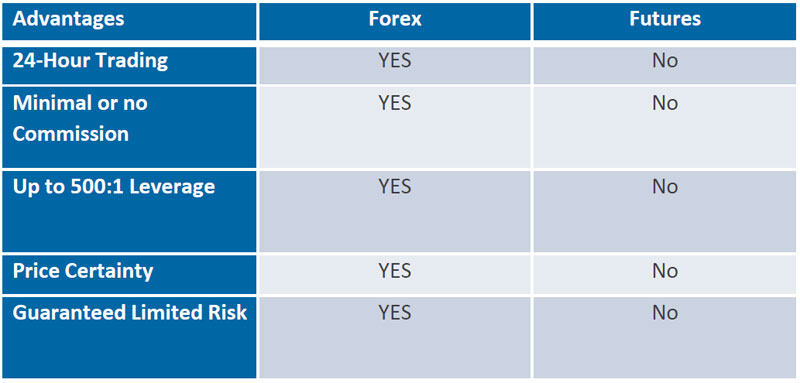

The Forex market also has of a bunch of advantages over the futures market, similar to its advantages over stocks. Here are just few of the examples:

Liquidity

In the Forex market, $4 trillion is traded daily, making it the largest and most liquid market in the world, whereas the futures market trades only 30 billion USD per day.

The futures markets can’t compete with its relatively limited liquidity. The Forex market is always liquid, meaning positions can be liquidated and stop orders executed with little or no slippage except in extremely volatile market conditions.

24-Hour Market

At 5:00 pm EST Sunday, trading begins as markets open in Sydney. At 7:00 pm EST the Tokyo market opens, followed by London at 3:00 am EST. And finally, New York opens at 8:00 am EST and closes at 4:00 p.m. EST. Before New York trading closes, the Sydney market is back open – it’s a 24-hour seamless market!

As a trader, this allows you to react to favorable or unfavorable news by trading immediately. If important data comes in from the United Kingdom or Japan while the U.S. futures market is closed, the next day’s opening could be a wild ride. (Overnight markets in futures currency contracts exist, but they are thinly traded, not very liquid, and are difficult for the average investor to access.)

Minimal or no commissions

With Electronic Communications Brokers becoming more popular and prevalent over the past couple of years, there is the chance that a broker may require you to pay commissions. But really, the commission fees are peanuts compared to what you pay in the futures market.

Price Certainty

When trading Forex, you get rapid execution and price certainty under normal market conditions. In contrast, the futures and equities markets do not offer price certainty or instant trade execution.

Even with the advent of electronic trading and limited guarantees of execution speed, the prices for fills for futures and equities on market orders are far from certain. The prices quoted by brokers often represent the LAST trade, not necessarily the price for which the contract will be filled.

Guaranteed Limited Risk

Traders must have position limits for the purpose of risk management. This number is set relative to the money in a trader’s account. Risk is minimized in the spot Forex market because the online capabilities of the trading platform will automatically generate a margin call if the required margin amount exceeds the available trading capital in your account.

Your account is protected by automatic Stop Out which closes the most negative trade when your margin level drops below 100%. This makes it very difficult for the account balance to go to negative. The risk grows slightly when keeping positions open over weekend when your margin level is already very low. After the weekend the markets may open on a different level and if this direction is even more on the negative for you, it is possible that the account balance goes to negative.

In the futures market, there is a chance that your position may be liquidated at a loss bigger than what you had in your account, and you will be liable for any resulting deficit in the account.