Simple Easy Forex Auto Fibo Trade Zone Trading Strategy (Fibonacci 50% Retracement System). This Auto Fibo Trade Zone forex trading indicator is designed to draw a Fibonacci retracement and trading zone, using as a basis the ZigZag indicator.

When studying technical analysis many traders come across a variety of methods for determining support and resistance. One of the most used methods for finding these pricing levels includes Fibonacci retracements and trade zone.

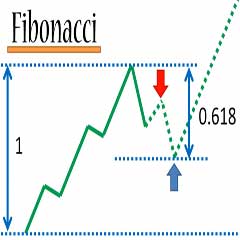

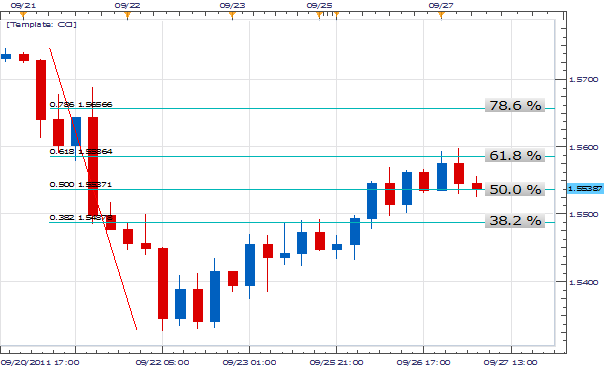

Fibonacci retracements of 23.6%, 38.2%, 50%, 61.8% and 78.6% are often used in financial markets.

Visually these points are represented on the graph by horizontal lines denoting support and resistance levels.

Traders may use these lines in a variety of ways.

Traditionally, traders begin to look for price to move from these levels back into the direction of the initial trend.

Forex Auto Fibo Trade Zone Trading Rules

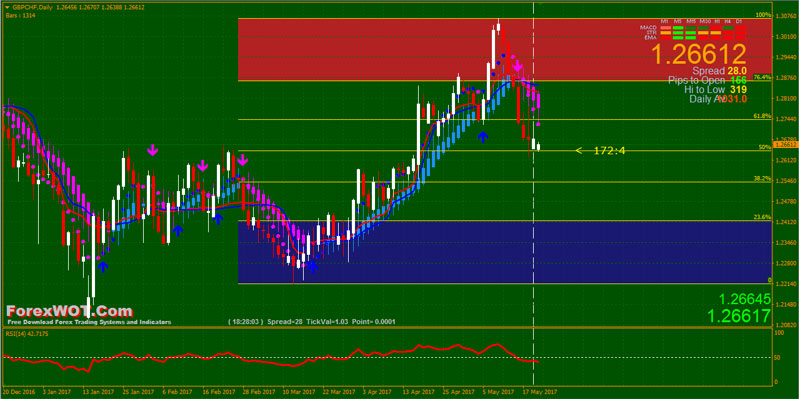

It is important to remember that Fibonacci retracements can be used on a variety of charts as well as time frames.

Once retracement levels are found, these technical points lend themselves to potentially trade a swing back in the direction of the primary trend.

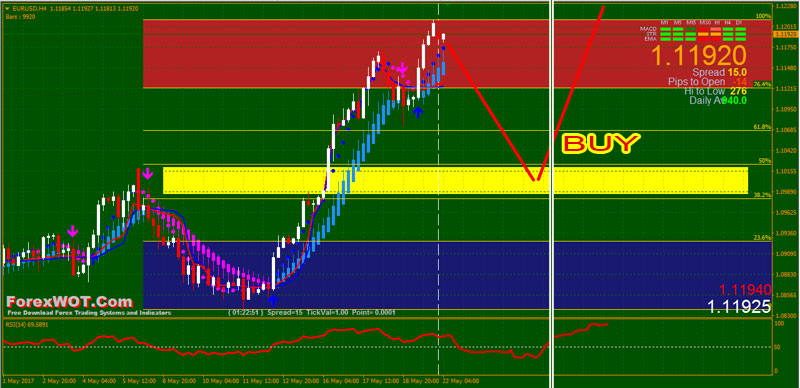

Traders can place entries near the Fibonacci retracements themselves, but more often than not Fibonnacci retracements can be used in conjuncture with other technical indicators like RSI (Relative Strength Indicator) because it reflects momentum, and it is well established that following Forex momentum can give you a winning edge. .

The RSI is a Forex momentum indicator, and it is the best momentum indicator.

If you are going to use the RSI, the best way to use it is to trade long when it is showing above 50 on all time frames, or short if below 50 on all time frames.

It is best to always trade with then trend.

50% Fibonacci Retracement Swing Trade

- Bullish Swing Trade

Look for a bullish price thrust that clears above the previous swing high with strong momentum. Mark out a “retracement zone” between 50% and 61.8% of the price thrust.

After price falls down to the retracement zone, buy above any bullish bar.

- Bearish Swing Trade

Look for a bearish price thrust that clears below the previous swing low with strong momentum. Mark out a “retracement zone” between 50% and 61.8% of the price thrust.

After price rises up to the retracement zone, sell below any bearish bar.

The examples below show the 50% retracement zone

Bearish Engulfing (Price Action Trading) Fibonacci 50% retracement zone

Fibonacci Retracements Notes

The Fibonacci retracement is a trend following tool, and helps isolate where pullbacks may end and the trend resumes.

Don’t place all your trust in it though.

The price may not stop exactly at a Fibonacci level, rather the levels are just a guide.

Don’t try to force a tool to work if it isn’t working; you don’t need to use Fibonacci levels to trade successfully. Only use the Fibonacci retracement tool in conjunction with price analysis and as part of a complete trading plan.