Trend Trading strategy with Forex Multi Time Frame EMA Trading System – This advanced and high profits trading system developed for 15 and 30 minutes timeframe.

“Multiple time frames” is a Forex trading strategy that works by following a single currency pair over different time frames.

Clearly, when looking at only one time frame you can never know the whole story and as a rule you always want to know the whole story before making an investment. Examining the price change over numerous time frames can also help us as an indicator when to enter of when to exit a trade.

Standard time frames to focus on are time frames in which each candlestick represents 15 minutes, 30 minutes or 1 hour. These time frames fall right in the middle as they allow the trader enough time to examine the market before making a move but are not too long-term making them profitable over relatively short periods of time.

Simple Profitable Forex Multi Time Frame EMA Trading Rules – Each time frame has its benefits. Long time frames allow us to understand the bigger picture and identify the overall trend. Average time frames present the short term trend and show us what is happening in the market right now. Short time frames are our way of recognizing the exact window for when to make our move.

The suggested working process is to choose a time frame to work in and then verify your move with one longer time frame.

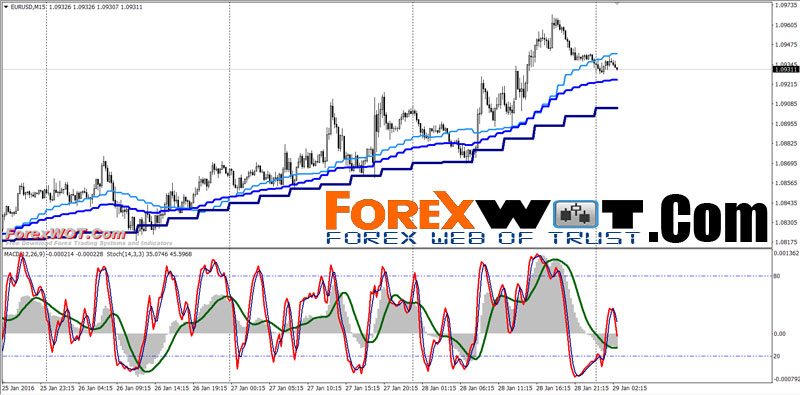

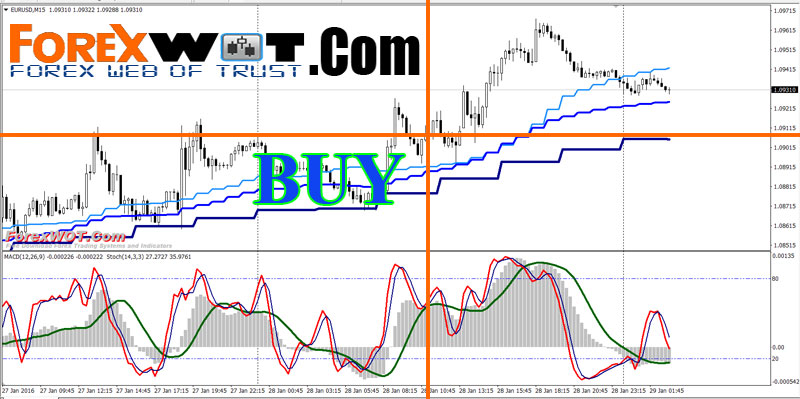

Forex Multi Time Frame EMA Trading Indicators:

- MTF EMAs: H1 12 MTF EMA to the open (blue line) & H1 12 MTF EMA to the close (dodger blue line);

- H4 12 MTF EMA (dark blue line);

- Stochastic indicator;

- MACD indicator.

5 conditions must be met:

- The Stochastic crosses up from the 20 line and is not overbought

- The MACD closes higher than the previous value.

- The Signal candle closes bullish (indicated by the white color).

- The upward Dodger blue H1-12 MTF EMA line and above upward Blue H1-12 MTF EMA line;

- Both H1-12 MTF EMA line above H4-12 MTF EMA line.

Notice: Trade signals are only confirmed on closed candles.

5 conditions must be met:

- The Stochastic crosses down from the 80 line and is not oversold

- The MACD closes lower than the previous value.

- The Signal candle closes bearish (indicated by the black color).

- The downward Dodger blue H1-12 MTF EMA line and below downward Blue H1-12 MTF EMA line;

- Both H1-12 MTF EMA line below H4-12 MTF EMA line.

Notice: Trade signals are only confirmed on closed candles.

NOTE:

Another clear benefit from incorporating multiple time frames into analyzing trades is the ability to identify support and resistance readings as well as strong entry and exit levels.

A trade’s chance of success improves when it is followed on a short-term chart because of the ability for a trader to avoid poor entry prices, ill-placed stops, and/or unreasonable targets.