Most Popular Moving Averages Technical Analysis – Trend Trading Strategy and Rules with Most Popular Moving Averages to maximise your profits. If Technical Analysis is the attempt to forecast future price trends then Moving Averages is a worthy start.

Once you understand moving averages, you can then apply two or more moving averages and find an entry and exit based on them.

In this article, we will learn high accuracy Moving Averages trading system. This Moving Averages trading system is a complete strategy trend momentum with more filters.

But for the first step, we’ll talk about “Who Uses Moving Averages”.

Moving Averages (MA) is the average price over a determined number of periods (e.g. 50, 100, 200).

If the market is in a significant uptrend, the average price over a determined period should rise and price should not weaken below the average.

Moving Averages are often the first indicator that new traders are introduced to and for good reason. It helps you to define the trend and potential entries in the direction of the trend.

However, moving averages are also utilized by fund managers & investment banks in their analysis to see if a market is nearing support or resistance or potentially reversing after a significant period.

Moving averages can be a simple tool to define support and resistance in the Forex Market.

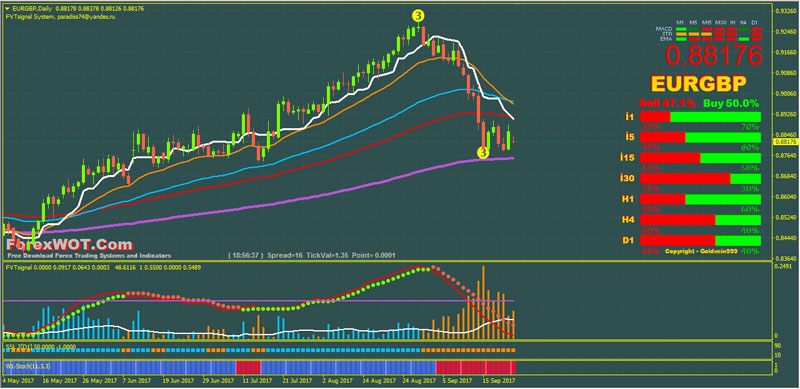

When a market is in a strong trend, any bounce off a moving average, like the first bounce off the 200-DMA in the GBPUSD chart above, can present a significant opportunity to join the trend until the price closes below the 200-DMA.

However, if price continues to move above and below the moving average in a short period of time, you’re likely in a range and those reversals are lest significant from a trading point of view.

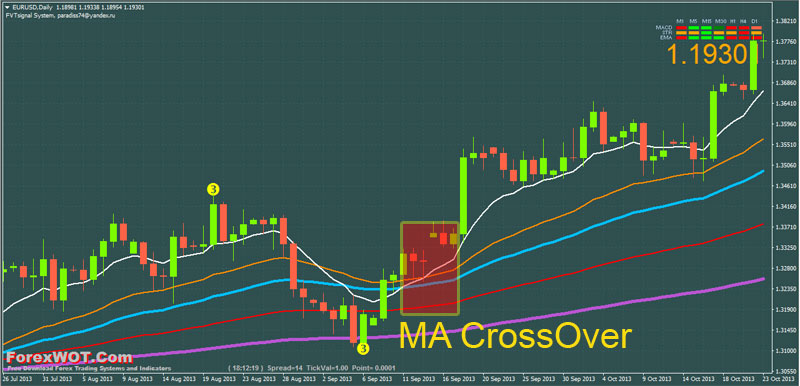

Moving Averages Crossover is the point on a chart when there is a crossover of the shorter-term or fast moving average above or below the longer-term or slower moving average.

The moving average crossover trading strategy brings together a shorter term moving average with a longer-term moving average.

Common examples are a 10 MA and a 30 MA for shorter-term entries or a 50 MA and a 200 MA for longer-term entries.

When you enter and exit based on crossovers you are allowing yourself to take objective signals that are reflective of market strength.

When looking to use moving averages, you’re able to control downside risk will determine your success.

It’s important to know that markets that were once trending, with very clean moving average signals, to a range with more noise than signals.

If you can get comfortable with a specific set of moving averages, you can objectively analyze and trade the Forex market week in and week out.

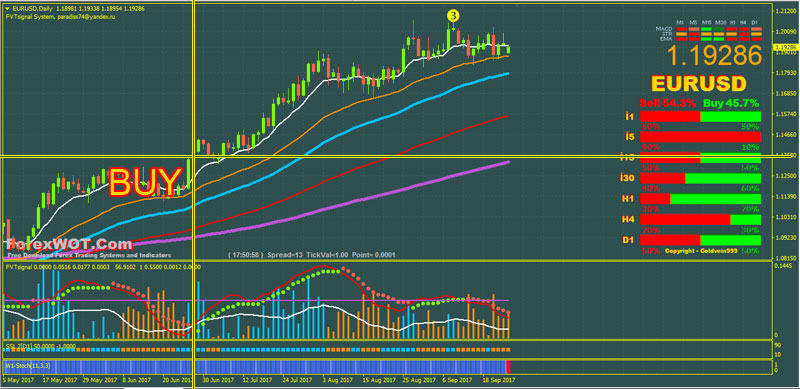

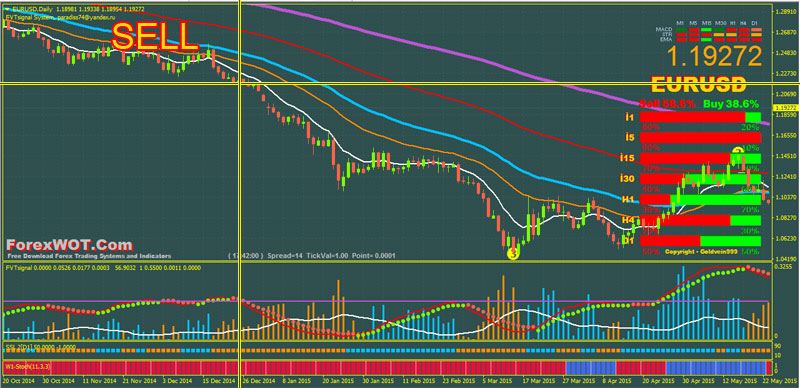

This trading system is a complete strategy trend momentum with more filters. You can trade intraday or swing. This strategy is discretionary.

- Best Time Frames: H1, H4, or higher

- Financial Markets: Indices, Currency pairs, and Commodities

ForexWOT Moving Averages Trend Trading System is simple to use and can be effective in recognizing trending, ranging, or corrective environments so that you can be better positioned for the next move.

- Exponential Moving Averages

- Strength Candles

- Signal Trend

- 3 Level ZZ Semafor

- FVT Signal

- 1 indicator

- 2 indicator

- SSL Fast

- Stoch Tape

- Moving Averages BULLISH FORMATION (200EMA< 100 MA < 50EMA, 30 EMA, and 10EMA)

- Indicator 2 green dot

- FVT Signal aqua bar

- Stoch TapeBlue color

- Moving Averages BEARISH FORMATION (200EMA> 100 MA > 50EMA, 30 EMA, and 10EMA)

- Indicator 2 red dot

- FVT Signal maroon bar

- Stoch Tape Red color

Risks of using a Moving Average Crossover Strategy

Although this is seen as the simplest trading strategy, the Moving Average Crossover for following trends is not without drawbacks.

The moving averages give equal weighting to all prices within the period selected when applying the indicator so there is a LAGGING nature to the indicators ability to respond to changes in price.

When there is a slower response time, this could mean that you’re sacrificing less reward and opening yourself up to greater risk.