Best 5+ Ways How To Earn More Income Online With Forex Trading. Did you know that… hundreds and thousands or forex traders trade in the forex market online every day… and make an absolute killing at it. How do they do it?

Well I am going to give you 5 easy tips that will help you make more money with forex trading.

Don’t Get Over-Confident

Take tiny margins. It is one of the biggest advantages in trading forex. It allows you to trade amounts far larger than the total of what you have deposited. But don’t get over confident with this… some rookies get greedy and this destroys many traders. Only increase depending on your experience and success.

Trade When It’s News Time

Most really big trade occur around news time. Trading volume is high and the moves are noteworthy. This means there is no better time to trade than when the news is released. This is when the big guns adjust their positions and prices change resulting in a serious currency flow. And below are 5 best trading systems to read the market movement..

- Forex Triple CCI Trading System and Strategy With BBands Stop Indicator

Forex Triple CCI Trading Strategy – Forex Triple CCI Trading System and Strategy With BBands Stop Indicator is based on the CCI and Fisher function with other indicators trend following.

Commodity Channel Index (CCI) – Developed by Donald Lambert and featured in Commodities magazine in 1980, the Commodity Channel Index (CCI) is a versatile indicator that can be used to identify a new trend or warn of extreme conditions.

Lambert originally developed CCI to identify cyclical turns in commodities, but the indicator can successfully applied to indices, ETFs, stocks and other securities. In general, CCI measures the current price level relative to an average price level over a given period of time.

CCI is relatively high when prices are far above their average. CCI is relatively low when prices are far below their average. In this manner, CCI can be used to identify overbought and oversold levels.

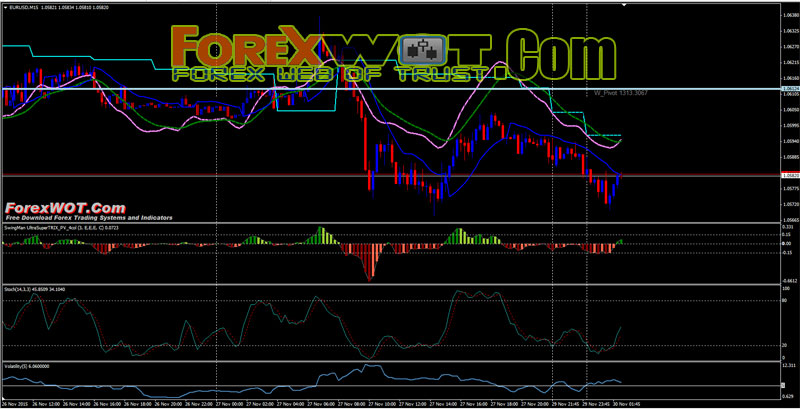

- Forex GANN Trading Strategy for Maximum Profitability Based on Volatility and TRIX Moving Average

Forex Trading Strategy for Maximum Profitability. The following is the very best trading strategy that I believe possible when trading the Forex markets. Forex GANN Trading Strategy is based on the principle, buy low and sell high off the 4hr. 30MTF Gann strategy is a trend following Trading system.

The Volatility Index is a contrarian sentiment indicator that helps to determine when there is too much optimism or fear in the market. When sentiment reaches one extreme or the other, the market typically reverses course.

What is volatility? One definition describes volatility as “the rate and magnitude of changes in price.” In simple English, volatility is how fast prices move. When the market is calm and moving in a trading range or even has a mild upside bias, volatility is typically low.

- Forex Heiken Ashi Smoothed Trend Trading System with Double CCI and HAS Bar

Forex Heiken Ashi Smoothed Trend Trading System is an trend following trading system based on the Heiken Ashi Smoothed, MTF 4TF Has indicator and Double CCI indicator.

The Heikin-Ashi Smoothed technique is used by technical traders to identify a given trend more easily. Hollow candles with no lower shadows are used to signal a strong uptrend, while filled candles with no higher shadow are used to identify a strong downtrend.

This technique should be used in combination with standard candlestick charts or other indicators to provide a technical trader the information needed to make a profitable trade.

- Forex Profitable Trends with Momentum Trend Channel Trading Strategy

How to Catch Forex Profitable Trends – Momentum Trend Channel Trading Strategy is mainly a trend following system designed for trading forex market. It’s based in volume, momentum, and trend channel (i-regression curve) stochastics candles.

[sociallocker]

[/sociallocker]

Trend Channel indicator : is simply a visual trend identifier ( yellow line ). It provides visual confirmation for the rest of indicators used to identify the major trend. It doesn’t provide buy/sell signals but it provides overbought and oversold areas – between red lines.

Momentum Indicator : One of the key tenets of technical analysis is that price frequently lies, but momentum generally speaks the truth. Just as professional poker players play the player and not the cards, professional traders trade momentum rather than price.

- Forex Easy M15 Trading the London and New York Session With Moving Average and ADX

Trading the London – New York Session With Moving Average and ADX. The open of the London session at 3:00 AM is when many consider this type of behavior to be starting for the day in the FX Market. By many accounts, London is the heart of the FX market with approximately 35% of daily volume transacted during this session.

[sociallocker]

[/sociallocker]

As the US (New York) session begins 5 hours later, the environment can change quite a bit as even more liquidity is entering the market; and this time it is coming from both sides of the Atlantic. For the purposes of this article, we are going to focus on the London session, before the US opens for business (3-8 AM Eastern Time).

The slower Tokyo market will lead into the London session, and as prices begin to come from liquidity providers based in the United Kingdom, traders can usually see volatility increase. As prices begin to come in from London, the ‘average hourly move’ on many of the major currency pairs will often increase.

Exiting Trades

If you place a trade and it’s not working out for you, get the hell out of there. Don’t multiply your mistake by staying in for hopes sake for a reversal. That is very unlikely to happen. And on the other side if you are winning a trade, don’t pull back because of the stress levels. You must learn to tolerate the stress, it is natural to trading, and you must get used to it.

Don’t be smart

The most successful traders keep their trading basic. They don’t analyze all day or research historical trends and track web logs and their results are excellent. They spend their time in the stress zone not in the library.

Build Your Confidence With Experience

If you lose money early in your trading career it’s very difficult to regain it; the trick is not to go off half-loaded; learn the business before you trade. Knowledge is power when coming to trading.

Forex is a game of knowledge… you must know about the business.