FREE DOWNLOAD Best 5+ Trading Systems You Need to Know to be a Successful Trader – Forex has caused large losses to many inexperienced and undisciplined traders over the years. You need not be one of the losers. Here are best 5+ forex trading systems that you can use to avoid disasters and maximize your potential in the currency exchange market.

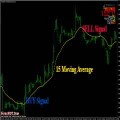

Trading Forex Trends With Moving Averages and Trigger Indicator

High accuracy Trading Forex Trends With Moving Averages and Trigger Indicator – It can be extremely difficult for new traders to finalize a trend trading strategy for trading the Forex market. However, the good news is that most trend based strategies can be broken down into three different components. Today we are going to review the basics of a trending market strategy by identifying the trend, planning an entry, and identifying an exit.

The first step to trend trading is to find the trend! There are many ways to identify the EURUSD trend pictured below, but one of easiest is through 10 MA high and low. If price is stair stepping upwards that means price closed above 10 MA high, and the trend is up. Conversely if price is stepping down below 10MA low this mean price is potentially declining in a downtrend.

High Profits Forex Moving Average Trading Using The M15 Time Frame

Forex Moving Average Trading – This High Profits Forex Trading Using The M15 Time Frame is a trend following trading system that Based on the SEFC indicators and Filter indicators for filterd the trading signals of Bollinger Bands Stop. These indicators repaint but Bollinger Band Stop alert indicator not repaint.

A simple, or arithmetic, moving average that is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods. Short-term averages respond quickly to changes in the price of the underlying, while long-term averages are slow to react.

Forex Harmonic Patterns and Harmonic Trading Strategy With MACD

Forex Harmonic Patterns and Trading Strategy – Harmonic price patterns take geometric price patterns to the next level by using Fibonacci numbers to define precise turning points. Unlike other trading methods, Harmonic trading attempts to predict future movements. This is in vast contrast to common methods that are reactionary and not predictive.

Harmonic price patterns are extremely precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point.

Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. The danger occurs when a trader takes a position in the reversal area and the pattern fails. When this happens, the trader can be caught in a trade where the trend rapidly extends against them. Therefore, as with all trading strategies, risk must be controlled.

Forex Easy M15 Trading the London and New York Session With Moving Average and ADX

Trading the London – New York Session With Moving Average and ADX. The open of the London session at 3:00 AM is when many consider this type of behavior to be starting for the day in the FX Market. By many accounts, London is the heart of the FX market with approximately 35% of daily volume transacted during this session.

As the US (New York) session begins 5 hours later, the environment can change quite a bit as even more liquidity is entering the market; and this time it is coming from both sides of the Atlantic. For the purposes of this article, we are going to focus on the London session, before the US opens for business (3-8 AM Eastern Time).

The slower Tokyo market will lead into the London session, and as prices begin to come from liquidity providers based in the United Kingdom, traders can usually see volatility increase. As prices begin to come in from London, the ‘average hourly move’ on many of the major currency pairs will often increase.

Momentum Trend Channel Trading Strategy

How to Catch Forex Profitable Trends – Momentum Trend Channel Trading Strategy is mainly a trend following system designed for trading forex market. It’s based in volume, momentum, and trend channel (i-regression curve) stochastics candles.

[sociallocker]

[/sociallocker]

Trend Channel indicator : is simply a visual trend identifier ( yellow line ). It provides visual confirmation for the rest of indicators used to identify the major trend. It doesn’t provide buy/sell signals but it provides overbought and oversold areas – between red lines.

Momentum Indicator : One of the key tenets of technical analysis is that price frequently lies, but momentum generally speaks the truth. Just as professional poker players play the player and not the cards, professional traders trade momentum rather than price.

NOTE: Begin with small sums, increase the size of your account through organic gains, not by greater deposits

One of the best tips for trading forex is to begin with small sums, and low leverage, while adding up to your account as it generates profits.

There is no justification to the idea that a larger account will allow greater profits. If you can increase the size of your account through your trading choices, perfect.

If not, there’s no point in keeping pumping money to an account that is burning cash like an furnace burns paper.