How to Use High Accuracy Elliot Wave Oscillator indicator to Predict Forex Moves – Elliot wave theory states that prices move in “waves” which are nothing more than the direction in which a price is heading.

This tool allows you to categorize move into 3 with trends or impulse moves and two corrective moves or retracements before price likely changes its underlying structure.

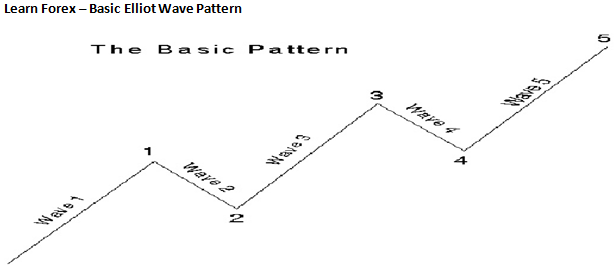

Here is a non-specific chart on what Elliot Wave looks like:

Waves or impulses are where trends occur. As a trader, trends are your friend.

However, identifying trends worth trading is a different manner all together.

Identification in real time is where most traders get frustrated and give up the process of using Elliot Wave.

We encourage you not to stop digging when you’re three feet from gold and rather learn ways to identify wave patterns that work best for you.

The Elliott Wave Oscillator (EWO) is a specific tool to help you identify the trend and the overall market pattern to assist in finding future trading opportunities.

Elliot Wave Guiding Principles

Before we go on to identify and learn how to use the EWO indicator to help you trade with Elliot Wave, I’d like to go on to share with you three Elliot Wave principles all 5 wave impulses follow:

- Wave 2 does not fall below the starting point of Wave 1. If that happened you’d still be I the prior trend.

- Wave 3 is not the shortest wave in terms of price as compared to wave 1 or 5.

- Wave 4 does not overlap the range of Wave 2.

With the principles in mind, let’s apply the Elliot Wave Oscillator keeping the default parameters.

Using the Elliot Wave Oscillator (EWO) to Predict Forex Moves

This oscillator produces a strong correlation with patterns of the Elliot wave. The key take away when using the EWO is that the strongest readings will show you where the 3rd wave lands on the chart.

The EWO will work in all time frames but it is recommended you have a large enough sample of price for the oscillator to work effectively.

You can decide to label the chart yourself but you’ll begin to see the waves without the labels through practice.

If you know where you are in the Elliot Wave process, you will often find yourself trading in the direction of the underlying market force. This feels like swimming with the tide which is close to paradise for a trader.