FREE DOWNLOAD Four Highly Effective Indicators & Forex Trading Systems Every Trader Should Know. Once you know how to use the Moving Average, RSI, Stochastic, & MACD indicator, you’ll be well on your way to executing your trading plan like a pro.

One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators.

Four Highly Effective Trading Systems

In keeping with the idea that simple is best, there are four easy indicators you should become familiar with using one or two at a time to identify trading entry and exit points. Once you are trading a live account a simple plan with simple rules will be your best ally.

Knowing how to use any one or more of the four indicators like the Moving Average, Relative Strength Index (RSI), Slow Stochastic, and Moving Average Convergence & Divergence (MACD) will provide a simple method to identify trading opportunities.

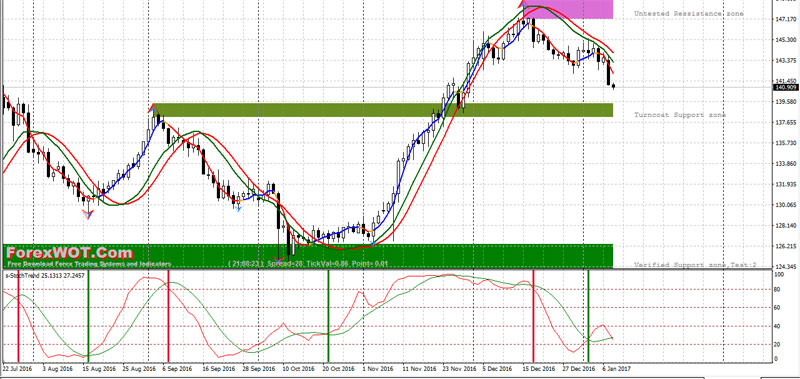

1 – Moving Average Trading System

Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. When the market is trending up, you can use the moving average or multiple moving averages to identify the trend and the right time to buy or sell.

[sociallocker]

[/sociallocker]

Forex MA Rainbow Intraday Trading Strategy with Asctrend and Traders Dynamic Index Value is a trend following strategy based on the sets of moving averages.

In my opinion, the strategy solves the problem of when to buy after a bearish pullback, or when to sell after a bounce retracement.

2 – Trading With RSI

The Relative Strength Index or RSI is an oscillator that is simple and helpful in its application. Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. For those who like to ‘buy low and sell high’, the RSI may be the right indicator for you.

[sociallocker]

[/sociallocker]

Easy forex trading with Trend MA RSI and Multi TimeFrame ADX Trading Strategy. If you want to be the best trader, you must learn from the best trader and use the best trading system.

3 – Trading With Stochastics

Slow Stochastics are an oscillator like the RSI that can help you locate overbought or oversold environments, likely making a reversal in price.

The unique aspect of the stochastic indicator is the two lines, %K and %D line to signal our entry. Because the oscillator has the same overbought or oversold readings, you simply look for the %K line to cross above the %D line through the 20 level to identify a solid buy signal in the direction of the trend.

[sociallocker]

[/sociallocker]

HolyTrend (HolySignalTrend and HolySignal) are very important indicators. It calculates and shows the real time tops and bottoms of the price. You can even use it alone with pretty good accuracy. This is not a well known ZigZag indicator.

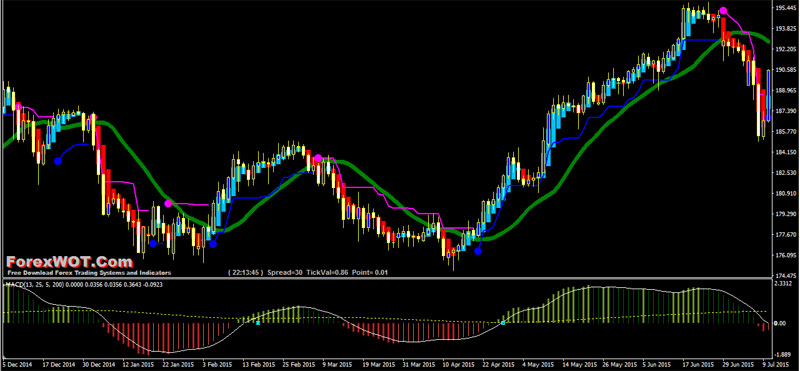

4 – Trading With the Moving Average Convergence & Divergence (MACD)

Sometimes known as the king of oscillators, the MACD can be used well in trending or ranging markets due to its use of moving averages provide a visual display of changes in momentum.

Like all indicators, the MACD is best coupled with an identified trend or range-bound market. Once you’ve identified the trend, it is best to take crossovers of the MACD line in the direction of the trend. When you’ve entered the trade, you can set stops below the recent price extreme before the crossover, and set a trade limit at twice the amount you’re risking.