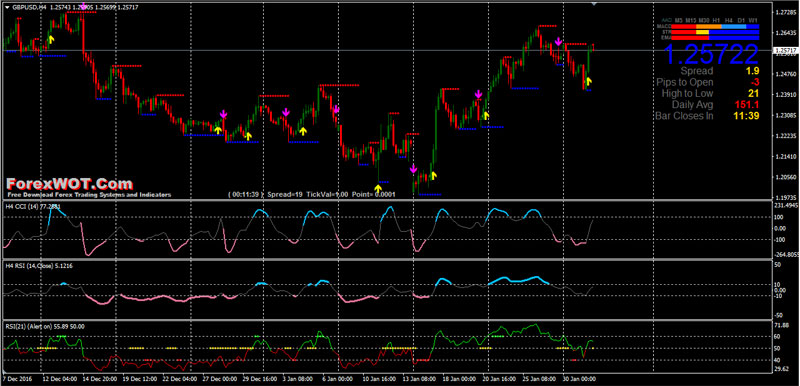

Best Momentum Breakouts Day Trading Strategies – H4 Time Frame No Repaint Profitable Strength of CCI RSI Momentum Forex Trading System. This Strength of CCI RSI Momentum Forex Trading System do not repaint.

This forex tradings rategy is based on RSI and CCI. The combination of these indicators represent a complex but efficient system of filters for trend or trend momentum arrows.

The Relative Strength Index (RSI)

Developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements.

The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 or 60 and oversold when below 30 or 40. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

The Commodity Channel Index (CCI)

Note that the CCI actually looks just like any other oscillator, and it is used in much the same way. (To learn more about oscillators, see Getting to Know Oscillators.) Here are the basic rules for interpreting the CCI:

Possible sell signals:

- The CCI crosses above 100 and has started to curve downwards.

- There is bearish divergence between the CCI and the actual price movement, characterized by downward movement in the CCI while the price of the asset continues to move higher or moves sideways.

Possible buy signals:

- The CCI crosses below -100 and has started to curve upwards.

- There is a bullish divergence between the CCI and the actual price movement, characterized by upward movement in the CCI while the price of the asset continues to move downward or sidesways.

Strength of CCI RSI Momentum Forex Trading Rules

Metatrader indicators for this template, that i share for your gain:

- Signal Bars,

- Asc trend, the use of this indicator is only as an example, you can use other indicators of trends or momentum trend.

- Buy-Sell (price action support and resistance only for visual),

- CCI NRP advanced alert MTF ( CCI period 14, price 5, OS 100, OB -100, this indicator is based on CCI Stochastic.

- RSI smoothed advanced (period 14, level up 10, level down -10, smooth 5,

- RSI TC NEW (21, buy level 50, sell level 50, this indicator is also used in many strategies for binary options high/low).

BEST Time Frame : H4

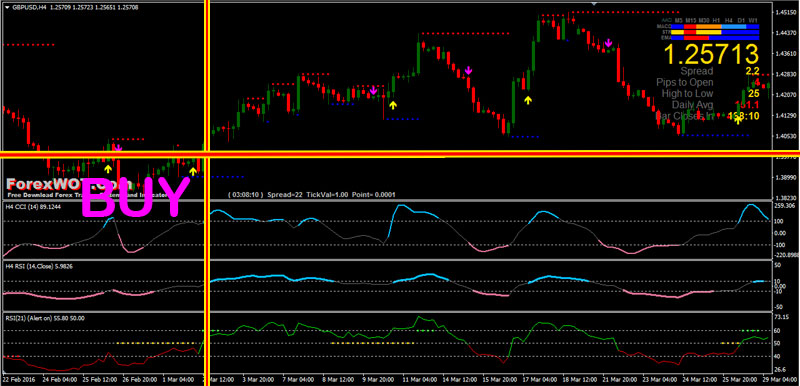

BUY Rules

- Signal Bars Blue.

- Asctrend buy arrow

- Buy-Sell alerts blue dots.

- CCI NRP advanced alert MTF aqua line.

- RSI smoothed advanced aqua line.

- RSI TC New green line.

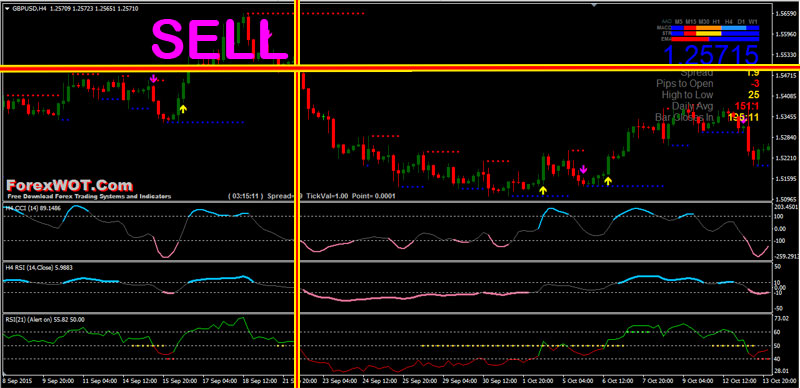

SELL Rules

- Signal Bars Red.

- Asctrend sell arrow

- Buy-Sell alerts red dots.

- CCI NRP advanced alert MTF red line.

- RSI smoothed advanced red line.

- RSI TC New red line.

Exit position with ratio 1:2 or 1:3.

Place initial stop loss on the previouis swing.