200 Pips A Week Easily – How to Use Bollinger Bands in Forex and Stock Trading. You may experiment with other currency pairs, but in general it works on the H1 timeframe with all major pairs.

Conservative & Mechanical Approach

Sell Entry Rules

- Green candle goes out of the BB followed by a red candle coming into the BB.

This pattern must form a pivot high - CCI crosses down below or touches the top red line after the close of the red candle.

CCI cross can either happen immediately at the close of the red candle that crosses the BB or up to 1 candle after. - Previous volume bar is higher than the candle prior.

- Enter at the close of the setup candle.

- Don’t enter if CCI has gone below the zero line at the close of the Setup Candle.

- Don’t enter if the candle is close to the BB center line.

- BB’s should be either wide or widening, never at a narrow point

- Always consider points of support, resistance and the current trend.

Sell Entry Examples

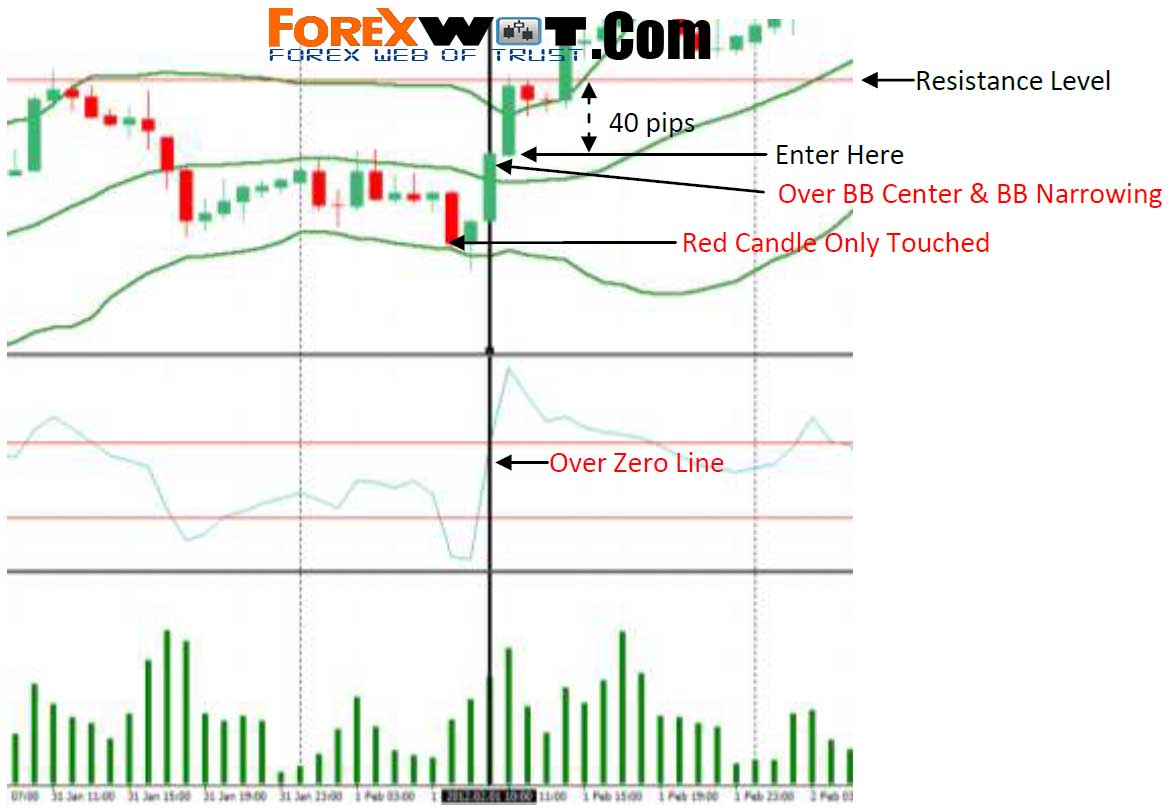

Buy Entry Rules

- Red candle goes out of the BB followed by a green candle coming into the BB

This pattern must form a pivot low - CCI crosses up above or touches the bottom red line after the close of the green candle.

CCI cross can either happen immediately at the close of the green candle that crosses the BB or up to 1 candle after - Previous volume bar is higher than the candle prior.

- Enter at the close of the setup candle.

- Don’t enter if CCI has gone above the zero line at the close of the Setup Candle.

- Don’t enter if the candle is close to the BB center line.

- BB’s should be either wide or widening, never at a narrow point.

- Always consider points of support, resistance and the current trend.

Buy Entry Examples

Aggressive & Manual Approach

To get more trades you need to ignore some of the above and use your chart reading experience. To do this you must use a combination of price & candlestick patterns, trend lines and S and R levels.

Some simple examples of this can be seen below:

Exit Rules

Now we have established when to enter a trade, we must know when to exit it.

Buy and Sell Take Profit Guidelines

- Short trade (ideal for those who don’t have time to monitor the trade)

o Set Take Profit at 20 pips - Long trade (ideal for those who have time to monitor the trade)

o Exit 50% of the trade at 20 pips

o Move Stop Loss to -20 pips (it’s now a free trade)

o Exit 25% at 35 pips

o Set a Trailing Stop Loss at 35 pips or Move your Stop Loss up at 5 pip increments

Buy and Sell Stop Loss Guidelines

- Set your initial Stop Loss at the previous swing high or low plus 3 pips

I just want to let you know that template does not correspond with pictures and description. There is StdDev and ATR indicators within template. And you work with CCI and volume indicators.