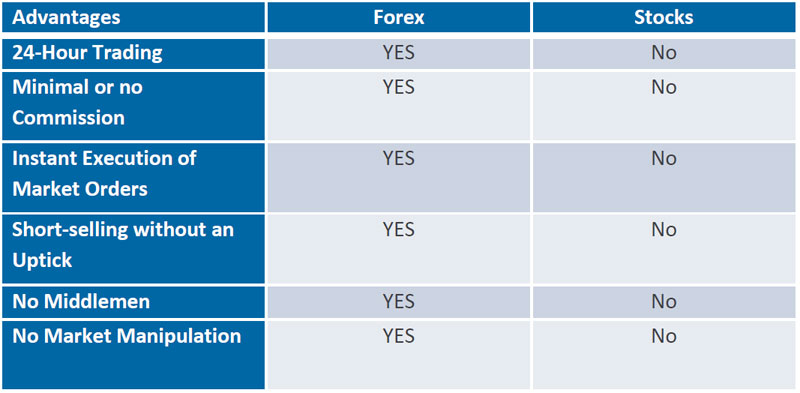

If we for example look at the New York Stock exchange, there are about 4 500 stocks listed. Another 3 500 are listed on the NASDAQ. Which one will you trade?… Have you got the time to follow so many companies? In spot currency trading, there are dozens of currencies traded, but the majority of market players trade the four major pairs. Aren’t four pairs much easier to keep an eye on than thousands of stocks?…

That’s just one of the many advantages of the Forex market over the stock markets. Here are a few more:

24-Hour Market

The Forex market is a continuous 24-hour market. Most brokers are open from Sunday 22:00 GMT+0 until Friday 22:00 GMT+0, with customer service available 24/5. With the ability to trade during the US, Asian and European market hours, you can customize your own trading schedule.

Minimal or No Commissions

With some of our trading accounts there is no commission or additional transactions fees to trade currencies online or over the phone. Combined with the tight, consistent, and fully transparent spread, Forex trading costs are lower than those of any other market. In addition, with some trading accounts brokers are compensated for their services through the bid/ask spread.

Instant Execution of Market Orders

Your trades are instantly executed under normal market conditions. Under these conditions, usually the price shown when you execute your market order is the price you get. You’re able to execute directly off real-time streaming prices.

Keep in mind that most brokers only guarantee stop, limit, and entry orders under normal market conditions.

Short-Selling without an Uptick

Unlike the equity market, there is no restriction on short selling in the currency market. Trading opportunities exist in the currency market regardless of whether a trader is long or short, or whichever way the market is moving. Since currency trading always involves buying one currency and selling another, there is no structural bias to the market. So you always have equal access to trade in a rising or falling market.

No Middlemen

Centralized exchanges provide many advantages to the trader. However, one of the problems with any centralized exchange is the involvement of middlemen. Any party located in between the trader and the buyer or seller of the security or instrument traded will cost them money. The cost can be either in time or in fees.

Spot currency trading, on the other hand, is decentralized, which means quotes can vary from different currency dealers meaning that Forex traders get quicker access and cheaper costs.

Buy/Sell programs do not control the market

How many times have you heard that “Fund A” was selling “X” or buying “Z”? The stock market is very susceptible to large fund buying and selling.

In spot trading, the massive size of the Forex market makes the likelihood of any one fund or bank controlling a particular currency very small. Banks, hedge funds, governments, retail currency conversion houses, and large net worth individuals are just some of the participants in the spot currency markets where the liquidity is unprecedented.

Analysts and brokerage firms are less likely to influence the market

Foreign exchange, as the prime market, generates billions in revenue for the world’s banks and is a necessity of the global markets. This means that analysts in foreign exchange have very little effect on exchange rates; they just analyze the forex market.