FREE DOWNLOAD NOW – Top 10 Best Forex Trading Systems for Beginners

Forex is short for foreign exchange, but the actual asset class we are referring to is currencies. Foreign exchange is the act of changing one country’s currency into another country’s currency for a variety of reasons, usually for tourism or commerce.

Due to the fact that business is global there is a need to transact with most other countries in their own particular currency. After the accord at Bretton Woods in 1971, when currencies were allowed to float freely against one another, the values of individual currencies have varied, which has given rise to the need for foreign exchange services.

This service has been taken up by the commercial and investment banks on behalf of their clients, but has simultaneously provided a speculative environment for trading one currency against another using the internet.

Forex as a Speculation

Since there is constant fluctuation between the currency values of the various countries due to varying supply and demand factors, such as: interest rates, trade flows, tourism, economic strength, geo political risk and so on, an opportunity exists to bet against these changing values by buying or selling one currency against another in the hopes that the currency you buy will gain in strength, or the currency that you sell, will weaken against its counterpart. And below are Top 10 Best Forex Trading Systems for Beginners can adopt to help you become a better trader..

- Trading Forex Trends With Moving Averages and Trigger Indicator

High accuracy Trading Forex Trends With Moving Averages and Trigger Indicator – It can be extremely difficult for new traders to finalize a trend trading strategy for trading the Forex market. However, the good news is that most trend based strategies can be broken down into three different components. Today we are going to review the basics of a trending market strategy by identifying the trend, planning an entry, and identifying an exit.

The first step to trend trading is to find the trend! There are many ways to identify the EURUSD trend pictured below, but one of easiest is through 10 MA high and low. If price is stair stepping upwards that means price closed above 10 MA high, and the trend is up. Conversely if price is stepping down below 10MA low this mean price is potentially declining in a downtrend.

- High-Probability Ichimoku Cloud THV Trading System With Step MA Stochastic Custem Indicator

Forex Ichimoku THV Trading System – A chart used in technical analysis that shows support and resistance, and momentum and trend directions for a security or investment. It is designed to provide relevant information at a glance using moving averages (tenkan-sen and kijun-sen) to show bullish and bearish crossover points.

The “clouds” (kumo, in Japanese) are formed between spans of the average of the tenkan-sen and kijun-sen plotted six months ahead (senkou span B), and of the midpoint of the 52-week high and low (senkou span B) plotted six months ahead.

- Forex High Profits Trend Following Trading System

Forex High Profits Trend Following Trading System – This strategy is trend following and to look out to breakouts to take a deal, based on serveral indicators. The most forex indicators are in colour DodgerBlue and Red. That´s the name 😉

[signinlocker]

[/signinlocker]

What is trend following trading ?… A trading strategy that attempts to capture gains through the analysis of an asset’s momentum in a particular direction. The trend trader enters into a long position when a stock or currency is trending upward (successively higher highs). Conversely, a short position is taken when the stock currency is in a down trend (successively lower highs).

- Forex Bollinger Bands Traders Dynamic Index Trading System

Forex Trading for Maximum Profit – Below this (Forex Traders Dynamic Index System), you will see the Forex Freedom Bar, which is a showing strength in 4 time frames you can adjust. Naturally…. Up = Blue, Down = Red. It display’s the reverse of the values in the properties display. (in other words…. From top to bottom, if you put in 60, 30, 15, 5; then it displays 5, 15, 30, 60). Its pretty easy to observe.

Bollinger Bands® are a great trading tool because they provide a lot of information in one indicator. Basically, the Bollinger Bands can help you with the three following things:

- Measuring volatility

- Identifying bottoms and tops

- Signaling the strength of a trend

Bollinger Bands are a great tool because they can do a variety of different things at the same time. The reason for that is because they are very close to the actual price, they consist of different things (a moving average and a standard deviation measurement) and they can be combined with different indicators easily.

- Best Intra-day Forex Ribbon Trading Strategy With Stochastic Oscillator and MACD

Forex Ribbon Trading Strategy With Stochastic Oscilltor and MACD is a trend momentum trading system because is based on the trend indicators and momentum indicators.

What is Stochastic Oscillator indicator ?… In technical analysis of securities trading, the stochastic oscillator is a momentum indicator that uses support and resistance levels. Dr. George Lane developed this indicator in the late 1950s. The term stochastic refers to the point of a current price in relation to its price range over a period of time.

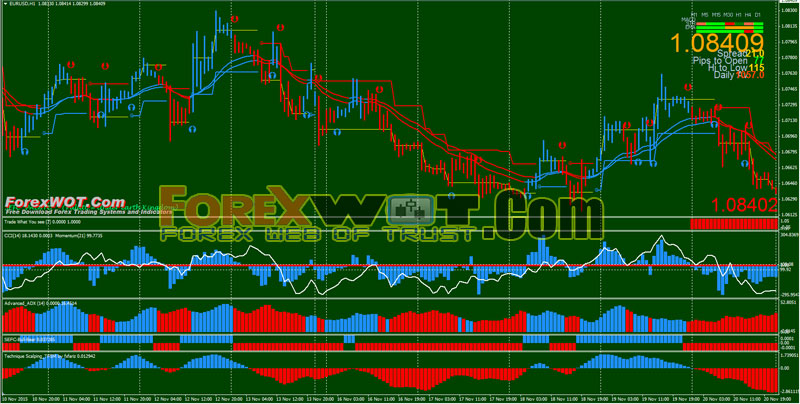

- Forex Moving Average CCI Trading System With Trend Reversal Indicator

Simple, Powerful and Effective Forex Trading System – Forex Moving Average CCI Trading System With Trend Reversal Indicator. This is trend following strategy based on retracement trading method. Time Frame M15, M30, H1 ,H4 and Daily rime frame.

Forex Moving Average CCI Trading Metatrader Indicators:

- SFX MLC (5,6,2,0,);

- Signal Bars – its one of the best indicators that is always on my charts

- CM;

- LC-FX Sipers

- FXST3 CCI indicator (14,4).

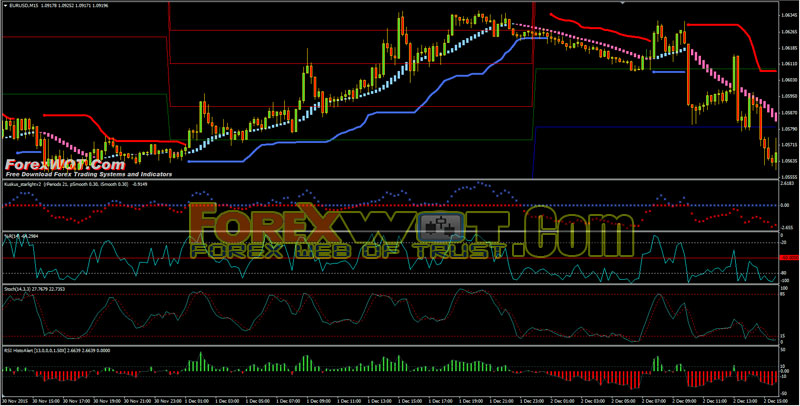

- Forex Kuskus Heiken Ashi Moving Average Trading System and Strategy

High Profits Forex Trading System and Strategy – This Forex Kuskus Heiken Ashi Moving Average Trading System is a trend-momentum forex strategy because it is composed of trend indicators and momentum indicators.

Best Time Frame: 15 min or higher.

Currency pair: any.

Forex Kuskus Heiken Ashi Moving Average Indicators:

- Bollinger Bands Stop indicator (15, 2);

- RSI histo Indicator (14 period) + 2 levels (+12, -12);

- William’s percent range (14 Period);

- Starlight indicator (rperiods 21, p.smooth 0.30, ismooth 0.30);

- Hama (Heiken Ashi Moving Average) pad V.2 (3 ,21,3) optional;

- Stochastic indicator (14,3,3,);

- Pivot Points Daily.

The main indicators in this trading system are Kuskus, HAMA, and RSI Histo. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength.

- London Session Forex CCI Fibonacci Retracement Trading System and Strategy

Forex CCI Fibonacci Retracement Trading – The commodity channel index (CCI) is an oscillator originally introduced by Donald Lambert in 1980.

Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in commodities, but also equities and currencies. The CCI can be adjusted to the timeframe of the market traded on by changing the averaging period.

Understanding the CCI Like most oscillators, the CCI was developed to determine overbought and oversold levels. The CCI does this by measuring the relation between price and a moving average (MA), or, more specifically, normal deviations from that average. The actual CCI calculation, shown below, illustrates how this measurement is made.

- Forex Trading Education With QQE Advanced ADX Trading System

Forex QQE Advanced ADX Trading System – is a trend following trading system filterd by QQE new histo alerts indicator and Advanced ADX.The purpose of this method is to filter the most number of false signals to increase the profitability of the Trading System.

[sociallocker]

[/sociallocker]

Advanced ADX – This is an advanced version of the Average Directional Movement Index (ADX) indicator. This indicator shows ADX indicator in another easy way. Buy when Bars is Green, Sell When Bars is Red.

The advanced ADX indicator is based on the Average Directional Movement Index (ADX). ADX basics: +DI above -DI means positieve trend. -DI above +DI means negative trend. ADX values above +23 suggest strong trends.

- Forex BBwin MACD Trading System with Moving Average and Heiken Ashi Indicators

Forex BBwin MACD Trading System is a trend folllowing Trading System and it’s based on BBwin MACD and Heiken Ashi indicator. This Forex Trading system is very simple but very-very effective.

Moving Average Convergence Divergence ( MACD ) is an extremely popular indicator used in technical analysis. MACD can be used to identify aspects of a security’s overall trend. Most notably these aspects are momentum, as well as trend direction and duration.

Pros and Cons of Trading Forex

If you intend to trade currencies, and regard the previous comments regarding broker risk, the pros and cons of trading forex are laid out as follows:

1. The forex markets are the largest in terms of volume traded in the world and therefore offer the most liquidity, thus making it easy to enter and exit a position in any of the major currencies within a fraction of a second.

2. As a result of the liquidity and ease with which a trader can enter or exit a trade, banks and or brokers offer large leverage, which means that a trader can control quite large positions with relatively little money of their own. Leverage in the range of 100:1 is not uncommon. Of course, a trader must understand the use of leverage and the risks that leverage can impose on an account. Leverage has to be used judiciously and cautiously if it is to provide any benefits. A lack of understanding or wisdom in this regard can easily wipe out a trader’s account.

3. Another advantage of the forex markets is the fact that they trade 24 hours around the clock, starting each day in Australia and ending in New York. The major centers being Sydney, Hong Kong, Singapore, Tokyo, Frankfurt, Paris, London and New York.

4. Trading currencies is a “macroeconomic” endeavor. A currency trader needs to have a big picture understanding of the economies of the various countries and their inter connectedness in order to grasp the fundamentals that drive currency values. For some, it is easier to focus on economic activity to make trading decisions than to understand the nuances and often closed environments that exist in the stock and futures markets where micro economic activities need to be understood. Questions about a company’s management skills, financial strengths, market opportunities and industry specific knowledge is not necessary in forex trading.