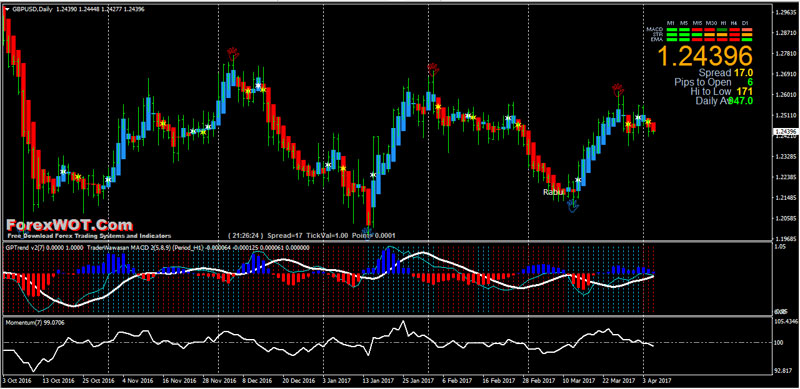

Easy and Simple M-5 or M-15 Trend Trading System – How to Identify and Determine IntraDay Trend in Forex Trading. The first step to trend trading is to find the trend! There are many ways to identify the trend, but one of easiest is using the collaboration of Heiken Ashi, MACD, and Momentum Indicator.

This is a trend trading system based on GP indicators.

You can use this system also in Multi time frame set the indicators of the next time frame. Example ( M-5 tf setting indicators (GP MACA and GP Trend M-60 tf.)

Forex Trading Rules

Optimal Time Frame : 5 min or higher.

Financial markets : Forex, Commodities and indicies.

Trading Indicators:

- GB Heiken ashi,

- GP star, (white star buy alert, yellow star sell alert)

- GP Reverse,

- In the same window: GP trend and GP MACD,

- Momentum,

- Signal Trend.

BUY Rules

- GP Reverse alert BUY,

- Momentum line upward and above 100 level,

- Heiken Ashi blue,

- GP Trend Blue square (AQUA line fast EMA upward and above WHITE line slow EMA),

- GP MACD blue histogram,

- Signal trend green color.

SELL Rules

- GP Reverse alert SELL,

- Momentum line downward and below 100 level,

- Heiken Ashi red,

- GP Trend Red square (AQUA line fast EMA downward and below WHITE line slow EMA),

- GP MACD red histogram,

- Signal trend red color.

Manage Exits

When trading markets, there is always the potential to lose money.

That’s why when trading trends, it is important to know that they will eventually come to an end.

In an uptrend, traders may place stops under the previously identified swing low (higher low).

In the event that price breaks under this value, it may symbolize that at least temporarily the trend may be ending. Traders can exit any positions at this point through the use of a Stop Order.

Knowing where to take profit is also an important part of any trend trading plan.

How to know when to take a 1:2 or 1:3 risk reward vs. when to trail your stop?…

The simple answer is that there is no way to ‘know for sure’, because we can’t ever know anything ‘for sure’ in the markets.

But, generally speaking, in strong trending markets we obviously have a better chance of getting a big winner through letting our trade run by trailing our stop.