FREE DOWNLOAD Trading Systems for the Best Times to Trade the Foreign Exchange Market – You may have noticed when reading the previous section that at several times of the day more than one market is open at the same time.

These overlapping times usually provide the greatest degree of liquidity in certain currency pairs, as well as wider pip range movements. This tends to make these more liquid periods better times to trade, theoretically at least.

Basically, since more liquidity and a higher volume of trades will often be more beneficial to the speculative forex trader, certain times when trading is heavier in particular currency pairs can give a trader the edge needed to be profitable. This is especially true for traders using short term trading systems and strategies like scalping or day trading. And below are 3 recommended forex trading systems for you…

Ichimoku Cloud THV Trading System With Step MA Stochastic

Forex Ichimoku THV Trading System – A chart used in technical analysis that shows support and resistance, and momentum and trend directions for a security or investment. It is designed to provide relevant information at a glance using moving averages (tenkan-sen and kijun-sen) to show bullish and bearish crossover points.

The “clouds” (kumo, in Japanese) are formed between spans of the average of the tenkan-sen and kijun-sen plotted six months ahead (senkou span B), and of the midpoint of the 52-week high and low (senkou span B) plotted six months ahead.

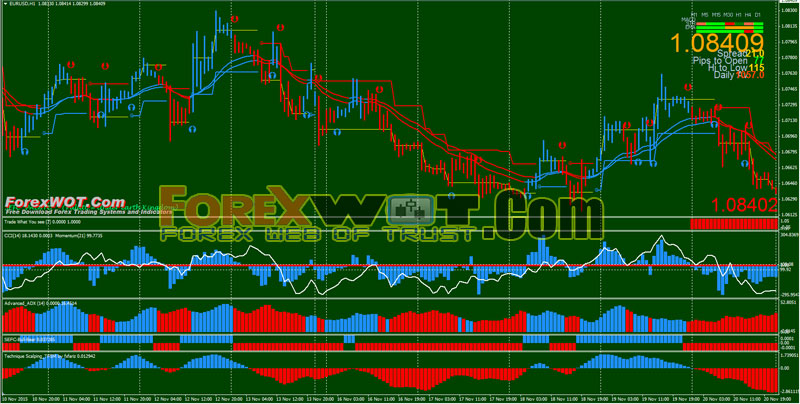

High Profits Trend Following Trading System

Forex High Profits Trend Following Trading System – This strategy is trend following and to look out to breakouts to take a deal, based on serveral indicators. The most forex indicators are in colour DodgerBlue and Red. That´s the name 😉

[sociallocker]

[/sociallocker]

What is trend following trading ?… A trading strategy that attempts to capture gains through the analysis of an asset’s momentum in a particular direction. The trend trader enters into a long position when a stock or currency is trending upward (successively higher highs). Conversely, a short position is taken when the stock currency is in a down trend (successively lower highs).

Forex Bollinger Bands Traders Dynamic Index Trading System

Forex Trading for Maximum Profit – Below this (Forex Traders Dynamic Index System), you will see the Forex Freedom Bar, which is a showing strength in 4 time frames you can adjust. Naturally…. Up = Blue, Down = Red. It display’s the reverse of the values in the properties display. (in other words…. From top to bottom, if you put in 60, 30, 15, 5; then it displays 5, 15, 30, 60). Its pretty easy to observe.

Bollinger Bands® are a great trading tool because they provide a lot of information in one indicator. Basically, the Bollinger Bands can help you with the three following things:

- Measuring volatility

- Identifying bottoms and tops

- Signaling the strength of a trend

Bollinger Bands are a great tool because they can do a variety of different things at the same time. The reason for that is because they are very close to the actual price, they consist of different things (a moving average and a standard deviation measurement) and they can be combined with different indicators easily.

Best Times to Trade the Foreign Exchange Market

Basically, since more liquidity and a higher volume of trades will often be more beneficial to the speculative forex trader, certain times when trading is heavier in particular currency pairs can give a trader the edge needed to be profitable.

The European-North American Overlap: 8:00 AM to 11:00 AM

This overlap is the key forex trading period when both the New York and London major forex trading centers are open for business. Trading in all the European currencies is heaviest during this period and offers the most liquidity for currency pairs involving the Euro, Pound Sterling and Swiss Franc.

Such especially liquid overlapping times would include the important 8:00 AM to 11:00 AM period when the major trading centers of New York and London are both open for business. Frankfurt is also open from 8AM until 10:00AM.

Also, if you are trading the EUR/USD, GBP/USD or USD/CHF currency pairs, then the market for these currency pairs would probably be the most active during that period because they represent the major currency pairs involving the United States and European countries.

The Asian European Overlap: 12:00 Midnight to 3:00 AM

Sydney closes at 1:00 AM, while the Tokyo, Hong Kong and Singapore stay open overlapping with Frankfurt and London at 2:00 AM and 3:00 AM respectively. This time period usually offers the most liquidity for the Japanese Yen, as well as the European Yen crosses.

Another good time to trade in order to take advantage of several different markets being open simultaneously, is between 1:00PM and 3:00 AM as Asian and European markets overlap at different points.

The Tokyo, Singapore and Hong Kong forex markets continue trading throughout this overlap period. The Frankfurt and London markets then open at 2:00 AM and 3:00 AM respectively, and they then overlap with Singapore and Hong Kong until 5:00AM.

This time period can see particularly active trading in the USD/JPY, EUR/JPY, GBP/JPY and CHF/JPY currency pairs.

The Australian Asian Overlap: 9:00 PM to 12:00 Midnight

This is the period during which the New Zealand and Australian markets overlap with the Asian markets of Tokyo, Singapore and Hong Kong. This time period tends to have the most liquidity for the Australian and New Zealand Dollars and their crosses.

Trading in Australia and New Zealand overlaps with Tokyo from 7:00PM and then with Singapore and Hong Kong from 9:00PM until Midnight when New Zealand closes and 1:00AM when Sydney closes.

This makes the overlap period from 9:00PM until Midnight especially liquid as Australia, New Zealand, Tokyo, Singapore and Hong Kong are all open.

This overlapping time frame often sees especially active trading in the AUD/USD, AUD/JPY, EUR/AUD, NZD/USD, AUD/NZD and NZD/JPY currency pairs.