FREE DOWNLOAD Best Moving Average For Forex Trading System and Strategy – A moving average can help cut down the amount of “noise” on a price chart. Look at the the direction of the moving average to get a basic idea of which way the price is moving.

Angled up and price is moving up (or was recently) overall, angled down and price is moving down overall, moving sideways and the price is likely in a range.

Demarker Technical Indicator (DeM)

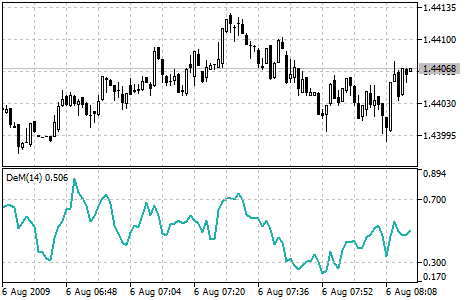

Demarker Technical Indicator (DeM) is based on the comparison of the period maximum with the previous period maximum.

If the current period (bar) maximum is higher, the respective difference between the two will be registered. If the current maximum is lower or equaling the maximum of the previous period, the naught value will be registered.

The differences received for N periods are then summarized.

The received value is used as the numerator of the DeMarker and will be divided by the same value plus the sum of differences between the price minima of the previous and the current periods (bars).

If the current price minimum is greater than that of the previous bar, the naught value will be registered.

When the indicator falls below 30, the bullish price reversal should be expected. When the indicator rises above 70, the bearish price reversal should be expected.

If you use periods of longer duration, when calculating the indicator, you’ll be able to catch the long term market tendency.

Indicators based on short periods let you enter the market at the point of the least risk and plan the time of transaction so that it falls in with the major trend.

Forex MA DeMarker Trading Rules

This is a trend momentum trading system.

- Best Time Frame : H1, H4, or D1

- Financial Markets : Commodities, Forex and Indicies.

Metatrader Indicators:

- De Marker

- SSL Fast sBar MTF

- Heiken Ashi Smoothed

- X Candles

- XMA v.2

- RSIOMA

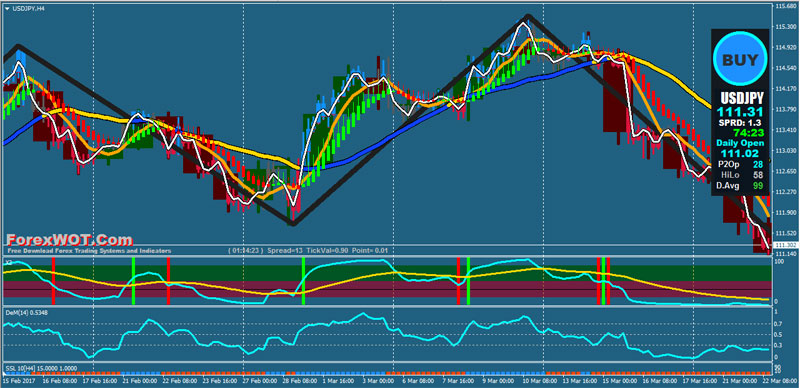

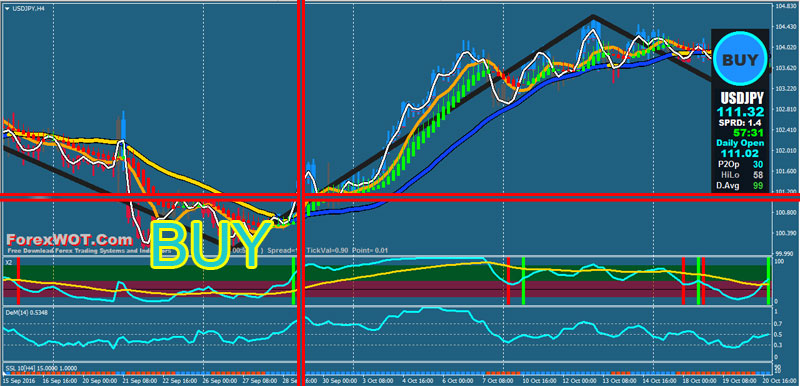

BUY Rules

- Only trades BUY when the trend line is blue and place stops at the previous day’s low

- De Marker line upward and above 0.5 level

- Price upward and above green Heiken Ashi Smoothed

SELL Rules

- Only trades SELL when the trend line is yellow and place stops at the previous day’s high

- De Marker line downward and below 0.5 level

- Price downward and below green Heiken Ashi Smoothed

RSI OMA Notes

- Use the orange line to get out of trades and back into continuation trades.

- Watch for RSI green and the Markers to show change in the trend.