Simple and high profits Forex Heiken Ashi Moving Average Trading System. The purpose of Heiken Ashi Smoothed Charts is to filter noise and provide a clearer visual representation of the trend.

For new traders the trend is easier to see, and for experienced traders the Heiken Ashi Smoothed Cart help keep them in trending trades and able to spot spot reversals, while still being able to see traditional chart pattern setups.

Heikin-Ashi Smoothed Charts help traders view trends and spot potential reversals. Therefore, they are most applicable to trend traders.

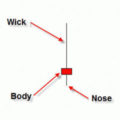

Heiken-Ashi Smoothed Candles use the open/close values from the prior period and the open-high-low-close values from the current period to create a special Haiken Ashi Smoothed Candle. The result is filtered candlestick out of some noise in an effort to better capture the trend.

Heikin-Ashi Smoothed represents the average-pace of prices. Heikin-Ashi Smoothed Candles are not used like normal candlesticks. Multiple of buy or sell reversal patterns consisting of 1-3 candles are not found. But instead, these candlesticks can be used to identify trending periods, potential reversal points and classic technical analysis patterns.

The Heikin-Ashi Smoothed technique is really useful for making candlestick charts more readable, trends can be detected and found a lot more easily, and buying/selling opportunities can be spotted at a glance. When you use Heiken Ashi Smoothed Indicators properly, this technique can help you spot trends and trend changes from which you can gain some pips!…

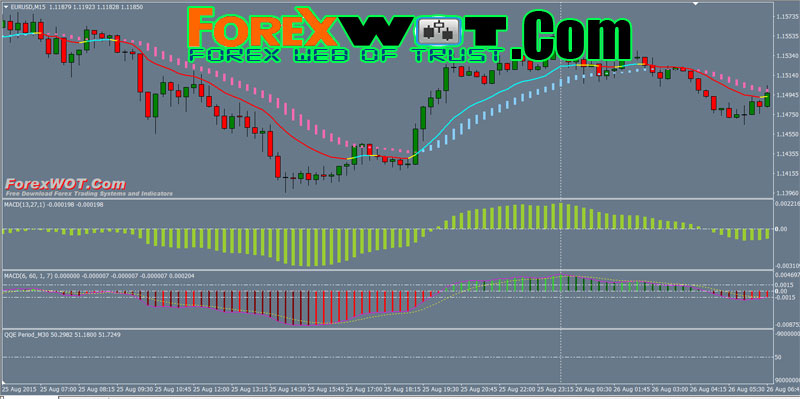

This is a trend following trading system based on the Smoothed Heiken Ashi MA, MACD indicator with QQE indicator filter MTF.

Best Time Frame : 15min or above.

Trading Sesssion: from 7 until 17 GMT + 0:00

Pairs traded: Eur Usd , Gbp Jpy ,Gbp Chf Eur/Jpy , Aud/Usd and Gbp/Usd.

Metatrader Indicators:

- Heiken Ashi Smoothed MA (HAMA2) indicator;

- Moving Average in Color;

- MACD indicator (13,27,1);

- MACD with EMA (Exponential Moving Average) (6,60,1,7);

- QQE indicator (14 with time frame 30).

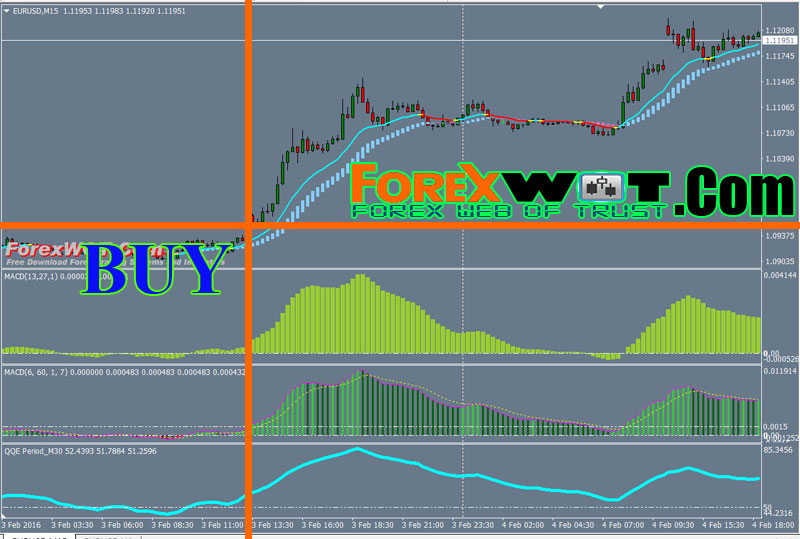

- Price above HAMA2 and HAMA2 is green;

- Moving Average in Color is green and above HAMA2.

- MACD prints a green bar above the zeroline .

- MACD and EMA prints a green bar that is above 0.004 (this is currency specific).

- QQE Period_M30 above 50 level.

- BUY at the close of candle. Stop at the immediate swing low.

- Price below HAMA2 and HAMA2 is red;

- Moving Average in Color is magenta and below HAMA2.

- MACD prints a green bar below the zeroline .

- MACD and EMA prints a red bar that is belowe 0.004 (this is currency specific).

- QQE Period_M30 below 50 level.

- SELL at the close of candle. Stop at the immediate swing high.

Heikie-Ashi Smoothed charts appeal to traders because trends are easier to spot. Traditional forms of technical analysis and chart patterns can still be used and traded with Heiken Ashi Smoothed.

Trading on Heikin-Ashi Smoothed charts is similar to trading on other charts. Focus on trading in the direction of the overall trend. Use Heiken Ashi Smoothed price bar characteristics to determine trend strength, when the trend is slowing down and apply other technical analysis concepts (such as trendlines) to isolate major price reversals. Apply stop loss orders to trades, and use slowdowns in the trend as exit points, or wait for a major reversal if a longer-term trader. Pre-determined profit targets can also be used.

its a good indicator.

thank you