Forex Trading Success Tips – How to Become a Self Taught Successful Forex Trader. There’s a wealth of fundamental knowledge you need to learn and even knowing this inside out will not guarantee that you’ll become a successful trader.

This might sound overly negative, but the unpopular truth is: it is not easy to make consistent profits in forex. 60% of forex traders lose money, and this is a conservative estimate.

As they say: “The best way to end up with $1000 in forex is to start with $2000”.

But it is definitely possible though. Here’s how I would approach it:

I know it sounds underwhelming, but try to focus first on the process instead of the profits. You should study the basics first (the ForexWOT Trading System is excellent for this). Below are 3 forex trading systems example…

Forex Simple Trading Strategy With 90% Winning Rate

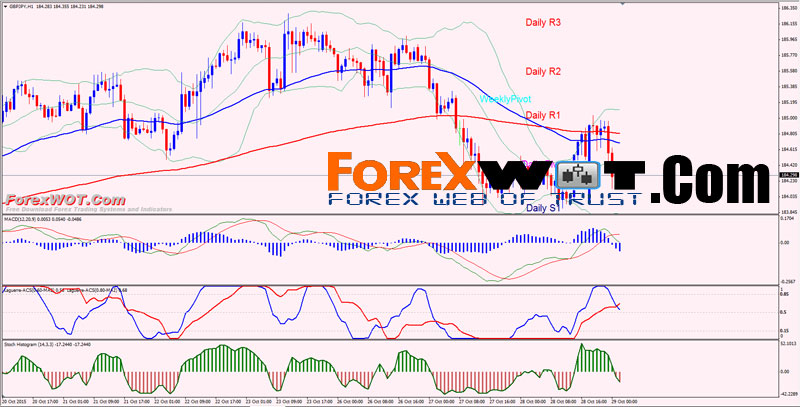

GBP JPY Forex Simple Trading Strategy – ( Works on All Time Frames and for all Pairs – Best used on 5Min/15min/ for short term Trades and 30min/1Hr/4hr/daily for Long term Trades ).

[sociallocker]

[/sociallocker]

I am trading in GBP/JPY and other currencies using this Simple method for quite sometime now and its proven to be successful 90% of the times, the only times it has failed is when a spike up or down during news time, so I discourage anyone to stop using this 30 mins prior and after the news to escape from the whipsaws.Center of Gravity Forex Super Scalping Trading Strategy

Use the system on any pair you like. Timeframe for main screen is M1 and M5. TP is 12 pips, SL is 45 pips. I’ve set slower moving pairs to TP 7 also, depends on your expectations. The higher the timeframe, the more profit you may want to take. The best thing would be to exit at the counter semafor … but I do not dare 🙂 You could set quiktrailing to break even at your liked pips or to lock in some profit, if you shoot for more…

[sociallocker]

[/sociallocker]

Eventually use a second backup screen for higher semafor check on M15/M30, but get your feeling. TRO says trading only if at least H1 shows ANY semafore (1,2,3) in your direction, but I work without that. It would of course give even more safety.Forex Trend Catcher Trading Strategy With Moving Average and MACD Custom Indicator

Forex Trend Catcher Trading Strategy – Since the system uses a lot of moving averages, placing them manually can detailing them here can be confusing, so using the template provided here is the best solution.

You can always study the setup from your charts directly and investigate into the moving averages and their individidual values. The setup is using 10 moving averages in all.

Then, get a demo account from a decent broker and try to get a feel of how trading works.

Next up, read a couple of good books on trading. Learn the basics of candlestick charting, price patterns, technical and fundamental analysis, trading emotions, etc. I’ve listed up some great forex books, most of them classics in their own regard. To keep an eye on the news, a good economic calendar is also useful.

You should also start creating your own trading plan with a trading journal. The difference between a successful trader and a losing one is that losing traders lack structure. A trading plan and journal provides that structure.

A trading journal should not only be a logbook of the trades you take, but also how you feel about taking that trade, what you perceive as risks and even ongoing emotions as the open trade unfolds. It deals with trading emotions in a systematic way that makes it easier to improve on them.

Ultimately, this will lead you to make the right decisions, achieve consistency and eventually make consistent profits in the forex market.

The big issue here with the question is expectations. A lot of people have attempted to over simplify the investing process. First and foremost cash is an asset which means that it will be part of a diverse investment portfolio for some and it will also be used as a means to offset risk, in addition to day to day speculation. So in this context we need to understand all the principles underpinning the use of FX. That’s the difference between a professional (someone who is trained to handle investments on a day to day basis with a view of maximizing opportunities) and “joe public”.

Let’s take a simple example, a trader, trading Options may be doing so to hedge exposure to some other asset entirely and also desires to hedge the Option for a specific period of time, this means taking an opposing position in the underlying cash FX market, this is not with a view of speculation but merely risk adjustment. This practice is institutional in nature and tends to occur in periods of market uncertainty, this could unbalance markets because of the volume of trades taken with this same objective. So putting all in to context, you may be able to digest the knowledge required in 3 to 6 months but application is a different story, you will also make errors and mistakes in practice, till you become proficient it may take 2 years, depending on your intelligence not of course forgetting that you need to find the information, when everyone is busy teaching some dud strategy.

So all things considered, market knowledge is important as I tell all my people at the Traders Club, this is sadly lacking in many traders today who are from the DIY crowd. I hope some day people will realize FX is an asset like stocks, etc and will be subject to more than blind speculation.