

The indicator applies convergence-divergence relationships to build trading signals, with the Jaw making the slowest turns and the Lips making the fastest turns.

The Lips crossing downward through the other lines signals a short sale opportunity while crossing upward signals a buying opportunity.

The three lines stretched apart and moving higher or lower denote trending periods in which long or short positions should be maintained and managed. This is referred to as the alligator eating with mouth wide open.

Indicator lines converging into narrow bands and shifting toward a horizontal direction denote periods in which the trend may be coming to an end, signaling the need for profit taking and position realignment. This indicates the alligator is sated.

The indicator will flash false positives when the three lines are crisscrossing each other repeatedly, due to choppy market conditions. According to Williams, the alligator is sleeping at this time, telling market players to remain on the sidelines until it wakes up once again.

This exposes a significant drawback because many awakening signals within evolving ranges will fail, triggering whipsaws and shakeouts.

ForexWOT Alligator Trading Rules

As with any technical indicator, an Alligator chart will never be 100% correct.

False signals can occur, but the positive signals are consistent enough to give a forex trader an “edge”.

Skill in interpreting and understanding Alligator signals must be developed over time, and complementing the Alligator tool with another indicator or pattern of pricing behavior is always recommended for further confirmation of potential trend changes.

BUY Rules

- The alligator eating with mouth wide open (candles upward above aligator).

- FR Trend Blue color.

- Trix4kids indicator green line.

- Tren CCI green histogram.

SELL Rules

- The alligator eating with mouth wide open (candles downward below aligator).

- FR Trend red color.

- Trix4kids indicator red line.

- Tren CCI red histogram.

Exit position with profit target predetermined or make profit with ratio 1:2 or 1:3 , initial stop loss on the previous swing.