Forex Trading Success Tips and Tricks – How To Avoid Losing Money in Forex?… This is a great question, because when you are familiar with the top reasons why forex traders lose money, you can improve yourself and already be one step ahead of the rest of retail traders.

I’ve written an article about the 5 most critical reasons why most forex traders lose out, have a look if you’re interested. It comes with actionable ways on how to fix these trading issues, so you can avoid losing money.

Why People Are Losing Money

There are many ways to lose money on the forex market.

I think the main driver is that people get caught up in emotion because of the possibility of an easy gain but that leads to huge losses on a longer-term.

You have to stay disciplined and focused in order to make profit.

Here are some of the highlights, the top reasons I believe why people are losing money (and it’s not about forex knowledge, that’s the easy part):

Poor Risk Management

By far the number one on this list, people risk way too much.

Forex is leveraged trading and it’s incredibly easy to wipe out your account by risking much more than what you can afford.

Even world class traders such as William Eckhardt will not risk more than 2% of their account balance on a trade. Why would you?…

No Discipline

Once you reach a decent level of forex knowledge, this is what most of us will be struggling with.

So many people jump into trades, just to feel the excitement of being in a trade. Or maybe you’re often widening your stop loss or taking profits too early? Also know about trading psychology and how things like cognitive biases will influence your trading behaviour.

No Structure

There are so many traders that just randomly enter trades and don’t really know why they took a given trade.

It’s bad for 2 reasons:

- first off, since you have no record of your trades, you can’t figure out what works or what doesn’t.

- The other reason is that you’re much less accountable if you don’t have a clear trading plan and journal in place, so you’ll be much more likely to just impulsively try something.

Many traders lack structure. A trading plan and journalling every trade can provide that structure.

After years of trading, I still use a checklist to see if the trade I’m taking is according to my trading plan.

Recommended Forex Trading Books

You should read some good books on forex trading and markets.

Books have always been and will always be an invaluable source of information that you can use for ideas, knowledge and enjoyment.

There are many books that are available to new traders but while you start being a Pro, the choice starts funneling down and you have to be picky about it.

Also, some books are pure lengthy and might make you bore in the middle, even if being too important while others are like education with entertainment. And here are some good forex books:

- “Currency Trading for Dummies” by Mark Galant and Brian Dolan

- “Trading in the Zone” by Mark Douglas

- “Day and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves” by Kathy Lien

- “The 10 Essentials of Forex Trading: The Rules for Turning Trading Patterns Into Profit” by Jared F. Martinez

- “The Sensible Guide to Forex: Safer, Smarter Ways to Survive and Prosper from the Start” by Cliff Wachtel

- “Enhancing Trader Performance: Proven Strategies From the Cutting Edge of Trading Psychology” by Brett Steenbarger

- “Market Wizards” by Jack Schwager

- “Japanese Candlestick Charting Techniques” by Steve Nison

- “Trade Your Way To Financial Freedom” by Dr. Van Tharp

- “Trading With Intermarket Analysis, Enhanced Edition: A Visual Approach to Beating the Financial Markets Using Exchange-Traded Funds” by John J. Murphy

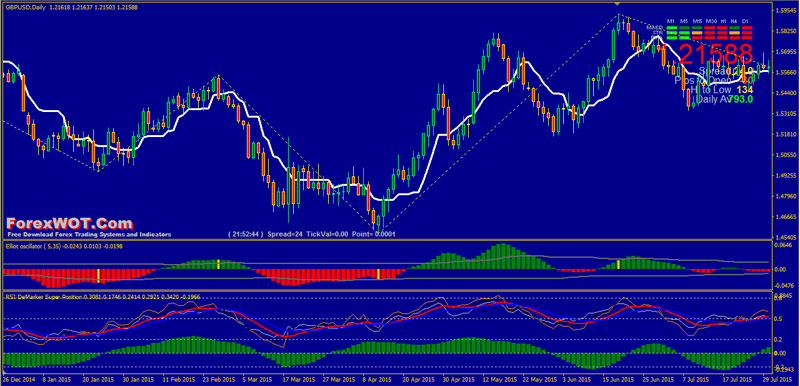

FREE DOWNLOAD Forex Trading System

FREE DOWNLOAD Forex RSI DeMarker Trading System Software – The only thing that could make this system fail over the long term is you not sticking to the rules…….that’s it!

RSI DeMarker Super Position indicator for MetaTrader 4 – As a rule it takes a lot of time to switch between periods and indicator parameters for comparing their behavior and detecting a true indicator development dynamics.

The indicator was developed after the working area was filled by a set of standard indicators with different parameters.