The MACD indicator is a versatile tool that can be applied in various trading strategies, such as scalping, day trading, and swing trading. In general, MACD indicators are used in one of three ways—crossovers, overbought/oversold conditions, or divergences.

The MACD crossover occurs when the MACD line and the signal line intercept, often indicating a change in the momentum or trend of the market. The MACD is seen as an effective indicator, especially in trending markets.

- A SELL signal is generated when the MACD crosses below the signal line,

- and a BUY signal is generated when the MACD crosses above the signal line.

In addition, the locations of these crossovers in relation to the zero line are helpful in determining buy and sell points.

- Bullish signals are more significant when the crossing of the MACD line over the signal line takes place below the zero line. Confirmation takes place when both lines cross above the zero line.

- Bearish signals are more significant when the crossing of the MACD line over the signal line takes place above the zero line. Confirmation takes place when both lines cross below the zero line.

The following is the most commonly applied solution by traders to maximize the accuracy of MACD indicator lines’ signals. It involves determining the market trend using the 200-period EMA.

As I’ve often explained, the 200-period EMA rule is widely utilized by institutional traders, banks, and professional traders.

- If the price is above the 200-period Moving Average line, it indicates a BULLISH market,

- while if the price is below the 200-period EMA, the market is considered BEARISH.

Therefore, when the price is above the 200-period EMA, traders wait for a BUY signal indicated by the MACD lines, as I mentioned earlier. On the other hand, if the market is below the 200-period EMA, traders only wait for a SELL signal shown by the MACD lines.

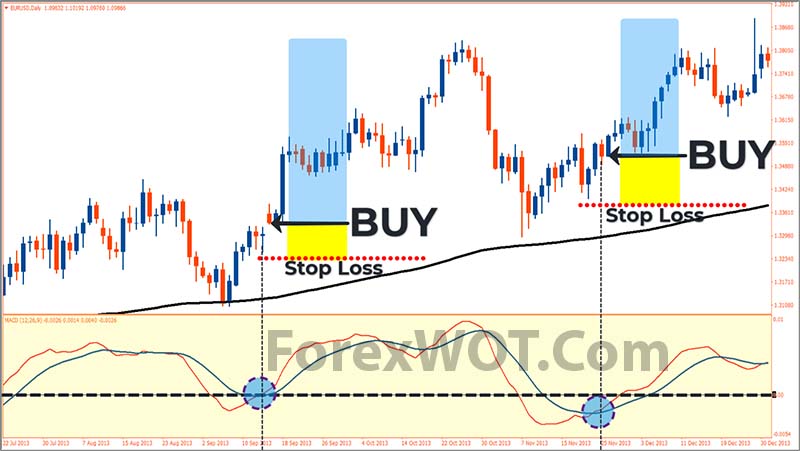

As seen in this chart, the price is confidently trending upwards and is above the 200-period EMA line.

In such a situation, all traders, including institutional traders, banks, and other professional traders, agree that the current market is in a BULLISH trend.

Then, you can spot a BUY signal below the 0 line, as indicated by the crossover between the MACD line and the signal line moving upwards. You can enter the market on the next candle with a stop loss set below the nearest swing low.

Furthermore, you can also observe the next BUY signal, again signaled by the crossover between the MACD line and the signal line moving upwards. Following the same approach, you can enter the market on the subsequent candle with a stop loss set below the nearest swing low.

Moving on to this chart, you undoubtedly share the same view that based on the price position below the 200-period EMA, the market trend is BEARISH.

Following the MACD crossover strategy, traders should only enter the market with a SELL position when there is a crossover above the zero line between the MACD line and signal line.

As you can see here, you must initiate a SELL position on the next candle after the MACD crossover occurs. Place your stop loss above the nearest swing high.

You are fortunate in this bearish trend. On the next MACD crossover signal, you also secure substantial profits after entering a SELL position immediately upon the perfect formation of the MACD crossover.

- Download “ForexWOT-MACDCrossoversSystem” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-MACDCrossoversSystem.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-MACDCrossoversSystem” trading system and strategy.

- You will see the “ForexWOT-MACDCrossoversSystem” is available on your Chart.

So, now you’ve mastered the MACD Crossover trading strategy as a whole.

You can easily set it up on any trading platform you use since it’s quite straightforward to do.

Alternatively, if you want the exact settings demonstrated in this tutorial, you can download the template through the link provided below. I’ve included a system template that will automatically plot all the indicators perfectly on your charts, so there’s nothing to worry about.