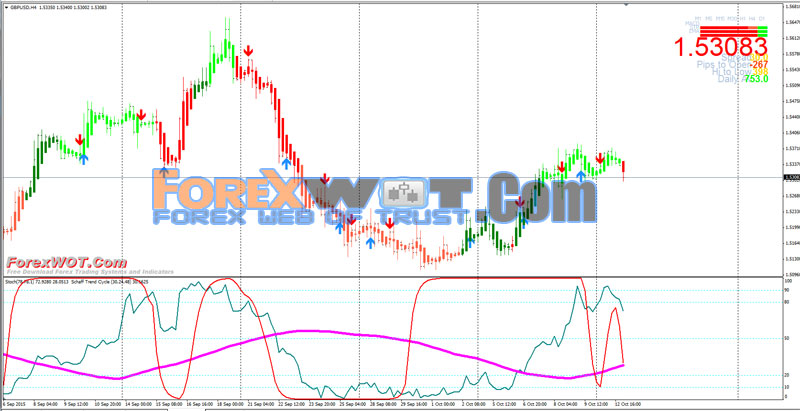

This Advanced Stochastic Oscillator Trading System is a momentum trend fx strategy based on the Schaff Trend Cycle with Slow Stochastic.

DEFINITION of ‘Stochastic Oscillator’ – A technical momentum indicator that compares a security’s closing price to its price range over a given time period. The oscillator’s sensitivity to market movements can be reduced by adjusting the time period or by taking a moving average of the result. This indicator is calculated with the following formula:

%K = 100[(C – L14)/(H14 – L14)]

C = the most recent closing price

L14 = the low of the 14 previous trading sessions

H14 = the highest price traded during the same 14-day period.

%D = 3-period moving average of %K

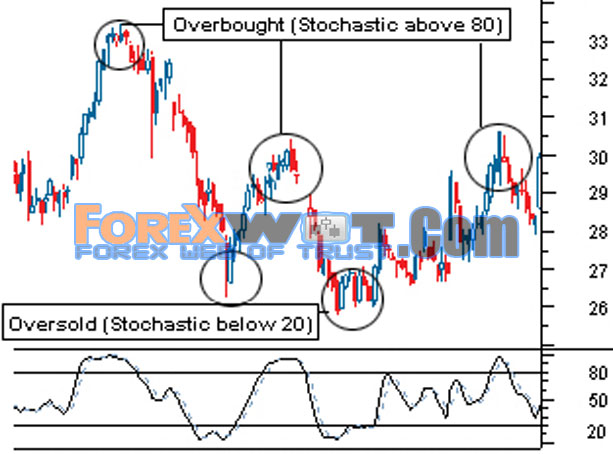

BREAKING DOWN ‘Stochastic Oscillator’ – The theory behind this indicator is that in an upward-trending market, prices tend to close near their high, and during a downward-trending market, prices tend to close near their low. Transaction signals occur when the %K crosses through a three-period moving average called the “%D”.

The Stochastic Oscillator and STC indicators provide you with information on both long‐and short‐term market direction. Together they present a rolling estimate of the market direction on a daily chart while maintaining the shorter term characteristics of hourly price movement. “The trend is our friend.”

Consequently, the combination of these two indicators is ideal for this approach to trading the Forex, as we are usually trading in the direction of the dominant trend. However, there are times when you can trade against the trend, taking advantage of a retracement or probable change in market direction.

- Time Frame: 15min or higher.

- Currency pairs: Majors; Indicies: S&P 500, Nasdaq, DAX, FTSE.

- Schaff Trend Cycle (30, 24, 48);

- Stochastic (78,78, 1);

- StochCandles.

- Signals Indicator.

- FX Arrow (you can change this arrow with another, I show two differents arrows ).

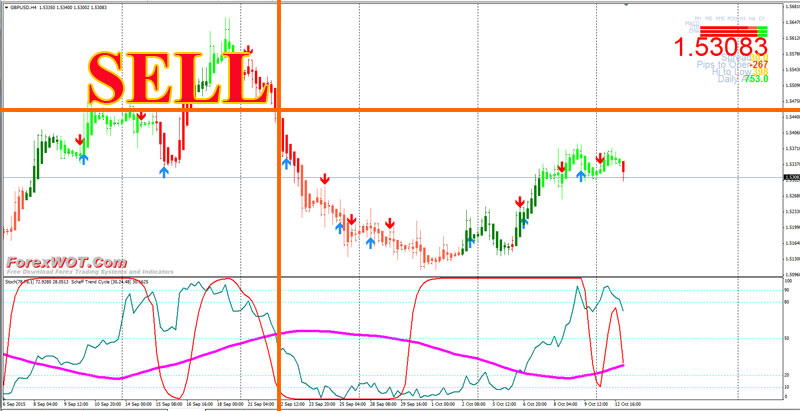

Trade with the trend

- FX Arrow buy confirmed by Stochastic line above the signal line and Schaff Trend Cycle is above the level 25.

- StochCandles green

- Signals indocator green

- FX Arrow sell confirmed by Stochastic line below the signal line and Schaff Trend Cycle is above the level 75.

- StochCandles red

- Signals indocator red

Exit position with profit target predetermid that depends by time frame and currecy pairs.

We recommend trading at a max of 1% per trade and 4% total on all currency pairs you’re trading. If you are trading only one calibrated pair, you could trade at 4%. If you are trading two calibrated pairs, you could trade each at 2%.

If you are trading 3 calibrated pairs, you could trade each at 1.33%. Finally, if you are trading 4 calibrated pairs, you could trade each at 1%. HOWEVER, you, and only you, can decide the amount of risk that is best for your circumstances and trading style.