Why do People Lose Money in the Forex Market – The short answer: because it’s really hard to be consistently profitable 🙂 As they say: “The best way to end up with $1000 in forex is to start with $2000”.

It’s definitely possible though. And when you are familiar with the usual mistakes that forex traders make, you can improve yourself and already be one step ahead of the rest of retail traders. Here are some ways people will lose out:

Poor Risk Management

By far the number one on this list, people risk way too much. Forex is leveraged trading and it’s incredibly easy to wipe out your account by risking much more than what you can afford. Even world class traders such as William Eckhardt will not risk more than 2% of their account balance on a trade. Why would you?

Know about risk/reward, R-multiple, position sizing, drawdowns, currency correlation, etc. Having solid risk management will keep you in the game a lot longer, which means you get a lot more time to make mistakes and learn from them.

No Discipline

Discipline is something that is often overlooked in an ocean of indicators, trading strategies and forex signals. But discipline is so incredibly important. Once you reach a decent level of forex knowledge, this is what most of us will be struggling with.

So many people jump into trades, just to feel the excitement of being in a trade. Or maybe you’re often widening your stop loss or taking profits too early? Have a clear image of what you want to achieve in a trade, and stick to it. Also know about trading psychology and how things like cognitive biases will influence your trading behaviour.

No Structure

There are so many traders that just randomly enter trades and don’t really know why they took a given trade. It’s bad for 2 reasons:

- first off, since you have no record of your trades, you can’t figure out what works or what doesn’t.

- The other reason is that you’re much less accountable if you don’t have a clear trading plan and journal in place, so you’ll be much more likely to just impulsively try something.

Many traders lack structure. A trading plan and journalling every trade can provide that structure. After years of trading, I still use a checklist to see if the trade I’m taking is according to my trading plan.

Strategy Jumping

This is one I see a lot with beginning traders. They want to try some new strategy. After 3 trades, they figure out it’s not working and jump to another strategy. The same happens with indicators.

What most traders forget to realise though, is that you need time to make a strategy your own. This doesn’t happen overnight! You have to learn the ins and outs, figure out what works and what doesn’t.

Try out the strategy over a long enough period of time to make it statistically relevant. A lot of traders would see much better results if they only stick to one strategy. Unfortunately, most traders are looking for the holy grail and lose interest way too fast. Want to try some new strategy ?… Below are 5 recommended forex trading systems & strategy for you.

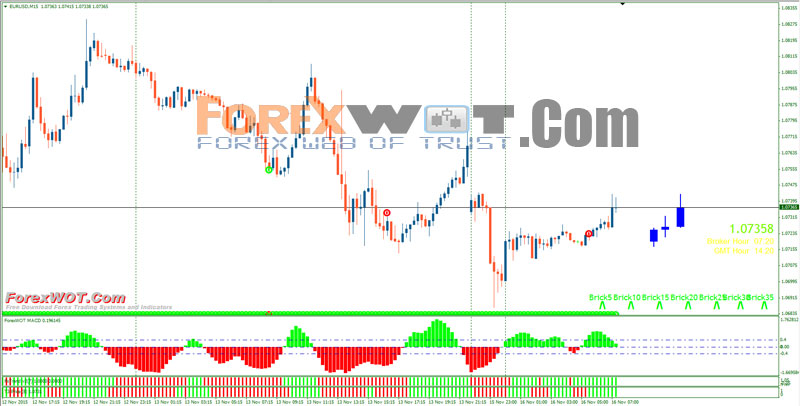

- Forex Price Action Trading Strategy With Trend MACD Indicator

Forex Price Action Trading Strategy – This system I designed does not have a pdf manual. You have to understand a couple of basic forex knowledge for setups with resistance/support followed by news in conjunction of my template and change your mindset to play defense in order to beat the insiders, market makers, big capital institutions with their daily agendas. I have attached charts to show what I see trading this system.

With knowledge of price action, traders can perform a wide range of technical analysis functions without the necessity of any indicators.

Perhaps more importantly, price action can assist traders with the management of risk; whether that management is setting up good risk-reward ratios on potential setups, or effectively managing positions after the trade is opened. KFSE Candle TF 1 HR Swing is the best Price Action indicator for this trading system.

- Advanced Simple Forex Renko Trading Trends With Moving Average

Forex Renko Trading Trends Strategy With Moving Average – The System is based on a Renko Chart that predicts the price micro trends with amazing probability! In our opinion this trading tool works better than all other system that we’ve tried because it uses a brand new trading algorithm and micro trends determination system! The main principle of the indicator is a custom trading indicators composite + micro trend indicator + price action false signals filter – All in one!

[sociallocker]

[/sociallocker]

We recommended to trade following the trend. Trading against trend might you get profit but it will be higher risk.You can see “MTF-TrendBar” indicator in the TOP RIGHT corner to get recent trend info. Use trend of Time Frame H1-above.

- Forex Nihilist Ultra ADX Trading Strategy With Moving Average and BB-MACD Custom Indicator

Forex Nihilist Ultra ADX Trading Strategy – This high accuracy trading system is an extremely low risk, high reward strategy which can and will change your life if you use it properly.

[sociallocker]

[/sociallocker]

I’m not exaggerating when I say this is probably going to be the easiest money you’ll ever make….it is!

The only thing that could make this system fail over the long term is you not sticking to the rules…….that’s it!

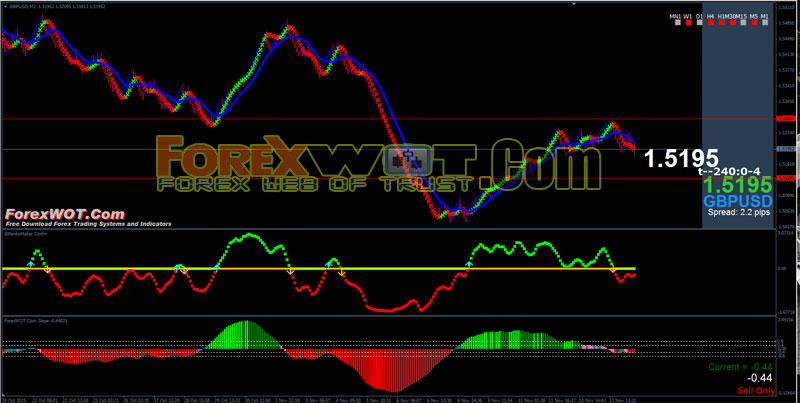

- Forex Vortex Moving Average Trading Strategy With Custom MACD Indicator

Forex Vortex Moving Average System is swing trend following system it’s based on the Moving Average indicator foiltered by Vortex.

The vortex indicator plots two oscillating lines, one to identify positive trend movement and the other to identify negative price movement. Crosses between the lines trigger buy and sell signals that are designed to capture the most dynamic trending action, higher or lower.

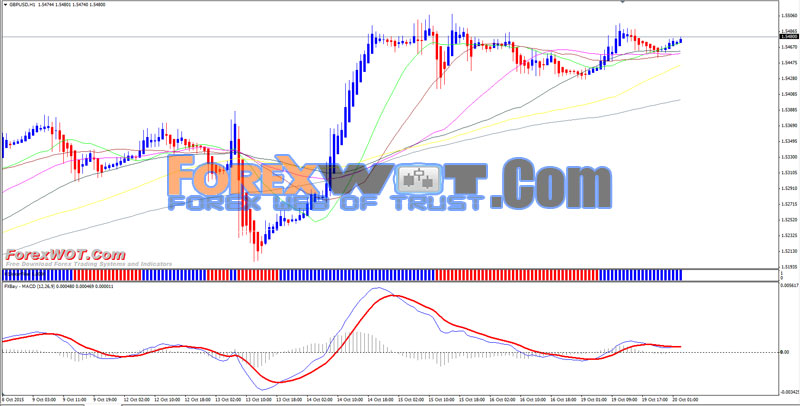

- Medium Term Forex Joker MACD Trading System With Heiken Ashi Candles

Forex Joker MACD Trading System is a trend following system based on the combination of trend filter indicators.

initial stop loss h1 time frame 15 pips below/above the entry bar, h4 time frame 25 pips above/belowe the entry bar.

Make profit when Joker filter changes direction or ratio 1.2 stop loss.

Perseverance

Even though you have all of the above right, it might still take some years before you “get it” and become profitable. Research has indicated that 80% of traders quit within the first two years. Don’t expect forex trading to be something you can pick up in an afternoon! Treat trading as a business.

Study, put in the hours, take it serious and above all, you should love trading. You’ll see that if you stick around long enough, results will come.