Free Forex Ichimoku Trading Short Course (Forex Day Trading System For Baginners). For every 10 traders that come to markets, at least 7 of them want to ‘day-trade,’ or as we call it in the forex market, ‘scalp.’ Even though many of these traders are still learning the market or are very new to trading, they know they want to embark on short-term trading.

Ichimoku Kumo / Cloud

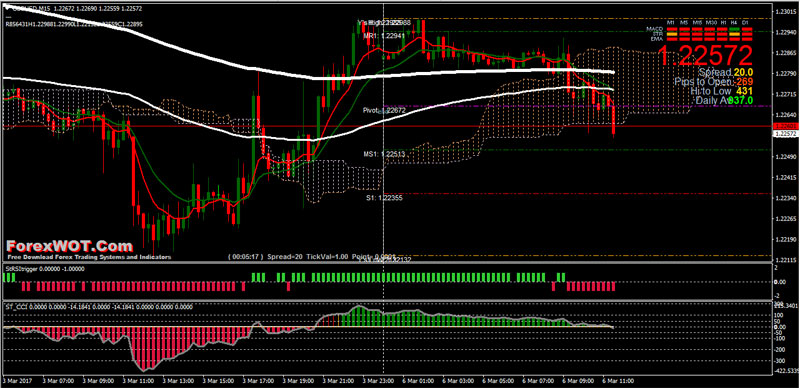

The most distinctive feature of the Ichimoku Kinko Hyo is the red and blue cloud you see stretching across (and ahead of) price.

Yes this is one of the rare indicators which forecasts price action ahead, contrary to what most believe technical analysis to be backward looking.

Also known as the Kumo, the cloud is created by the two lines “Senkou Span A” and “Senkou Span B”. It is primarily an ever-changing support and resistance zone, serving as resistance above price and a resistance below price.

At one glance, you can see whether price is currently bullish (above the cloud), bearish (below the cloud) or consolidating (inside the cloud).

Exponetial Moving Average 100 & 200

Moving Average is arguably the most commonly watched indicator in the stock, currency and commodity markets.

Price is expected to go bullish (bearish) when the faster moving average crosses above (below) the slower moving average.

Calculation of moving averages is done by taking the mean of the past closing prices.

I think the 100 and 200 sma’s are popular is because 100 is 1/3rd of a year and 200 is 2/3rds of a year (out of 365 days), so if price crosses that number, that says that now price is on average over the last 100 days higher than it was the previous 100 days. Same with the 200.

Forex Ichimoku Kumo Day Trading System Rules

“Trend is your friend“, do not forget it.

BUY Rules

- EMA 100 above EMA 200

- Price above Bulish Kumo

- ST RSI Trigger Green

- ST CCI Green

SELL Rules

- EMA 100 above EMA 200

- Price above Bulish Kumo

- ST RSI Trigger Green

- ST CCI Green

Day Trading Risk Management

Risking More Than 1% of Capital – Excessive risk does not equal excessive returns. Almost all traders who risk large amounts of capital on single trades will eventually lose in the long run.

A common rule is that a trader should risk (in terms of the difference between entry and stop price) no more than 1% of capital on any single trade.

Professional traders will often risk far less than 1% of capital.

Day trading also deserves some extra attention in this area.

A daily risk maximum should also be implemented. This daily risk maximum can be 1% (or less) of capital, or equivalent to the average daily profit over a 30 day period.

- For example, a trader with a $50,000 account (leverage not included) could lose a maximum of $500 per day.

Alternatively, this number could be altered so it is more in line with the average daily gain – if a trader makes $100 on positive days, she keeps losing days close to $100 or less.

The purpose of this method is to make sure no single trade or single day of trading hurts the traders account significantly.

By adopting a risk maximum that is equivalent to the average daily gain over a 30 day period, the trader knows that he will not lose more in a single trade/day than he can make back on another.