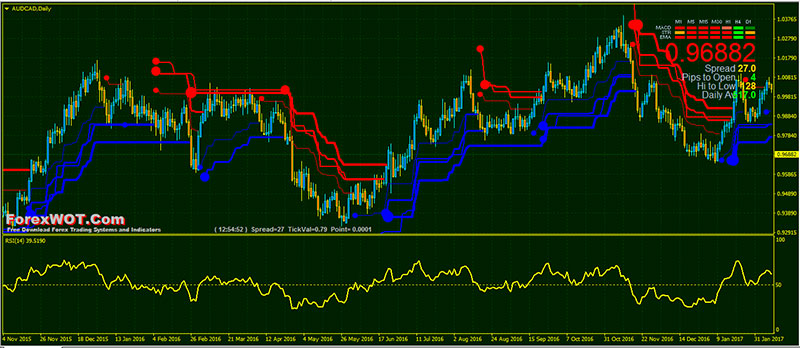

High Accuracy Forex Volty Channel Stop RSI System – The Volty Channel Stop indicator uses the ATR and the Moving Average indicator for calculation of support/resistance lines.

Volty Channel Stop RSI System is quite an advanced forex trading system and it is an extremely powerful forex trading system.

It generates highly profitable setups.

The good thing about Volty Channel Stop RSI System is that it has “only three” HIGH ACCURACY indicators to confirm the trades.

Volty Channel Stop is very effective for EURUSD and GBPUSD pairs.

This is SUPER EASY and HIGH ACCURACY trading system…!!!

Recommendations to use in trading are standard.

- When you see a blue circle (the price is higher than a line) that is a signal for BUY

- …and if you see a red circle (the price is lower than a line) that is a signal for SELL

Bullet points are a signal that the trend is reversed.

This indicator can become a good alternative to a standard Parabolic SAR indicator in your trading systems.

Remember: A trading system is only effective if it is followed! You need to have the discipline to stick to the rules! Okay, let’s go to the trading rules.

- Best Time Frames: H1, h4, and Daily

- Recommended Currency Pairs: GBPUSD, EURUSD, and BITCOIN

- Volty Channel Stop

- Signal trend

- RSI

- All Volty Channel Stop line blue color

- Signal trend green bars

- RSI line upward and above 50 level

- All Volty Channel Stop line red color

- Signal trend red bars

- RSI line downward and below 50 level

This “ForexWOT Volty Channel Stop RSI” is a SUPER EASY and HIGH ACCURACY trading system…!!!

Before you start thinking about trading and risking your hard earned money, you need to enter the market with the RIGHT MINDSET.

MASTERY

You need to know what your trading strategy is and you need to master it.

You have to know it inside and out and have absolutely no doubts or questions about what the market needs to look like before you risk your money in a trade.

You have to become a “SNIPER”.

Once the market conditions match your strategy criteria, you place your trade, without the fear holding you back.

RISK MANAGEMENT

You always, ALWAYS manage your risk on EVERY single trade.

The moment you lose your control over your trades, you allow emotion to creep in and before you know it, you’re in a downward spiral of emotional Forex trading and losing trades.

Only risk the money you are prepared to lose in every trade.

In fact, you should go in expecting to lose on any given trade so that you’re constantly aware of the very real possibility of it happening.

TRADING PLAN

You need to be VERY ORGANIZED.

Have a trading plan and journal to track your trades consistently.

Think of Forex trading as a business rather than placing a bet in a casino.

Invest with your calculator and not your heart, stay calm in your dealings with the market.

DISCIPLINE

You need to understand that TRADING is a DISCIPLINE.

It is a LONG-TERM GAME OF PROBABILITIES, you will win some trades, you will lose on some trades, but as long as you a disciplined enough to stick to your trading system and strategy, to not be emotionally attached to your losses, or worse your wins, you will tend to make more winning trades than losing trades and nett a profit.

Again, keeping your Forex Trading Mindset right is the outcome of always taking a conscious effort to practice, manage, and control your emotions when it comes to trading.

[sociallocker]

[/sociallocker]