Forex & Stocks 50-period EMA SuperTrend SCALPING Strategy – In this guide, you’ll pick up a template for creating your own simple “SCALPING” and “DAY TRADING” strategy. In particular, this simple trading strategy template:

- Covers the necessary parts of a robust pullback trading strategy;

- Uses no more than two trading indicators; and

- Allows you to include your favorite tools.

Practical simplicity is the result of sensible limitations.

This is why we limit ourselves to looking for pullback setups and to a maximum of two trading indicators.

- Download “ForexWOT-50EMAsupertrend” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-50EMAsupertrend.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-50EMAsupertrend” trading system and strategy.

- You will see the “ForexWOT 50-period EMA SuperTrend System” is available on your Chart.

This is a basic template for trading intraday trends.

- 1st. Find the trend

- 2nd. Define a retracement

- 3rd. Establish your entry and exit rules

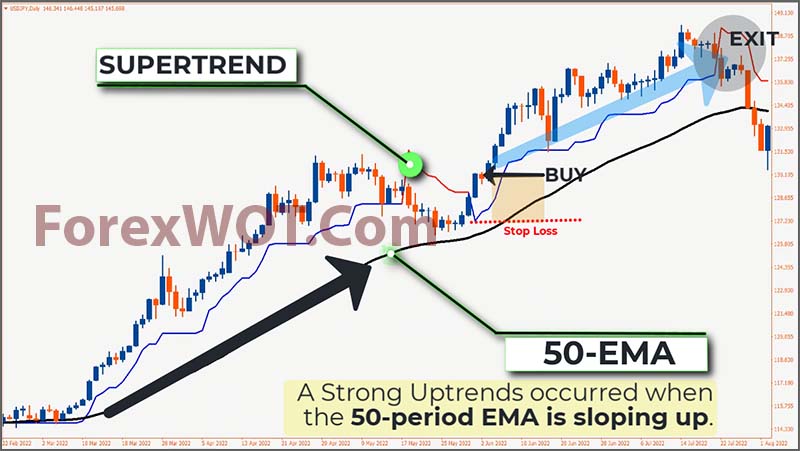

- 1st. Find the strong uptrend.

- We used a 50-period EMA to define a strong trend. A Strong Uptrends occurred when the 50-period EMA is sloping up.

- 2nd. Define a retracement period.

- We waited for a test of the 50-period EMA before looking for a continuation trade entry. This test confirmed a pullback that we were interested in. Paying attention to the SUPERTREND indicator, we observed a red line SUPERTREND indicator which triggered our retracement period.

- 3rd. Open a buy order as soon as the Supertrend indicator changes back to blue. Set the stop loss on the support below the supertrend indicator.

- 4th. Close the trade as soon as the Supertrend line changes to red.

- 1st. Find the strong downtrend.

- A Strong downtrends occurred when the 50-period EMA is sloping down.

- 2nd. Define a retracement period.

- We waited for a test of the 50-period EMA before looking for a continuation trade entry. This test confirmed a pullback that we were interested in. Paying attention to the SUPERTREND indicator, we observed a blue line SUPERTREND indicator which triggered our retracement period.

- 3rd. Open a sell order as soon as the Supertrend indicator changes back to red. Set the stop loss on the support above the supertrend indicator.

- 4th. Close the trade as soon as the Supertrend line changes to blue.

- Instead of focusing on the tools and strategies, start with understanding your goals. What do you want to achieve?

- Once that is done, you will find it a lot easier to choose the right tools for the job.

We use MACD in combination with 5, 8, and 13 EMA lines in our long-term trading strategy. EMA lines will act the same as the short-term strategy. This strategy works fine in any time frame chart; we recommend using the daily chart.

- Download “ForexWOT-EMAnMACD” (Zip/RAR File).

- Copy mq4 and ex4 files to your Metatrader Directory …/experts/indicators/

- Copy the “ForexWOT-EMAnMACD.tpl” file (template) to your Metatrader Directory …/templates /

- Start or restart your Metatrader Client.

- Select Chart and Timeframe where you want to test your forex system.

- Right-click on your trading chart and hover on “Template”.

- Move right to select “ForexWOT-EMAnMACD” trading system and strategy.

- You will see the “EMA and MACD” is available on your Chart.

- A bullish crossover occurs between the EMA signal lines.

- The blue signal line crosses above the red signal line, and both lines are heading toward the upside in the MACD indicator window.

- MACD histogram bars appear above the middle line of the MACD window.

- A bearish crossover occurs between the EMA signal lines.

- The blue signal line crosses below the red signal line, and both lines are heading toward the downside in the MACD indicator window.

- MACD histogram bars appear below the middle line of the MACD window.

no strategy gives a 100% profitability guarantee at all times. We suggest following money and trade management rules when trading with these strategies besides practicing these at demo trading before applying them on actual trading.