Forex Joker MACD Trading System is a trend following system based on the combination of trend filter indicators.

A type of candlestick chart that shares many characteristics with standard candlestick charts, but differs because of the values used to create each bar. Instead of using the open-high-low-close (OHLC) bars like standard candlestick charts, the Heiken-Ashi technique uses a modified formula:

Close = (Open+High+Low+Close)/4

Open = [Open (previous bar) + Close (previous bar)]/2

High = Max (High,Open,Close)

Low = Min (Low,Open, Close)

The Heiken-Ashi technique is used by technical traders to identify a given trend more easily. Hollow candles with no lower shadows are used to signal a strong uptrend, while filled candles with no higher shadow are used to identify a strong downtrend.

This technique should be used in combination with standard candlestick charts or other indicators to provide a technical trader the information needed to make a profitable trade.

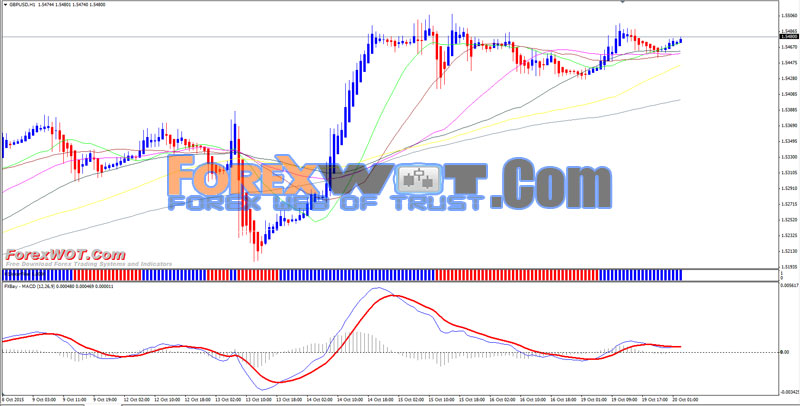

- Time Frame: H1 and H4.

- Markets: Forex (EUR/USD, GBP/USD, AUD/USD, USD/CAD, NZD/USD, USD/CHF, GBP/JPY, EUR/JPY, USD/JPY; Index (Dax, S&P500, Nasdaq, FTSE).

- Heiken Ashi v.3;

- FXbay MACD,

- Gaug EMAs (Trend Direction Filter),

- Joker Filter (short term trend direction filter).

- Joker Filter blue bar,

- FXbay MACD blue line above red line

- Gaug EMAs trend direction filter upward

- Heijen Ashi blue bar

When these conditions are agree place a buy order at the opening of the next bar.

- Joker Filter red bar,

- FXbay MACD blue line below red line

- Gaug EMAs trend direction filter downward

- Heijen Ashi red bar

When these conditions are agree place a sell order at the opening of the next bar.

initial stop loss h1 time frame 15 pips below/above the entry bar, h4 time frame 25 pips above/belowe the entry bar.

Make profit when Joker filter changes direction or ratio 1.2 stop loss.