There is so much liquidity during the European Session and countless transactions take place that almost any pair can be traded. With this knowledge it may be best to stick with the Majors (EUR/USD, GBP/USD, USD/JPY, and USD/CHF), as these normally have the tightest spreads.

Also worth noting is that these pairs that are normally directly influenced by any news reports that come out during the European session. You may also try the yen crosses (more specifically, EUR/JPY and GBP/JPY), as these tend to be pretty volatile at this time. Because these are Cross Pairs, the Spreads might be a little wider though. Below are The Best Forex Indicators and Trading Systems for High Liquidity Market During the European Session..

Easy Profits Double RSI Forex Trading System and Strategy

RSI 5 and RSI 14 in the same window trading technique – This is Easy Profits Double RSI Forex Trading System. The default RSI setting of 14 periods work well for swing traders. But many intraday traders find it lacking, because it produces infrequent trading signals.

Some traders deal with this problem by lowering their time-frame. Others lower the RSI period setting to get a more sensitive oscillator. However, these solutions produce RSI signals that are more unreliable.

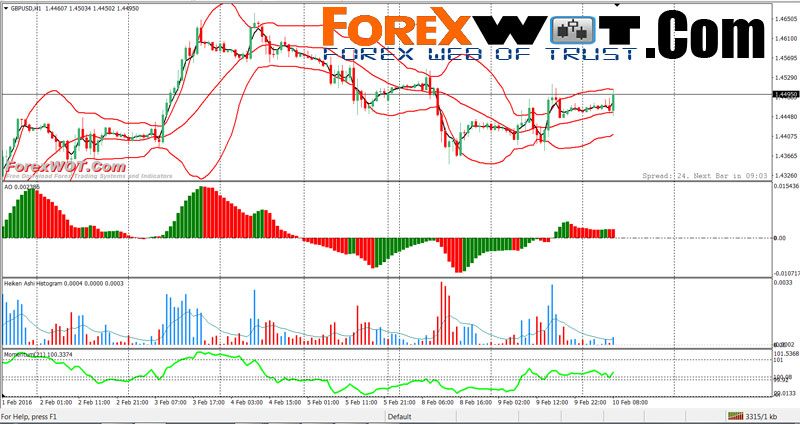

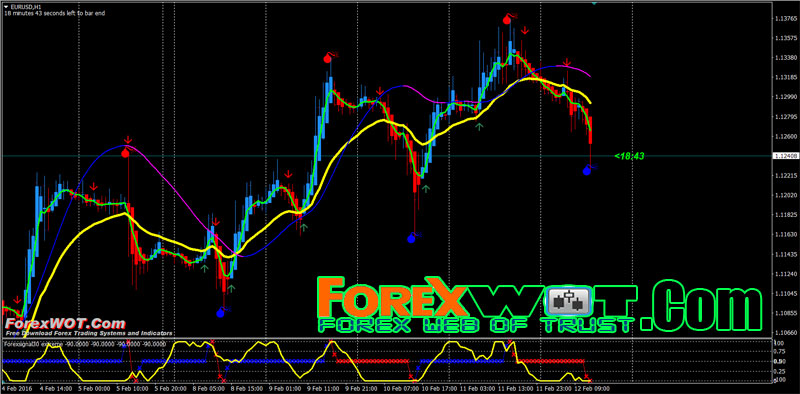

Awesome Oscillator Forex Trading Strategy with Bollinger Bands and Heiken Ashi Histogram

Successfull Forex Awesome Oscillator Trading System with Bollinger Bands and Heiken Ashi Histogram – Awesome Oscillator (AO) is a momentum indicator reflecting the precise changes in the market driving force which helps to identify the trend’s strength up to the points of formation and reversal.

Awesome Oscillator Strategy includes 3 ways of trading. The first way is to open a sell position when the oscillator is below the zero line forming a peak, and open a buy position when the oscillator is above the zero line forming a gap.

Forex M1-M5 High Profits Scalping System

I would like to share this ‘Forex M5 High Profits Scalping System‘ with you and also hope that we can start helping each other to make this system even more powerful.

[sociallocker]

[/sociallocker]

Forex scalping generally involves large amounts of leverage so that a small change in a currency equals a respectable profit. Forex scalping system strategies can be manual or automated. A manual system involves a trader sitting at the computer screen, looking for signals and interpreting whether to buy or sell.

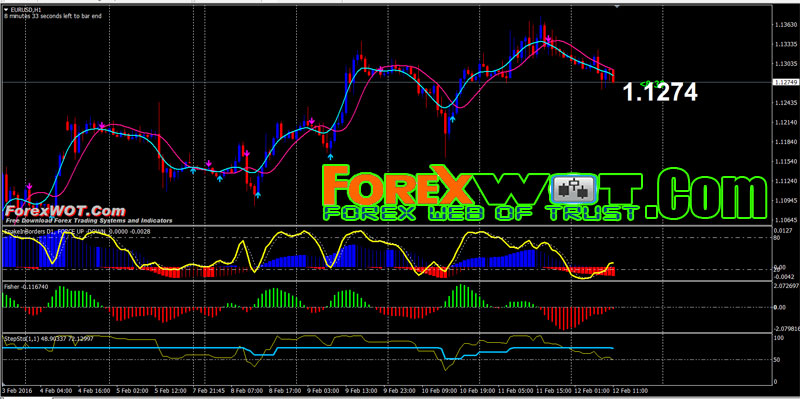

Forex Step Stochastic Intraday Trading with Snake Custom Indicator

High Accuracy Forex Step Stochastic Intraday Trading with Snake Custom Indicator – Intraday traders are mostly full time traders and it is imperative that they dedicate themselves to the task during whatever market hours they trade.

Strictly, intraday trading is trading only within a day, such that all positions are closed before the market closes for the trading day. Many traders may not be so strict or may have day trading as one component of an overall strategy. Traders who participate in intraday trading are called day traders. Traders who trade in this capacity with the motive of profit are therefore speculators.

Forex BIG TREND Trading Strategy Anyone Can Learn

Forex BIG TREND Trading Strategy – A trend is not actually a strategy by itself; it’s just an added point of confluence that increases the probability of a trade. But one of the major difficulties in trading trends is that by the time the trend has been established it is often too late to enter a trade.

The use of Forex BIG TREND Trading Strategy is very essential. With this method, you may be able to watch the clear direction of the regarding the market that goes and invest accordingly to the movements. You can also look for the current market price, the average movement and many breakouts that happened on the past.

—————————–

Knowing when the markets are Active or Slow is vital for all Currency Traders. For the Short-Term day Fx Trader, basing trades around the more volatile periods of the day increases the probability that the trade will be at your advantage. For Longer-Term Fx Traders, a slow down in price action presents a better period to enter a trade.

With this kind of knowledge and reasoning, you are probably more likely to increase your confidence in these very tricky markets in time. But always be careful with whichever angle you choose to strike at.

Well that should sum up the major trading times and how these times affect fx currency trading.