High-Probability Aroon Up-Down System – This is a very simple and easy Multiple Time Frames Trading and Analysis. Once you have identified the trend (on higher time frame (ex. Weekly)), you now need to identify profitable trading signals (on your trading chart (ex. H4)).

Does Multiple Time Frames analysis offer an edge?… The first question that comes to mind when talking about multiple time frame analysis is its effectiveness and whether this approach offers any value to the trader, or gives an edge.

The simple answer is YES; but only when applied correctly.

At any given time, short-term scalpers and long-term fundamental traders are looking at the same currency pairs and are trying to determine how to place or adjust their trades.

However, while they may be looking at the same currency pairs, they are not looking at the same chart time frames.

Short-term traders are most likely looking at 1-minute to 15-minuted currency charts, while long-term traders are most likely looking at daily to monthly charts.

Multiple Time Frames (MTF) analysis is considered to be one of the most robust technical analysis models, where in, the trader analyses at least two or more different time frames in order to draw up a trading plan.

For the average trader, multiple time frame analysis could seem to be a bit complicated due to the various time frames involved.

But with a disciplined approach a trader could very well incorporate multiple time frame analysis with ease.

Of course, with multiple time frame analysis, the biggest issue with “Analysis Paralysis” With multiple time frame analysis, it is easy for a trader to end up over-analyzing their charts resulting in analysis paralysis; the moment where you end up being confused or end up with conflicting views of the markets all together.

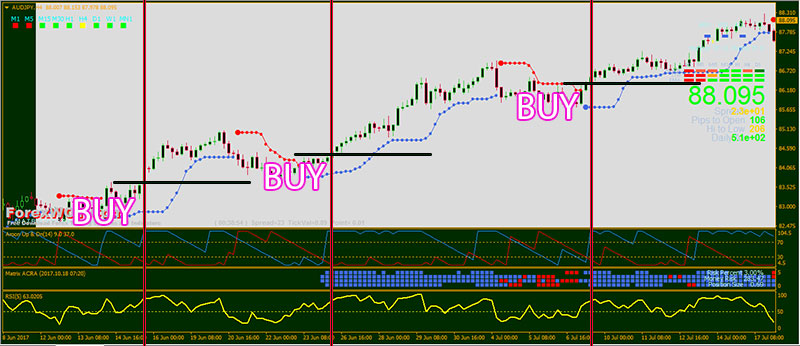

Take a look at the illustration from the charts of the AUDJPY below.

In this example we take a look at the AUDJPY currency and apply weekly and H4 multiple time frame analysis to find a better level of entry and this minimize risks.

Long Term trend analysis shows that AUDJPY is in a confirmed uptrend (weekly time frame chart).

This simply tells you that the next and a few candles could close bullish.

But at which price would you enter long?

Do you simply enter long at the open of the next weekly candle and risk the retracement that generally applies?…

The answer is on the H4 Time Frame chart

Once you have identified the trend on the weekly time frame chart, you should go down to H4 time frame chart to find appropriate trading signals (in this case we should find high probability BUY signals).

With multiple time frame analysis in forex your entry can be timed such that you minimize your risk while maximizing your profits.

The charts above illustrate one such example of how multiple time frame analysis helps.

Besides the above example, traders can use multiple time frame analysis in different ways, some of which are summarize below:

Indicator based: One of the simples and common uses of MTF is based on indicators.

- Example, if the RSI indicator gives a BUY signal on the Weekly chart, then the trader would shift to H4 chart and wait for a BUY signal to be triggered which helps in timing.

Price Action: Support/Resistance, trend lines etc. are also commonly used to apply multiple time frames analysis in order to fine tune the entries.

Traders usually make note of higher time frame support/resistance levels and trend lines and use them as profit targets or stop loss levels while use the lower or smaller time frame support/resistance levels and trend lines for entering new positions.

When traders consider multiple time frame analysis, they should also take into account the time it takes for holding the trades.

The table below should give a quick summary for traders:

This is a great trading system and example of how to apply technical analysis using Multiple Time Frame charts in your Forex trades.

Practice until this becomes your second nature.

[sociallocker]

[/sociallocker]

Thankyou

This is such an informative article on forex trading systems utilizing frame analysis. The forex trading benefits are brilliant. Hopefully, this will one day become second nature.