Today, I want to introduce the Forex Profit Boost system to you. This system is an effective combination of indicators to boost your profit making abilities in the market. This system is really good because of its simplicity, versatility, and credibility.

The rules of this system are straightforward and easy to follow, and there’s no need for guesswork in this system. That makes this system very simple.

The system is versatile as it works well with any timeframe from 1 Minute (M1) to the Daily (D1) timeframe. You can choose the timeframe you prefer and comfortable trading with. Also, you can trade it on any currency pair. You can decide on which currency pair to focus on.

The system is credible. Most of the time, it doesn’t give false signals. About 90% of the time that I use this system, I am able to hit my targets.

I will explain two ways to enter the market using the system, either with an aggressive approach or a conservative approach.

I will teach you everything you need with Forex Profit Boost. We’ll look at the components that make the system work and then go over the trading rules. Also, I will provide trading examples for your reference. It’s time to get the ball rolling…

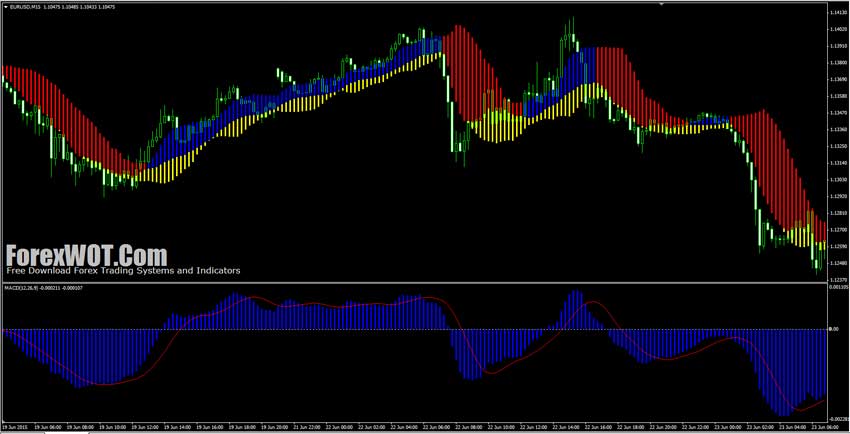

The Forex Profit Boost system uses two indicators: Forex Profit Boost and MACD. Below is how the chart template looks like.

The Forex Profit Boost is a custom indicator and is the first step to confirm the entries.

This indicator changes in color – it can turn from Blue to Red or vice versa. The indicator will appear Blue when the market is bullish and indicates that there’s a possible long trade. On the other hand, it will turn Red when the market is bearish and there’s a possible short trade.

Blue bars signify an uptrend and Red bars suggest a downtrend. For a BUY entry, the Forex Profit Boost bars should be Blue in color and are below the candlesticks.

For a SELL entry, the Forex Profit Boost bars should be Red in color and are above the candlesticks.

The Yellow bars below the Blue and Red give us an extra confirmation. They give us an indication of a stronger or weaker signal.

When the Yellow bars are below the Blue bars, it indicates that we have a stronger signal that the market will continue on moving upwards.

When the Yellow bars are below the Red bars, this indicates that the downtrend will eventually stop and the Red bars will start to turn into Blue.

The Moving Average Convergence-Divergence, or simply MACD, is a technical momentum indicator developed by Gerald Appel. This indicator is popular, it’s used by many traders to confirm buy and sell signals. The indicator consists of the center line (also called zero line), signal (red) line, and histogram (or bar graph).

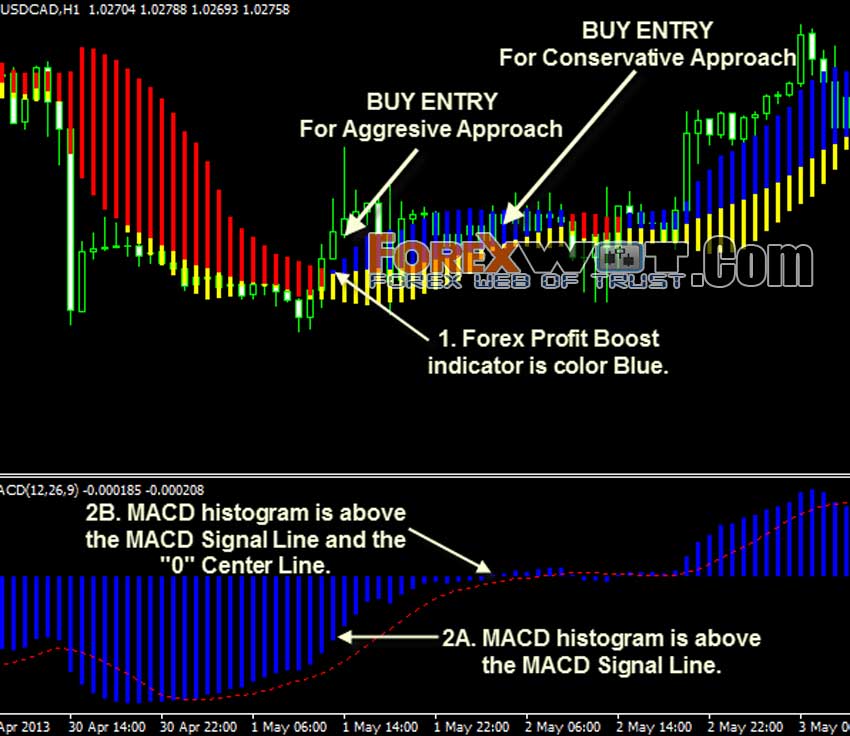

On the image below, you can see that the signal line crossed under the histogram. This means that price is starting to climb. With the aggressive approach, you get a buy signal when the histogram is above the signal line.

While with the conservative approach, the signal line has to cross the zero line to get a confirmation that price is indeed rising. So you have a buy signal when the histogram is above the signal line and has crossed (or is above) the “0” center line.

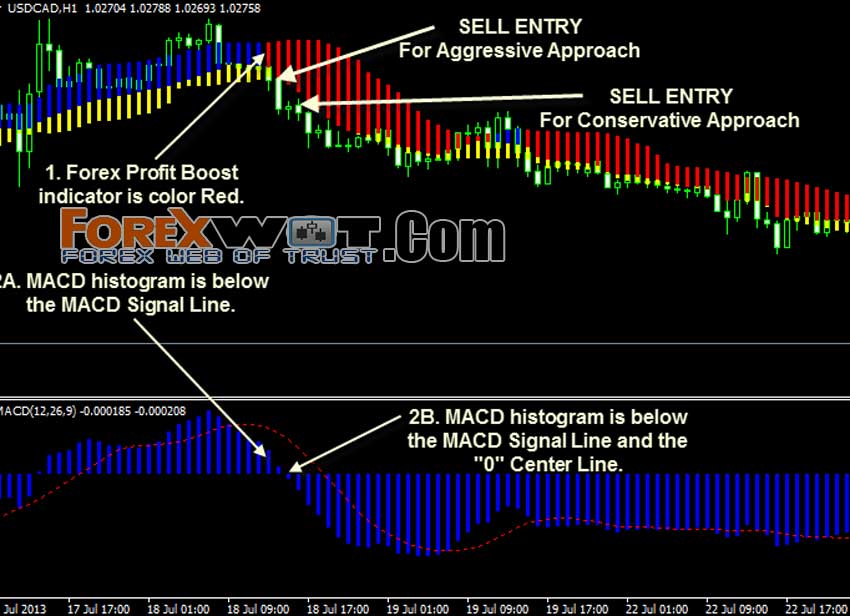

On the other hand, when you see that the signal line is crossing above the histogram, this means that the price will be moving downwards. You get a sell signal when the histogram is below the signal line with the aggressive approach.

When using the conservative approach, the signal line has to cross under or be below the zero line to get a confirmation that the price is falling. You will have the sell signal when the histogram is below the signal line and has crossed under the “0” center line.

-

- Wait for the Forex Profit Boost indicator to turn Blue in color.

- Check the MACD for confirmation:

Aggressive Entry: a. Wait for a MACD histogram bar to form above the MACD signal line.

Conservative Entry: a. Wait for a MACD histogram bar to be above the MACD signal line. b. The MACD histogram must cross above (or be above) the “0” center line. - When you get confirmation from the two indicators above, place a Buy trade as soon as the signal candle closes (or at the open of the next candle).

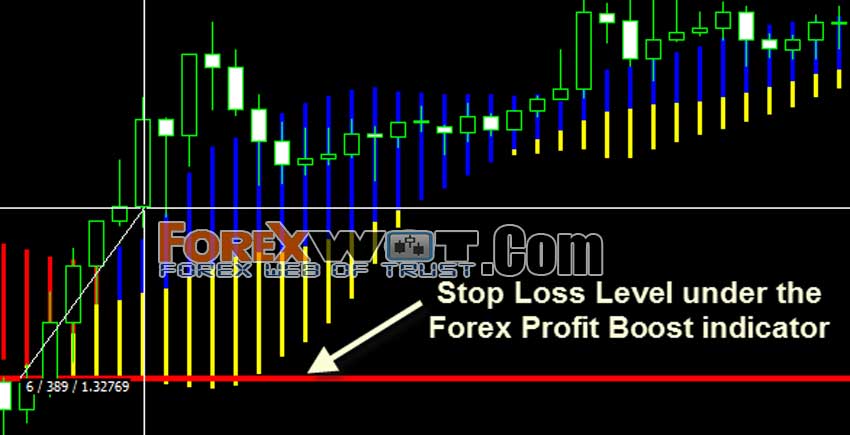

- Set the Stop Loss a few pips below the most recent swing low or under the Forex Profit Boost indicator.

- Set the Take Profit Level at the same distance as the Stop Loss (1:1 risk-ratio). For example, if the Stop Loss is set at 30 pips then the Take Profit should be set at 30 pips.

The Stop Loss and Take Profit Levels illustrated below are for our conservative entry.

- Wait for the Forex Profit Boost indicator to turn Red in color.

- Wait for the MACD for confirmation:

Aggressive Entry: a. Wait for a MACD histogram bar to form under the MACD signal line.

Conservative Entry: a. Wait for a MACD histogram bar to form under the MACD signal line. b. The MACD histogram must cross under (or be below) the “0” center line. - When you get confirmation from the two indicators above, place a Sell trade as soon as the signal candle closes (or at the open of the next candle).

- Set the Stop Loss a few pips above the most recent swing high or above the Forex Profit Boost indicator.

- Set the Take Profit Level at the same distance as the Stop Loss (1:1 risk-ratio). For example, if the Stop Loss is set at 30 pips then the Take Profit should be set at 30 pips.

The Stop Loss and Take Profit Level illustrated below are for the conservative entry.

Below is the USDCAD 15 Minute chart. Using the aggressive approach, the first step is to check for the Forex Profit Boost indicator to turn Blue in color.

Once it’s formed blue bars, we’ll look for our second signal on the MACD indicator to make sure that the histogram bar is above the MACD signal line.

You can see that both signals appeared below along the vertical line, we can place a buy trade order at the open of the next candle.

For this particular trade, we’ll set the Stop Loss Level few pips below the most recent swing low.

Next, we have to set the Take Profit Level at the same distance as the Stop Loss. Since the Stop Loss is set at 23 pips then the Take Profit will be set at 23 pips.

This is a good example of an aggressive long trade taken using the Forex Profit Boost system.

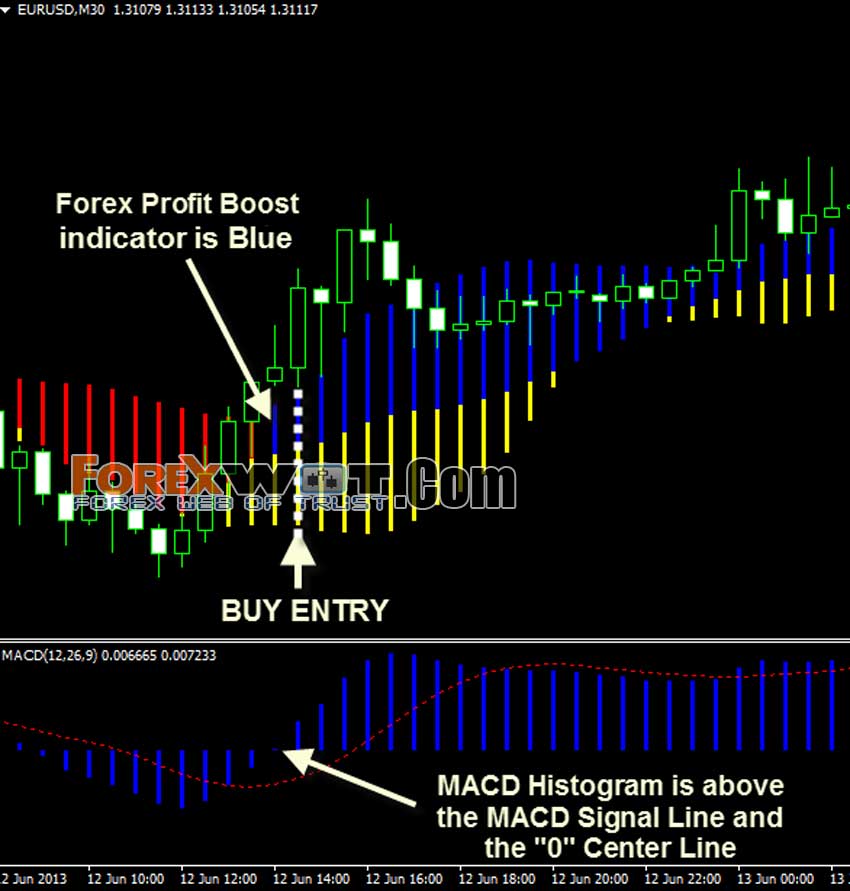

Here’s another buy trade example, but this time using the conservative approach. We will take a look at the EURUSD 30 minute chart.

The first buy signal occurs when the Forex Profit Boost indicator turns Blue. For our second signal, we should check that the MACD histogram is above both its signal line and the MACD “0” center line. After these two signals have been met, we can place a buy trade order at the open of the new candle.

We will then place the Stop Loss level under the Forex Profit Boost indicator or approximately 39 pips away.

For our Take Profit Level, we will set it at the same distance as the Stop Loss based on 1:1 ratio. Since the Stop Loss is set at 39 pips then the Take Profit will be set at 39 pips.

You can see that our Take Profit level was hit after three candles and we managed to exit this particular trade with a healthy profit.

Our first sell trade example is on the GBPUSD 30 Minute chart with an aggressive approach.

Similar to the buy trades, we will look at two indicators: the Forex Profit Boost indicator and the MACD. For the sell trade though, the Forex Profit Boost should be Red in color and the MACD histogram should be below the MACD signal line.

After we got these confirmations, we can place a sell trade order at the open of the new candle.

We’ll place our Stop Loss level a few pips above the recent swing high.

Next, we will place our Take Profit level at the same distance as the Stop Loss. Since the Stop Loss is set at 22 pips, our Take Profit will also be at 22 pips.

We can see that the price dropped over the next few candles and hit our Take Profit level.

Our last example is a sell trade using the conservative approach on the EURNZD 15 Minute chart.

Again, we should first look at the Forex Profit Boost and the MACD indicators. We can see below that the Forex Profit Boost gave us the first signal that the market is going to move downwards.

The Forex Profit Boost has turned Red. Afterwards, we can see that the MACD histogram fell under the signal line and the “0” center line.

As soon as we have these confirmations, we can place a Sell trade order at the open of the new candle.

For our Stop Loss, we’ll set it at the top of the Forex Profit Boost indicator.

For our Take Profit Level, we will set it at the same distance as the Stop Loss based on 1:1 ratio. Since the Stop Loss is set at 34 pips then the Take Profit will be set at 34 pips.

Price continued to decline and not long after we placed the Sell Trade, our Take Profit Level was hit and we exited this particular trade with a healthy profit.

When using the Forex Profit Boost, you only need to focus on the two indicators: the Forex Profit Boost and MACD.

Before placing your trades, check the stop loss level first. If the stop loss is too far from the most recent swing low, then use the edge of the Forex Profit Boost indicator alternatively.

Another thing that you will love about this system is that the system works on all timeframes and currency pairs. But don’t get greedy, trade only with currency pairs you are familiar with and make sure that the spread is low.

You have the option to use the conservative or the aggressive approach but the conservative approach yields the best results. So before placing your trades, make sure you are using the best signals.

If you are using the aggressive approach, you may want to employ additional risk reduction methods, such as moving the stop loss to breakeven once the trade has reached halfway towards your target.

Remember, don’t risk more than 2-5% of your account on any one trade and have only 1 trade at a time to reduce the number of losing trades that your account will incur at any one time.

Hi there

Can any person send me this Trading System

Greetings

Aslam ,I have this trading system.

How to download this system?

Hello,

Can send me this system? Tq.

Hello, looks very interesting. Does this system repaint?

Hi,

sir

I like this software

How much this software cost plz

https://forexwot.com/forex-profit-booster-most-of-the-time-it-doesnt-give-false-signals.html