I have been trading for a living as an individual trader for more than 15 years now. I have an engineering background but I decided that this field was not for me. Like you, I was lucky to realize very quickly that a 9-5 job was not for me. I am a dreamer and I cannot stand a 9-6 job with a hierarchy, etc…So I decided to to jump over the fence and to make a living as a full time trader.

In order to be successful and profitable, you really need to consider the trading activity like any other business. It is not a game. It is not a gamble. It is not fortune telling. As an individual trader, you are an entrepreneur like any other entrepreneur. You are using your own money. If you fail, you lose all your money like any other business.

The main advantage of trading is that it is accessible to any one who is willing to learn and to work hard. A lot of people are confused. Trading will not make you become multi millionaire overnight. But it will generate comfortable income everyday and forever. I know some “friend” traders who are former soccer player, former engineers, former executives, former welders, etc…

Like any other business, you need a few things to start:

- Initial capital investment

- Process and System

- Skills set

INITIAL CAPITAL INVESTMENT

In order to start making money, you need to spend some time and some money to learn. It has a cost. You need to open a trading account with a major broker. Usually there is a requirement for an initial deposit. The choice of the broker is dictated by the type of products that you are willing to trade. Most brokers are specialized by products (forex, CFD, Options, etc…).

PROCESS AND SYSTEM

In any company, in order manufacture and deliver the products you need to follow a process or a system in order to be able to deliver the products to the customers and to be profitable. Like any other business trading requires you to have or to build a process/system called TRADING SYSTEM.

You can either buy an existing trading system or build your own trading system from scratch. I always recommend beginners to spend time and money to build their own trading system.

By building your own trading system, you fine tune a system perfectly matched with your psychology and your character. Secondly, by building your own trading system, you go through a trial and error process that accelerate your learning curve. Below are 5 recommended trading systems for you…

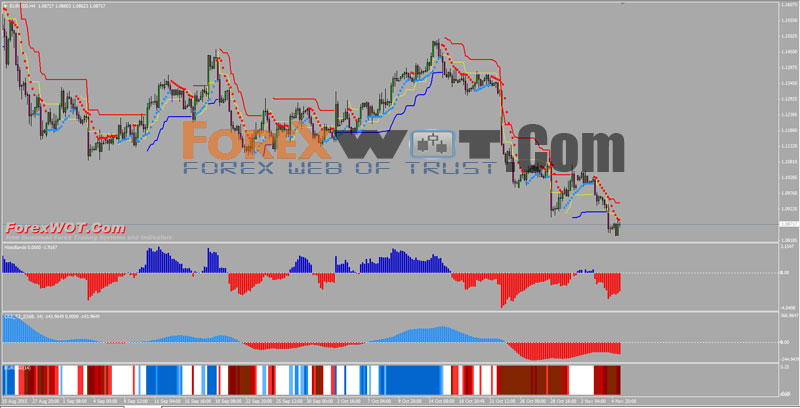

- CCI ATR Forex Trend Follower Trading System Designed For Longer Time Frames

This system is designed for longer time frames, it’s a trend following system that just ride the trend to the maximum profit, you can use shorter time frames but you will be exposed to more market noise, this system works perfectly in H4 and D1 time frame.

This system is made of two basic functions:

- Determining the actual trend (The trend director indicators)

- Determining when to take a position (The trade activator indicators).

Longer ATR stop line = red line;

Shorter ATR stop line = yellow line.

- Forex Super TendLines Trading System With MACD and RSI Indicators

Forex Super TendLines Trading System With MACD and RSI Indicators – Now, let’s get started! To display the system indicators onto your chart, right click on chart then choose: Template >>>> ForexWOT-SuperTrendlines – just like this! Now your chart should look like this one:

Before we move to the trading rules, you must check one thing first… You must specify the time frame you want with the Trend Channel indicator. As I said before, the Trend Channel indicator is to show the trend of the higher timeframe on your mainly traded timeframe.

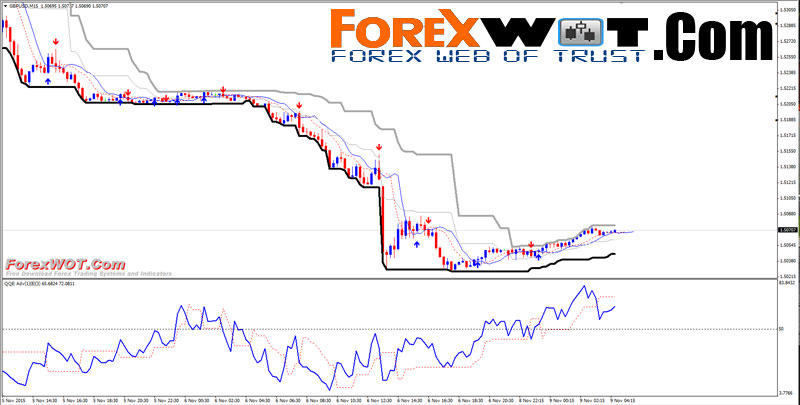

- QQE Adv Dhoncian Channels Forex Trading System and Strategy

QQE MetaTrader indicator — or Quantitative Qualitative Estimation, is based on a rather complex calculation of the smoothed RSI indicators. As a result we get 2 lines in a separate indicator window — fast and slow. There is also an important indicator level (50), which is used in signals. You can enable text, sound and e-mail alerts for this indicator. The indicator is available for both MT4 and MT5.

In the original QQE indicator trading system, the signals are generated when the blue line crosses level 50 and when it crosses the yellow (dotted) line.

- Forex Intraday and Swing Trading With Heiken Ashi Smoothed Indicator Strategy

Forex Trading With Heiken Ashi Smoothed Indicator Strategy – Heiken Ashi Smoothed and BBSqueeze trading system is an forex strategy, trend following that you can use for intraday trading or for swing trading.

- Intraday Trading : Time Frame 30 min

- Swing Trading : Time Frame 60 min and 4H or daily.

- Best Currency Pairs : Majors and Indicies.

Initial Stop loss 30 min and 60 min Time Frame 16-24 pips depends by currency pairs.

Profit Target on the pivots leves or ratio 1.2 stop loss.

- Forex Always Trading in Trend With Alligator Trading System and Strategy

Alligator Trend Trading System and Strategy – Always trading in trend it’s an simple trading system trend following. I tried to confirm this: the trend is your friend,”! Trading trends is fairly straight forward and can lead to profitable trading in the appropriate situation on the right pairs.

[sociallocker]

[/sociallocker]

Time Frame : H1, 4H, and higher.

Financial Markets : Forex, Stocks, Indicies, Commodities.

How to use this trading system with conservative approach…? Find the Currency pairs (also correlated) in trend and apply the template.

SKILL SET

The first skills you need to have is your capability to work hard for a period of 12 months, which is the minimum learning period in order to start becoming profitable.

Then, you need to develop or enhance your patience. Indeed trading includes a lot of waiting/idling time during which you wait for the right configuration of price (according to the rules of your trading system) to happen in order to enter a position.

Then, you need to be very disciplined. You need to follow the rules of your trading system like a robot. Anytime you jump over the rules, you are sure to fail.