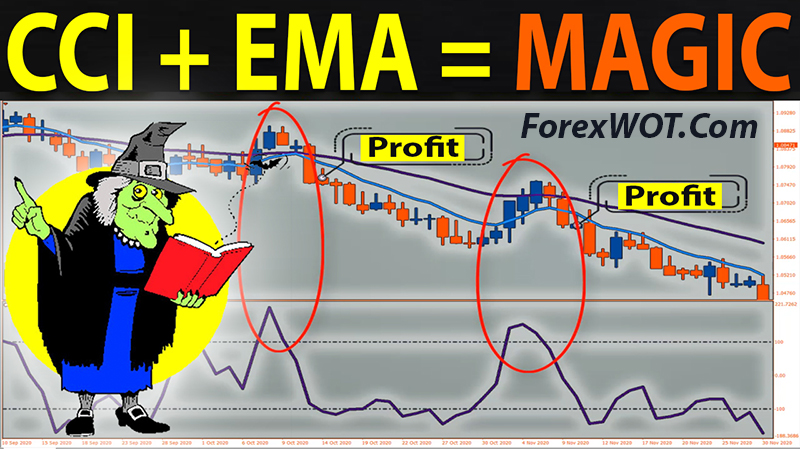

CCI Moving Average Crossover Trading Strategy. The logic for CCI Moving Average Crossover Trading Strategy is simple because we are combining both a trend following indicator as well as an oversold-overbought indicator.

Moving averages can show you the approximate trend and change of trend when the crossover occurs. CCI is an oscillator that shows you whether the market is oversold or overbought.

- Download “ForexWOT-CCIMACrossOver” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-CCIMACrossOver.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-CCIMACrossOver” trading system and strategy.

- You will see the “CCI-MA Crossover Trading System” is available on your Chart.

You can use any time frame but consider that amount of noise on lower time frames. Consider using 15 minute charts and above.

As mentioned in the title of this article, we are going to use only two trading indicators:

- First, CCI (commodity channel index) with the setting of 7, which is much lower than the standard setting of 14.

- Second, Two exponential moving averages set at 30 and 10. We use a fast and slow exponential moving average so we can see the potential trend change earlier

Do not add any other technical indicators to the mix for this strategy. The only addition will be the use of candlestick patterns of individual candlesticks.

- 10 EMA crosses the 30 EMA to the downside

- Wait for price to rally back to the moving averages

- Is the CCI above the 100 level or just crossed below it?

If those 3 points line up, you have a sell setup happening and to confirm the trading signal, you may want to use a price action entry such as a bearish reversal pattern.

Once you enter the trade, you can set an initial stop loss above the recent high.

- 10 EMA crosses the 30 EMA to the upside

- Wait for price to retrace back to the moving averages

- The CCI below the -100 level and start to rise back above -100

- In many cases, market strategists find the ideal Risk Reward Ratio for their investments to be approximately 1:3, or three units of expected return for every one unit of additional risk.

The 50 and 200 day moving averages are widely watched by traders and investors in almost all major markets, particularly the US stock indexes. A 50 and 200 period crossover event is held with high regard by market participants.