Easy High Accuracy Forex Support Resistance Trend Trading System and Strategy. Support and resistance is one of the most widely used concepts in forex trading. Strangely enough, everyone seems to have their own idea on how you should measure forex support and resistance.

Plotting the true and reliable support and resistance lines are a little technical and need more experience. However, there is an easier way to use the support and resistance to trade. You can trade the support and resistance “levels”.

Unlike the support and resistance lines (or trendlines), you do not need to have at least two points to locate a support or resistance level.

In fact, each support or resistance level is simply a low or a high created through the price movement, in bearish, bullish or sideways markets.

Look at the diagram above. As you can see, this zigzag pattern is making its way up (bull market). When the forex market moves up and then pulls back, the highest point reached before it pulled back is now resistance.

As the market continues up again, the lowest point reached before it started back is now support. In this way, resistance and support are continually formed as the forex market oscillates over time. The reverse is true for the downtrend.

We can trade using the below facts:

- To go up, the price has to break above the resistance level, otherwise it will stay below the resistance level, and will either form a range or will go down and form a downtrend. When we have a resistance level, we can go long if the price breaks above this level, because “usually” when the price breaks above a resistance level, it will go higher and will form another peak or resistance level which is higher than the previous one.

- To go down, the price has to break below the support level, otherwise it will stay above the support level, and will either form a range or will go up and form an uptrend. When we have a support level, we can go short if the price breaks below this level, because “usually” when the price breaks below a support level, it will go lower and will form another valley or support level which is lower than the previous one.

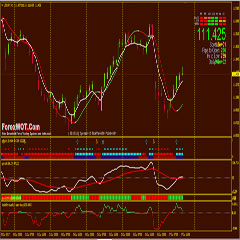

In this sforex strategy there are H4 Support Resistance Indicator, 4 trend indicators and one indicator of momentum (gmt 106).

Metatrader indicators of Golden Trend Slope Trading System :

- H4 Support Resistance Indicator,

- gmt102 (slope indicator green buy, red sell),

- gmt103

- gmt104

- gmt105 (multi time frame filter H1)

- gmt106 (momentum filter indicator)

Best Time Frame : 15 min or 30 min.

Currency pairs: EUR/USD, GBP/USD, AUD/USD, USD/CHF.

Trade when all the indicators are in the same direction.

- The price stay above the H4 support level, go up and form a uptrend, or we can go long if the price breaks above H4 resistance level.

- Blue Super signal,

- Price above blue gmt 102 Moving Average,

- Gmt 105 green,

- White gmt 106 line upward and above red gmt 106 line,

- Market Trend green.

- The price stay below the H4 resistance level, go down and form a downtrend, or we can go short if the price breaks below H4 support level.

- Yellow Super signal,

- Price below red gmt 102 Moving Average,

- Gmt 105 red,

- White gmt 106 line downward and below red gmt 106 line,

- Market Trend red.

Initial stop loss at the opposite swing after the Stop Loss

We use a 20 pips trailing stop. This means that if price goes into +5 pips profit our stop loss will move 5 pips upwards, so the maximum price can go back before we exit the trade is 20 pips.

This is how you can use the support and resistance levels to trade. It is much easier and more mechanical in comparison to support/resistance lines, but you have to keep in your mind that your stop loss will be triggered with any trading system, and there is no trader who can be a winner 100% of the times. Any trading system has a risk level, and the more you practice and gain experience, the higher success rate you will have.