Super Easy Forex Investing and Forex Trading Strategy With Double MACD and Momentum Indicator – MACD is an acronym for Moving Average Convergence Divergence. This tool is used to identify moving averages that are indicating a new trend, whether it’s bullish or bearish.

After all, our top priority in trading is being able to find a trend, because that is where the most money is made.

How to Trade Using MACD

Because there are two moving averages with different “speeds”, the faster one will obviously be quicker to react to price movement than the slower one.

When a new trend occurs, the fast line will react first and eventually cross the slower line. When this “crossover” occurs, and the fast line starts to “diverge” or move away from the slower line, it often indicates that a new trend has formed.

Double MACD Momentum Trading Rules

Double MACD trading is a trend momentum strategy multipositions based on Kiads indicator build with MACD and Momentum.

- Best Time Frame : 15 min or higher.

- Currency Pairs : majors and minor.

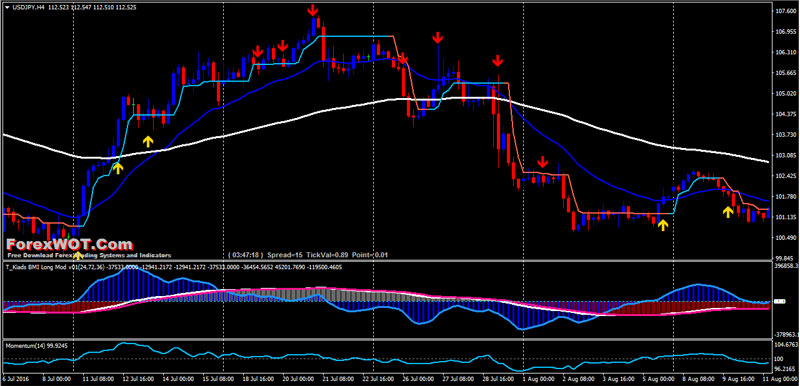

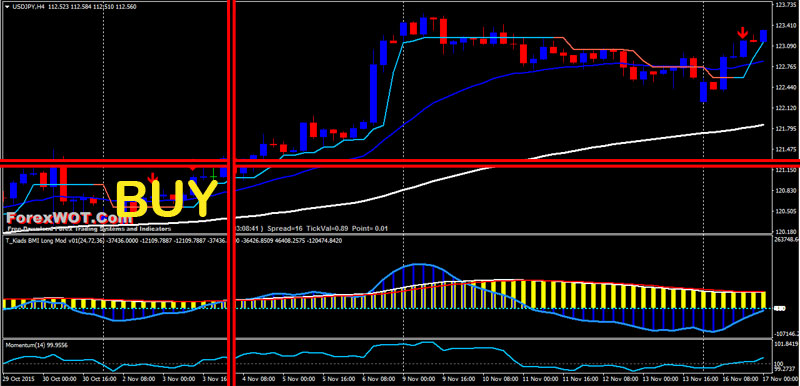

BUY Rules

- When appears the blue BUY arrow below the price,

- The blue line Half Trend Indicator crosses upward above the 13 EMA blue line,

- Half Trend Indicator and the 13 EMA blue line upward above 55 EMA white line,

- Yellow Double MACD and Blue Double MACD above 0 level,

- Momentum line above 100 level.

SELL Rules

- When appears the red SELL arrow above the price,

- The red line Half Trend Indicator crosses downward below the 13 EMA blue line,

- Half Trend Indicator and the 13 EMA blue line downward below 55 EMA white line,

- Yellow Double MACD and Blue Double MACD below 0 level,

- Momentum line below 100 level.

EXIT Rules

- close all the positions at the opposite signal.

- exit with predetermined profit target that depends by time frame and currency pairs with initial stop loss at the previous swing high/low.

MACD Trading Note

There is one drawback to MACD. Naturally, moving averages tend to lag behind price. After all, it’s just an average of historical prices.

Since the MACD represents moving averages of other moving averages and is smoothed out by another moving average, you can imagine that there is quite a bit of lag. However, MACD is still one of the most favored tools by many traders.