FREE DOWNLOAD Top 3 Best Successful Fibonacci Trading Systems and Strategy – This strategy named after a famous Italian mathematician is one of the most popularly used forex trading strategy in the forex market. It’s a medium-long term trading strategy that is used by following the repeated support and resistance levels method.

Fibonacci trading strategy is used by taking advantage of the wavy movement of the market. It is define by ratios that can be used to identify potential resistance and support levels on the financial charts. 61.8%, 50% and 31.8% are the most commonly used Fibonacci ratios.

Forex Fibonacci Retracement Price Action Systematic Trend Following Trading Strategy

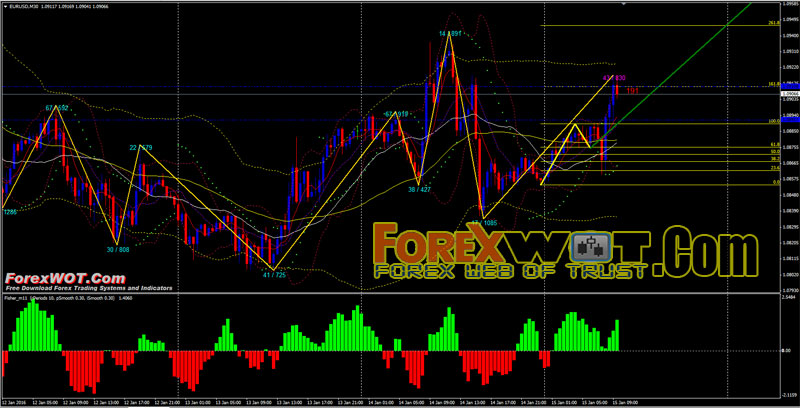

Price Action Forex Fibonacci Retracement Systematic Trend Following Trading Strategy – This intraday (M30) high accuracy forex trading system works also with higher time frame.

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction.

These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses.

London Session Forex CCI Fibonacci Retracement Trading System and Strategy

Forex CCI Fibonacci Retracement Trading – The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period.

Understanding the CCI Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average (MA), or, more specifically, normal deviations from that average. The actual CCI calculation, shown below, illustrates how this measurement is made.

The Fibonacci retracement is the potential retracement of a financial asset’s original move in price. Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses.

The key Fibonacci ratio of 61.8% – also referred to as “the golden ratio” or “the golden mean” – is found by dividing one number in the series by the number that follows it. For example: 8/13 = 0.6153, and 55/89 = 0.6179.

The 38.2% ratio is found by dividing one number in the series by the number that is found two places to the right. For example: 55/144 = 0.3819.

The 23.6% ratio is found by dividing one number in the series by the number that is three places to the right. For example: 8/34 = 0.2352.

M1 M5 RSIOMA Forex Scalping System With AUTO Fibonacci Retracement Indicator

RSIOMA Forex Scalping System With AUTO Fibonacci Retracement Indicator. RSIOMA MetaTrader indicator — this indicator takes two moving averages, calculates their RSI (Relative Strength Index) and then also adds a moving average of the calculated RSI. These two lines now can accurately signal the trend changes.

They are shown in the separate window where they change from 0 to 100. Additional histogram indicator is shown for quick reference below the lines.

Fibonacci Retracement – A term used in technical analysis that refers to areas of support (price stops going lower) or resistance (price stops going higher). The Fibonacci retracement is the potential retracement of a financial asset’s original move in price.

Fibonacci retracements use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before it continues in the original direction. These levels are created by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

What is a ‘Fibonacci Retracement

A Fibonacci retracement is a term used in technical analysis that refers to areas of support (price stops going lower) or resistance (price stops going higher).

Fibonacci retracement levels use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the trend continues in the original direction.

These levels are created by drawing a trendline between the high and low and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

BREAKING DOWN ‘Fibonacci Retracement

Fibonacci retracement is a very popular tool used by many technical traders to help identify strategic places for transactions to be placed, target prices or stop losses. The notion of retracement is used in many indicators such as Tirone levels, Gartley patterns, Elliott Wave theory and more. After a significant price movement up or down, the new support and resistance levels are often at or near these lines.

Fibonacci retracement levels are static prices that do not change, unlike moving averages. The static nature of the price levels allows for quick and easy identification. This allows traders and investors to anticipate and react prudently when the price levels are tested. These levels are inflection points where some type of price action is expected, either a rejection or a break.

Trading Fibonacci Retracement Levels

Fibonacci retracement price levels can be used as buy triggers on pullbacks during an uptrend. It is prudent to have a momentum indicator like stochastic or a MACD oscillator to pinpoint the most advantageous entries.

In downtrends, the levels can be used to short sell when bounces reject off a Fibonacci retracement level. When a price level overlaps with other indicator price levels like a 200-day moving average, then it becomes a fortified price level, making it an even stronger support or resistance.

The most significant Fibonacci retracement level to watch for is the 0.618. This is the inverse of the golden ratio, 1.618 or phi. The 0.618 retracement level tends to be the maximum pullback zone where fear climaxes as the final sellers throw in the towel and bargain hunters rush into the stock to resume the uptrend.

On downtrends, the 0.618 price level should be where the final buyers are exhausted as sellers take the opportunity to unload their positions and short-sellers jump off the fence to push down the price and resume the downtrend.

Some traders prefer to wait for two to three candlestick closes above or below a Fibonacci retracement level to confirm support or resistance before placing a trade.