BEST & TOP 10 Forex Trading System For ECN Brokers – An ECN broker is a forex financial expert who uses electronic communications networks (ECNs) to provide its clients direct access to other participants in the currency markets. Because an ECN broker consolidates price quotations from several market participants, it can generally offer its clients tighter bid/ask spreads than would be otherwise available to them.

The ECN provides an electronic system for buyers and sellers to come together for the purpose of executing trades. It does this by providing access to information regarding orders being entered, and by facilitating the execution of these orders.

The network is designed to match buy and sell orders currently present in the exchange.

When specific order information is not available, it provides prices reflecting the highest bid and lowest ask listed on the open market.

FREE DOWNLOAD NOW TOP 10 Forex Trading System For ECN Brokers.

1 – MA Bollinger Bands Forex Trading System

2 – Vertex Reversal Price Border Swing Trading System

Vertex Reversal Price Border Swing Trading System is a trading system based on Vertex Indicator and Price Border indicator ( TMA bands). This is a reversal system for intraday trading or swing. This system is also good for trading with Binary Options High Low.

[sociallocker]

[/sociallocker]

3 – Highly Profitable Renko Street Trading System

[sociallocker]

[/sociallocker]

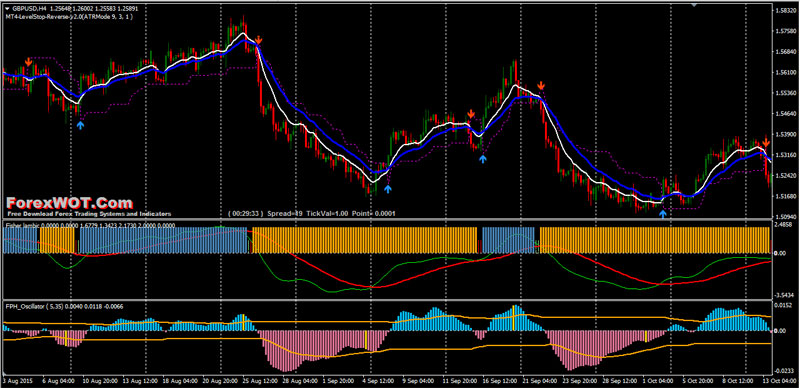

4 – Vertex Reversal Price Border Swing Trading System

Highly effective Forex Trading System – Best Collaboration of Forex Fisher Lambic and FPH Oscillator Trading Indicator to Maximize the Results of a Trade. The trading strategy is based on Fisher Lambic and FPH Oscillator.

5. Nihilist ADX System

Nihilist Forex Trading System with the ADX Indicator. Trading in the direction of a strong trend reduces risk and increases profit potential. The average directional index (ADX) is used to determine when price is trending strongly. In many cases, it is the ultimate trend indicator.

[sociallocker]

[/sociallocker]

6 – RSI Kijun-sen Forex Trading System And Strategy

7 – Simple Noise Free Forex 5 Minutes Scalping Trading System

DOWNLOAD Free Noise Forex Scalping Trading System – Simple Noise Free Forex 5 Minutes Scalping Trading System with Heiken Ashi and RSI indicator. Heikin Ashi will help trader to remove the unwanted noise from the chart.

Simple Noise Free Forex 5 Minutes Scalping Trading System

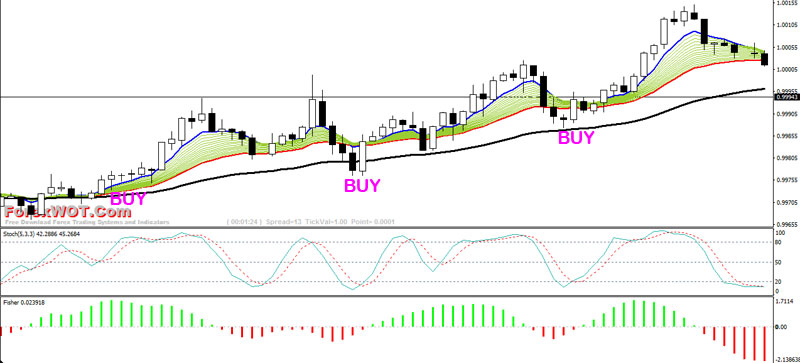

8 – Forex Scalping Strategy With Fisher MACD & Stochastic Oscillator

This 5 Minutes Forex Scalping Strategy With Fisher MACD can provide you with lot of and high accuracy trading opportunities each day.

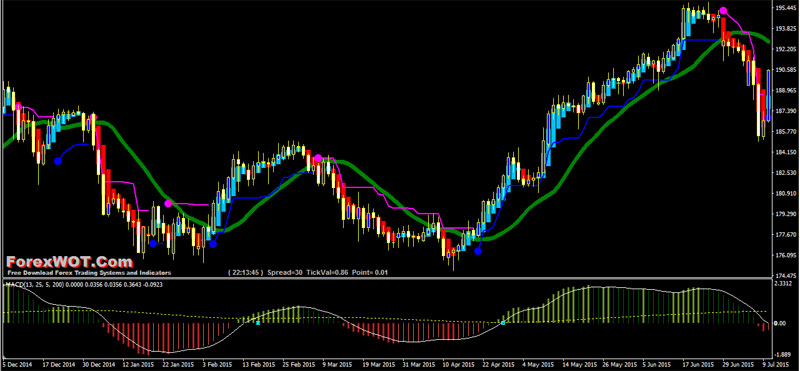

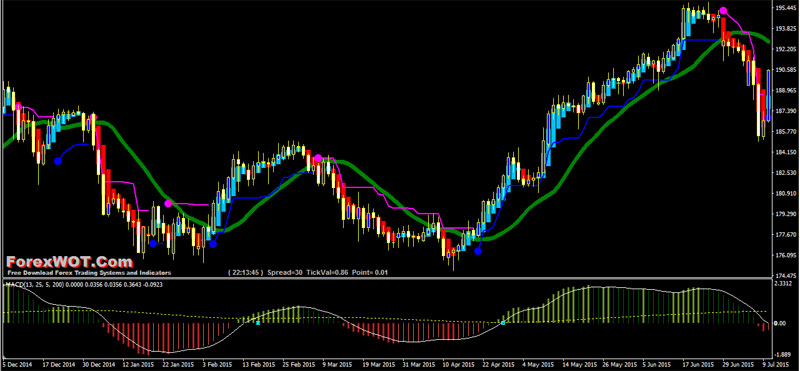

8 – Trading With the Moving Average Convergence & Divergence (MACD)

Sometimes known as the king of oscillators, the MACD can be used well in trending or ranging markets due to its use of moving averages provide a visual display of changes in momentum.

Like all indicators, the MACD is best coupled with an identified trend or range-bound market. Once you’ve identified the trend, it is best to take crossovers of the MACD line in the direction of the trend.

When you’ve entered the trade, you can set stops below the recent price extreme before the crossover, and set a trade limit at twice the amount you’re risking.

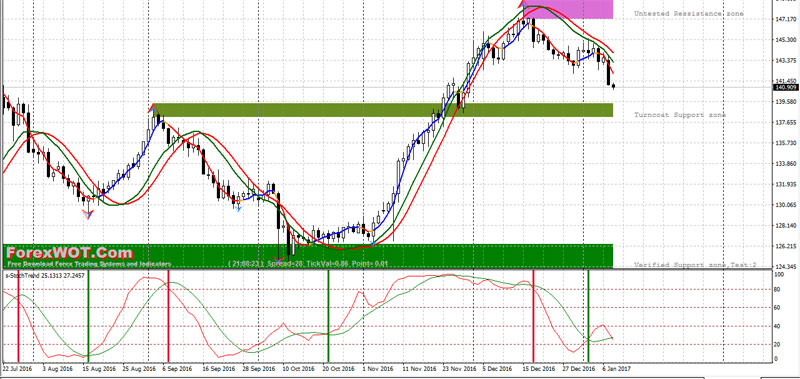

9 – Trading With Stochastics

Slow Stochastics are an oscillator like the RSI that can help you locate overbought or oversold environments, likely making a reversal in price.

The unique aspect of the stochastic indicator is the two lines, %K and %D line to signal our entry. Because the oscillator has the same overbought or oversold readings, you simply look for the %K line to cross above the %D line through the 20 level to identify a solid buy signal in the direction of the trend.

[sociallocker]

[/sociallocker]

10 – Trading With the Moving Average Convergence & Divergence (MACD)

Sometimes known as the king of oscillators, the MACD can be used well in trending or ranging markets due to its use of moving averages provide a visual display of changes in momentum.

Like all indicators, the MACD is best coupled with an identified trend or range-bound market. Once you’ve identified the trend, it is best to take crossovers of the MACD line in the direction of the trend.

When you’ve entered the trade, you can set stops below the recent price extreme before the crossover, and set a trade limit at twice the amount you’re risking.