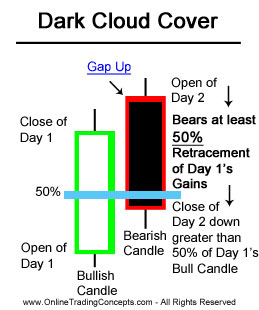

Best High Profits Forex Trading Dark Cloud Cover Pattern – The Dark Cloud Cover, in candlestick charting, is a pattern where a black candlestick follows a long white candlestick. It can be an indication of a future bearish trend.

There are two components of a Dark Cloud Cover formation:

- Bullish Candle (Day 1)

- Bearish Candle (Day 2)

A Dark Cloud Cover Pattern occurs when a bearish candle on Day 2 closes below the middle of Day 1’s candle.

In addition, price gaps up on Day 2 only to fill the gap (see: Gaps) and close significantly into the gains made by Day 1’s bullish candlestick.

The rejection of the gap up is a bearish sign in and of itself, but the retracement into the gains of the previous day’s gains adds even more bearish sentiment. Bulls are unable to hold prices higher, demand is unable to keep up with the building supply.

Dark Cloud Cover Example

Dark cloud cover, circled in A, appears on the daily scale. Price moves in a brisk upward trend, forming a tall white candle.

The next day, the clouds move in forming a black candle that begins the day with a higher open but closes below the middle of the white candle.

The change from bullish to bearish occurs in just one candle. It also represents a trend change from up to down when price breaks out downward. That happens when price closes below the lowest low in the dark cloud cover. Thereafter, price trends lower in a comparatively smooth move downward.

Shown is not the preferred setup. The best setup for the dark cloud cover candlestick is for it to appear when price is trending lower.

An upward retrace of that down move appears followed by dark cloud cover. It signals a reversal and when price breaks out downward, and the stock joins the downward primary trend already in existence. It is like a swimmer moving with the current turning against the current to avoid a buoy followed by a resumption of him swimming with the current.

NOTE:

Nobody knows what will happen after formation of a trade setup, either strong or weak. We have to decided based on what is already formed on the chart.

We have to analyze the conditions, and choose a good trade setup that has the minimum risk. You can go short at the top of a strong bull market, and it is possible that you make a good profit.

However, those who take the risky trade setups, can not be profitable in long term. They make profit periodically, but can not be profitable consistently.

Am I saying that a strong Dark Cloud Cover that forms while bulls were already exhausted, can reverse the price definitely?

Absolutely not. There is no guarantee that even a too strong Dark Cloud Cover formed while bulls were already exhausted, ends to the price reversal and a strong bearish movement. That is why we should always set a reasonable stop loss in all the positions we take.