Best of The Best RSI trading strategy – Top 7 Relative Strength Index (RSI) Winning Strategies For Trading Forex. The Relative Strength Index (RSI) is the most famous oscillators of them all.

30 and 70 levels are the levels where price is considered to be overbought (above 70) and oversold (below 30). The RSI travels between zero and one hundred and it is impossible at any one time to have negative values or values above the one hundred level. No matter how aggressive a move may be, those levels cannot be broken.

Top 7 Relative Strength Index (RSI) Winning Strategies For Trading Forex

The following are Top 7 Relative Strength Index (RSI) Winning Strategies For Trading Forex, and all of them are important for a trader, based on the trading style and the timeframe the oscillator is applied to. There’s not one approach more effective than another, there’s only one trader that pays more attention to details than another.

- High Accuracy Trendisimo-RSI Trading Strategy With T&C Wonders Signal Indicator

[sociallocker]

[/sociallocker]

-

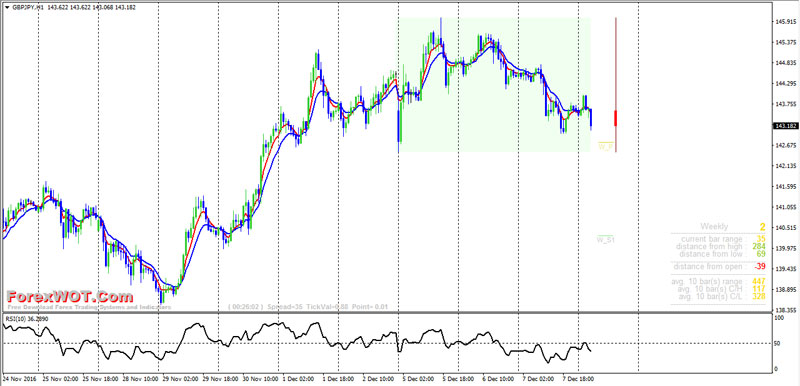

RSI Kijun-sen Forex Trading System And Strategy

-

Super Easy Amazing EMA Crossover Forex Trading System With RSI – 200 Pips Per Day

-

Trend MA RSI and Multi ADX Trading Strategy

[sociallocker]

[/sociallocker]

-

Forex Trend Reversal Points Trading System with RSI and Moving Average Indicators

-

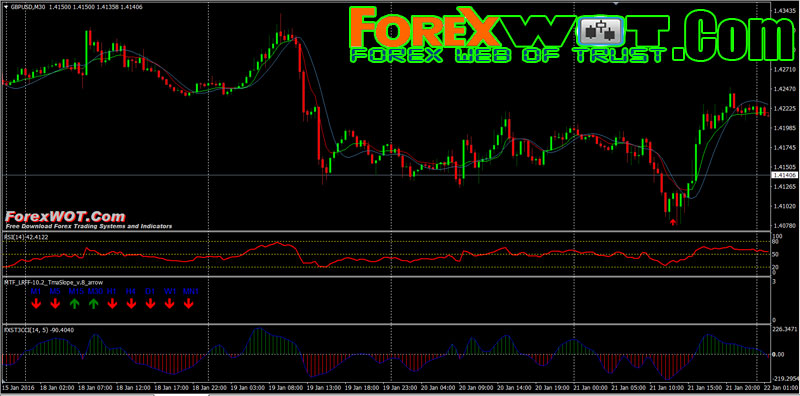

Forex M 30 Trading Strategy with Multi TimeFrame Single Trend and RSI

-

Easy Profits Double RSI Forex Trading System and Strategy

TRADING NOTE:

- Avoid trading too aggressively

Trading too aggressively is perhaps the biggest mistake new traders make. If a small sequence of losses would be enough to eradicate most of your risk capital, it suggests each trade has too much risk.

- Think long term

It stands to reason that the success or failure of a trading system, will be determined by its performance in the long term.

So be wary of apportioning too much importance to the success or failure of your current trade.

Do not bend or ignore the rules of your system to make your current trade work.