How to Use ATR in a Forex Strategy – ATR is considered a volatility indicator as it measures the distance between a series of previous highs and lows, for a specific number or periods.

The ATR indicator was originally designed with commodities in mind, but today it is widely applied to stocks and Forex.

Because ATR does not measure the direction and simply considers the magnitude of range, it has limited utility as a means for generating trading signals. But it is a useful tool for giving an idea about how much a market may move. This, in turn, informs key trading decisions such as position size and stop placement.

The ATR indicator measures volatility. Traders often mistakenly believe that volatility equals bullishness or bearishness. Volatility does not say anything about the trend strength or the trend direction, but it tells you how much price fluctuates.

The ATR just looks at how far price swings and not how much it actually moves into one direction.

- Volatility = How much price fluctuates around the average price. In a high volatility environment, price candles usually have long wicks, you can see a mix of bearish and bullish candles, and their candle body is relatively small compared to the wicks.

- Momentum = Momentum is the exact opposite. Momentum describes the trend strength into one direction. In a high momentum environment, you typically see only one color of candles (very few candles moving against the trend) and small candle wicks.

Combining the ATR (Volatility )with the RSI (Momentum) can tell you so much about the market you are in. Being able to understand which type of market you are looking at, can help you make much better trading decisions.

H2

The ATR not only provides information about the current market state, but it is also a tool that can be used to make trading decisions. Especially when it comes to stopping loss, take profit and trade exit improvements, the ATR can be of great help.

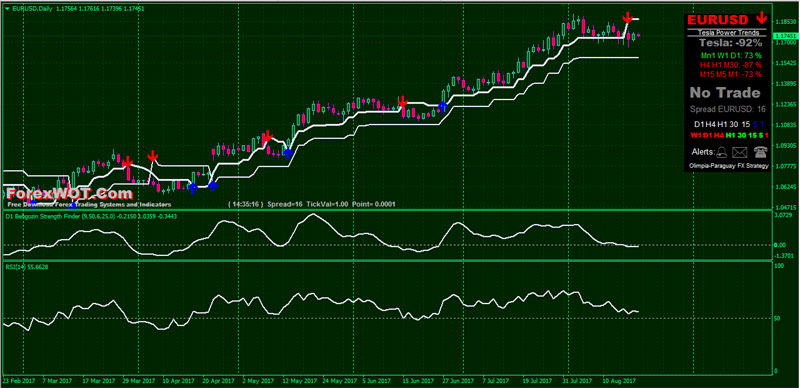

- Best Time Frames: H1, H4, and Daily

- Recommended Currency Pairs: GBPUAS, EURUSD, and GBPJPY

- LURCH (ATR Level Stop)

- Tesla Power Trend

- Behgozin Strength Finder

- Relative Strength Index

- Price upward above ATR Level Stops

- RSI line upward and above 50 level

- Behgozin Strength Finder line upward and above 0.00 level

- Tesla Power Trend Green color

- Price downward below ATR Level Stops

- RSI line downward and below 50 level

- Behgozin Strength Finder line downward and below 0.00 level

- Tesla Power Trend Red color

ATR is not a leading indicator, means it does not send signals about market direction or duration, but it gauges one of the most important market parameter – price volatility.

Forex Traders use Average True Range indicator to determine the best position for their trading Stop orders – such stops that with a help of ATR would correspond to the most actual market volatility.