FREE DOWNLOAD Top 5 Trading Systems and The Best Way to do Forex Trading – If you’ve looked into trading forex then you have most doubtable been exposed to all the various opportunities to make money and are wondering which is the best way to learn forex trading.

First of all

The foremost thing I would advise is to get a Forex Education. There are countless material on Forex in the internet for newcomers as well as experienced traders – all you need to do is search. Spend some time reading up on how forex trading works, the concepts behind trades and how prices are impacted by economic and political conditions.

Set rules that will determine your trading pattern and how you will enter and exit the market. And below are top 5 best Forex Trading Systems and Rules you have to know..

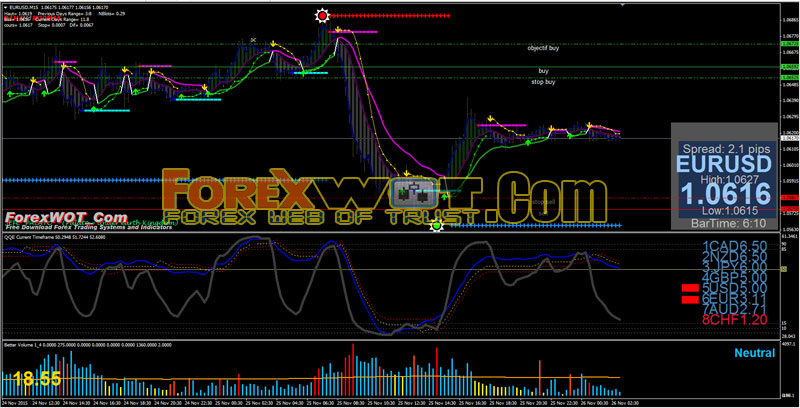

- Forex Easy M15 Trading the London and New York Session With Moving Average and ADX

Trading the London – New York Session With Moving Average and ADX. The open of the London session at 3:00 AM is when many consider this type of behavior to be starting for the day in the FX Market. By many accounts, London is the heart of the FX market with approximately 35% of daily volume transacted during this session.

As the US (New York) session begins 5 hours later, the environment can change quite a bit as even more liquidity is entering the market; and this time it is coming from both sides of the Atlantic. For the purposes of this article, we are going to focus on the London session, before the US opens for business (3-8 AM Eastern Time).

The slower Tokyo market will lead into the London session, and as prices begin to come from liquidity providers based in the United Kingdom, traders can usually see volatility increase. As prices begin to come in from London, the ‘average hourly move’ on many of the major currency pairs will often increase.

- Forex Harmonic Patterns and Harmonic Trading Strategy With MACD

Forex Harmonic Patterns and Trading Strategy – Harmonic price patterns take geometric price patterns to the next level by using Fibonacci numbers to define precise turning points. Unlike other trading methods, Harmonic trading attempts to predict future movements. This is in vast contrast to common methods that are reactionary and not predictive.

Harmonic price patterns are extremely precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point.

Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. The danger occurs when a trader takes a position in the reversal area and the pattern fails. When this happens, the trader can be caught in a trade where the trend rapidly extends against them. Therefore, as with all trading strategies, risk must be controlled.

- High Profits Forex Moving Average Trading Using The M15 Time Frame

Forex Moving Average Trading – This High Profits Forex Trading Using The M15 Time Frame is a trend following trading system that Based on the SEFC indicators and Filter indicators for filterd the trading signals of Bollinger Bands Stop. These indicators repaint but Bollinger Band Stop alert indicator not repaint.

[sociallocker]

[/sociallocker]

A simple, or arithmetic, moving average that is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods. Short-term averages respond quickly to changes in the price of the underlying, while long-term averages are slow to react.

- Forex Volume Trading Strategy Based on BBand Stop and QQE Indicator

Forex Volume Trading Strategy – Volume is an extremely popular trading tool when trading stocks, options, futures, and many other instruments. But when it comes to Forex, we do not see many traders using volume. The reason is that the Forex market is decentralized and the overall market volume is not available.

The solution for this is Better Volume indicator. While it won’t show us how much volume is being traded world-wide, it will tell us how much volume is being traded in your broker accounts. Due to Broker’s large client base, Better Volume indicator can use this to determine how volume is fluctuating on a relative basis.

Forex Volume Trading Strategy Based on BBand Stop and QQE Indicator is intraday trading system trend following it’s based from two indicators in the same window Rsioma and QQE, Better volume, and BBand Stop indicator. RSIOMA is an indicator of force of markets that derive from RSI, QQE is an trend indicator.

- Forex Bollinger Bands Price Action Trading System and Strategy

Bollinger Bands trading system is a price action forex strategy based on Zig Zag rnp indicator, advanced-ADX, ArrzzX2 indicator with Bollinger bands.

Bollinger Bands® are a technical chart indicator popular among traders across several financial markets. On a chart, Bollinger Bands® are two “bands” that sandwich the market price. Many traders use them primarily to determine overbought and oversold levels.

One common strategy is to sell when the price touches the upper Bollinger Band® and buy when it hits the lower Bollinger Band®. This technique generally works well in markets that bounce around in a consistent range, also called range-bound markets. In this type of market, the price bounces off the Bollinger Bands® like a ball bouncing between two walls.

Secondly you must get some experience

If you want to learn forex trading, it’s the only way. To begin with it is prudent for this to be on a demo account. This will give you a good technical foundation on the mechanics of making forex trades and get used to using a trading platform.

Real Account

After having traded for some time on a demo account it is very important to also use a Real one, albeit with little investment amount – find a broker that will accept lower sized trades (0.01 lots for FX) so that you can get a real feel for the live market. It is a whole different game trading on a demo and real platform, due to the psychological effect that trading with real money has. Trading small will allow you to put your money on the line, but at little risk if you make mistakes or lose money.

Gradually increase your trading size

From there, provided you are gaining more than you are losing, you should gradually increase your trading size and invested capital, always keeping in mind it should be an amount you can afford to lose and which you feel comfortable with.

Hello!You can describe this strategy?High Profits Forex Moving Average Trading Using The M15 Time Frame