Trading successfully is HARD WORK – especially hard personal work.

Trading demands your UNDIVIDED ATTENTION, draws on all your strengths and requires total dedication on your part at all times.

That is why a TRADER can be compared to a HIGHLY COMPETITIVE ATHLETE who can only enjoy continued success if he constantly keeps developing.

During this process keeping a top-notch trading, a journal can be of such help that it must not be underappreciated.

To a trader, a good trading journal is like a MIRROR that he needs to look at the time and again to find out where his current deficits lie.

Broadly speaking, most traders use a trading journal to track trade information such as entry price, initial stop, exit price, buy and sell date, fees, profit/loss and perhaps additional hand-written notes.

However, such a journal could actually offer a lot more.

If equipped with the right tools, a trading journal might well be of invaluable help in almost all trading activities.

So what does a trading journal need to have to be in the top league….?

To answer this question, I will be writing about how I got started in trading and about my first few encounters with this topic.

My trading career began at the end of the nineties, in the middle of the Internet boom, with high profits.

However, during the stock market crisis of 2000 to 2003, those profits turned into large losses within a very short period of time.

After a large part of my portfolio was lost, I withdrew from the markets for a year to OBSERVE and ANALYZE what mistakes I had made.

That is when I realized that I had hardly any data to analyze.

The only information I had were the broker’s data such as date, entry price, exit price and profit or loss as well as an additional field to record notes on the trade.

I collected all this information in an Excel file serving as a journal.

While this made it possible for me to determine my average profit or loss, I did not find any concrete clues as to at which point of my trading system and style there were unseen errors.

After nearly two years of trading, I had no opportunity whatsoever to evaluate this period of time and hundreds of trades.

While I had gained experience during all this time, it was unfortunately impossible to translate that into direct analyses and statistics which could have led to direct action, for example, a change in strategy.

To do that, additional data such as:

- The strategy used,

- The kind of trade (day trade, scalping, trend following etc.) different entry dates,

- The trader’s mental state,

- The type of order,

- The product,

- as well as some exit information would have been necessary in order to find out whether a strategy is profitable or loss-making,

- or whether profits or losses are more likely to be made at certain times of day,

- or if trading with certain products is profitable or not, or which entry or exit signal is profitable or not etc.

But there were also other reasons for my losses that came to light:

- Lack of knowledge of portfolio and risk management

- No use of money management rules

- No feedback on trading behavior

- No use of profitable trading strategies

- Use of products that do not fit the account

- Insufficient capital stock coupled with too high risk

After many conversations with other traders, I came to the conclusion that the above reasons and experiences may also be applicable to most other traders.

While a trader may acquire knowledge of Money Management through books, reflecting on one’s own trading style turns out to be extremely difficult.

As an athlete, I was used to making a plan for myself and implementing it through SELF-DISCIPLINE.

By collecting all the relevant data, such as date, the exact time of training, physical condition prior to training (illness, indisposition, headache etc.), detailed diet plan, the amount and nature of training etc., you always get a complete picture of your degree of progress.

If there is a setback, that detailed record allows you to uncover any mistakes made, to rectify them and thus to improve.

Only by such reflection, by comparing all the data collected, is any future progress possible.

This approach used by highly competitive athletes has been tried and tested and is highly functional.

Why then should it not be possible to duplicate this in the world of trading?

However, in sports, there are also other aspects of reflection such as competition, competitors, coaches, friends, training partners and measurable results (speed, stamina, strength).

These external components provide the athlete with permanent feedback on his performance status, but these are precisely the ones that the trader totally lacks.

The only feedback he receives is his profits or losses, and unless he has an extensive database full of information about his trades he has, as a rule, no chance of any real further development.

So, keep a TRADING JOURNAL and collect as much data as possible in order to have a complete record of your trading activities.

The question now is what should such a trading journal look like and how it can support a trader’s work.

A good trading journal should include all the reasons initially identified for any losses accrued and provide insight to the trader in each of these items.

With most brokers, there is usually no opportunity to actively manage portfolios and risks.

Account statements can be reviewed at the end of the month, although, that only provides information about the current balance and the profit and loss of trades.

However, active management of one’s portfolio(s) would make more sense.

This could be kept track of in a journal in which several portfolios are registered and administered to provide a quick survey of the portfolio(s) at all times.

In addition, it should be possible for payment transactions to be copied.

But the most important thing is RISK MANAGEMENT which has to be organised separately for each new portfolio.

In RISK MANAGEMENT, risk parameters are determined for the portfolio, money management, and trades.

This includes, for example, the entire risk for the portfolio, for a series of trades (all open trades) and the individual trade.

Furthermore, these parameters should be classified according to the trader‘s predetermined risk categories.

If money management modules are offered, it should be possible for these to be defined by their individual risk parameters to enable suitable fine-tuning.

RISK MANAGEMENT serves to monitor TRADES and to control the RISK TAKEN.

When entering a trade the risk parameters, suitably adjusted, should be checked and compared to the trade entered.

Should the risk level in question be exceeded, this ought to be indicated and the trade not executed.

In this way, unnecessarily high risks and losses can be avoided.

The use of MONEY MANAGEMENT discussed in this magazine and is, unfortunately, still vastly underappreciated.

Without the application of STRICT MONEY MANAGEMENT RULES, it is not possible to make profits long-term on the stock market.

If that’s the case, then being supported by a trading journal is of paramount importance.

While Risk Management defines the level of risk taken, Money Management determines how that risk is calculated.

Generally speaking, there are two ways to practice successful money management.

A trader can take many frequent small stops and try to harvest profits from the few large winning trades, or a trader can choose to go for many small squirrel-like gains and take infrequent but large stops in the hope the many small profits will outweigh the few large losses.

The first method generates many minor instances of psychological pain, but it produces a few major moments of ecstasy.

On the other hand, the second strategy offers many minor instances of joy, but at the expense of experiencing a few very nasty psychological hits.

With this wide-stop approach, it is not unusual to lose a week or even a month’s worth of profits in one or two trades.

In further developing one’s own trading style very many items of information are required, each of which has to be recorded when entering the trade.

The more data collected on the trade, the finer the adjustment can be made to the trading style.

This makes it necessary for the recorded data to be divided into various categories in order to later provide differentiation.

- 1) Basic Trade Settings:

Day of trade, portfolio, currency, product, direction, strategy, and trade target - 2) Further Factors of Influence:

Mental state at beginning of trade (relaxed, fearful, tense etc.), type of trade (day trade, trend following etc), time of day, hit probability, volatility at beginning of trade - 3) Entry Parameters:

Type of market (trend market, range market etc), entry signal (indicator, resistance etc), kind of execution (planned, unplanned, too early etc). Type of order (limit order, market order, stop order etc), financing rate, holding period - 4) Trade Entry:

Average True Range (ATR), entry price, time of entry, initial stop, price target, current price, number, deferred stop, exit price, time of exit, profit/loss - 5) Additional Information on Stocks:

Stock entry, list of shares, stock exchange, Electronic Communication Network (ECN) - 6) Exit Parameters:

Type of execution (planned, unplanned, too early etc), exit signal (indicator, resistance etc), reason for exit (profit taking, safety exit etc), Type of order (limit order, market order, stop order etc), mental state at exit (relaxed, fearful, tense etc) - 7) Error Entry:

Entry of standardized errors (entry criteria disregarded, stop criteria disregarded etc) - 8) Optimum Trade:

Optimum entry, optimum stop, optimum exit, optimum profit, maximum move - 9) Note:

Opportunity to record the trade in your own words - 10) Evaluation:

Evaluation of preliminary planning, set-up, entry, exit, mental state and market conditions, all based on school marks

On the basis of this list, you can see how complex the optimum recording of data ought to be.

The trading journal should make it possible for all these data to be recorded relatively quickly and without complications.

Except for the price data, all other parameters must be standardized.

That means that these data are compiled in select lists, subsequently stay unchanged and may only be supplemented.

Additionally, it should be possible for this data to be defined by traders themselves so that their own trading style can be reflected in the program.

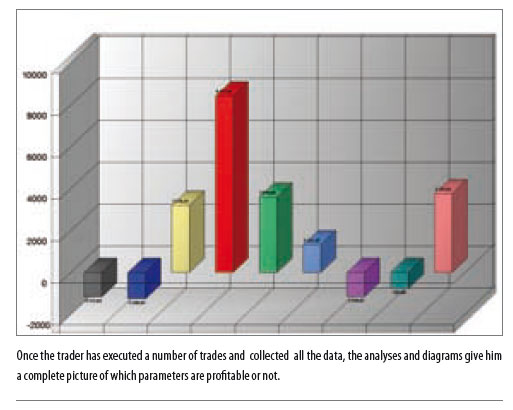

Once the trader has completely collected all the required data, the trading journal should offer him the opportunity to check the data for their profitability.

To do so, he needs statistics, evaluations and above all, diagrams.

Pivot diagrams may make it possible to display the collected data graphically causing anything abnormal to immediately stand out.

Here is one example:

In Figure above a trader has been trading for three months and executed 100 trades, using nine strategies.

The result amounts to a profit of €16,060.

According to the evaluation, there are five profitable and four loss-making strategies.

If the trader were to stop using the loss-making strategy and exclusively concentrate on his profitable ones, his profit would amount to €20,518, representing an increase of approximately 22 percent.

In that case, however, not only would his profit rise but his hit rate would increase considerably as well.

The above example can also be used for each of the parameters entered at the trade entry whether it be the time of day, the entry signal, market volatility, product, mental state and all the others.

Altogether, you would then have 21 to 25 possible starting points to effect changes.

As you have seen in the example of Figure above, the evaluation of one individual parameter may have a major impact on your performance.

However, you would have more than 20 possible starting points according to the concept described.

You can see from this how much fine-tuning you could apply to your trading style by using such a trading journal.