“GBP-JPY Forex Trading” – Best TOP 5 GBP-JPY or USD-JPY Forex Trading System and Indicators. The BRITISH POUND – JAPANESE YEN currency pair is a volatile offering that presents traders with potentially large moves in price relative to many other pairings.

This currency pair is, at times, so volatile that it has earned the nickname of ‘The Dragon,’ as well as another well-coined term: “The Widow-maker.”

FREE DOWNLOAD Best TOP 5 GBP-JPY Forex Trading System and Indicators

Trading a currency pair like GBPJPY could be optimal for traders looking for volatility or large moves; but it should be noted that those moves aren’t always very smooth; which is exactly why overall profitability wasn’t higher on the pair.

The first point of emphasis is that given the above points, trading in GBPJPY should always entail a protective stop-loss order. Lack of doing so exposes the trader to significant risks as the pair may trend for an extended period of time.

Due to this volatile nature, and given the fact that the pair could trade with very wide swings in either direction, breakouts can be an attractive approach when trading GBPJPY. This will allow traders to maximize profits on the large swings when they are right; while also allowing them to cut their losses short as the big swings move against them.

-

Stoch Bollinger Bands Pro FX Forex Trading System & Strategy

Please feel free to have a look. I am about to make a bold claim here, this system does and will work if used properly.

It is important that everyone has a good working knowledge of Risk Management. The system is only a part of making money and keeping it.

-

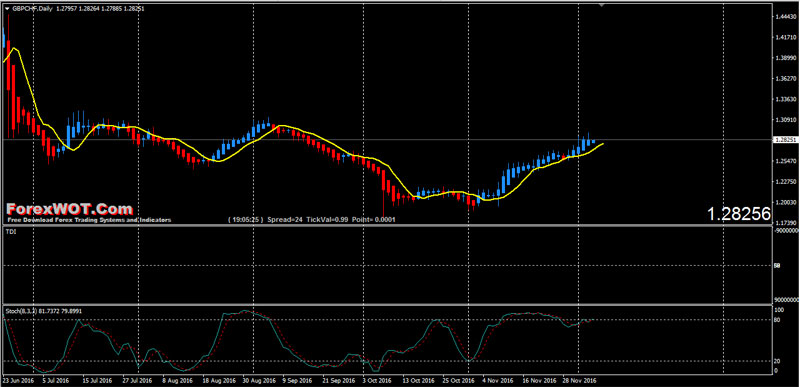

Forex Heiken Ashi candles TDI Stochs Trading Method

Very Profitable Forex Heiken Ashi candles TDI Stochs Trading Method – I am a price action trader by nature and have always resisted indicators overall, but the reality is even a Japanese candlestick is an indicator.

The nice thing about Heiken Ashi candles is that you can apply price action analysis to them to get a good idea of where price may go. Price action for an Heiken Ashi chart is a little different but there are some similarities.

-

Forex Multiple Moving Averages and Momentum Trading Strategy

Multiple Moving Averages and Momentum Trading Strategy – A trading system is based on 4 indicators: MACD Candles, FX Graphics, FX CMA, and Momentum.

[sociallocker]

[/sociallocker]

The main principle of trading in the financial markets – to understand the indicators when you open positions. Use these indicators to confirm a high probability of successful trades. This particular trading strategy will show you trading oppurtunities in two market conditions: trending market and volatile market.

-

Simple High Probability Forex Trade Areas Trading Strategy with Currency Correlation Indicator

High Probability Forex Trade Areas – You can trade this method on any timeframe and on any currency pair. This also works on non-Forex charts, so if you trade Oil or Gold, you are still good.

[sociallocker]

[/sociallocker]

The Levelator will give us levels in which we can:

- Buy or sell.

- Place a stop loss.

- Place a take profit order.

By default, the Levelator will look to identify the lowest low and the highest high over the last 100 candles and then connect them.

-

Forex Heiken Ashi Smoothed Trend Trading System with Double CCI and HAS Bar

Forex Heiken Ashi Smoothed Trend Trading System is an trend following trading system based on the Heiken Ashi Smoothed, MTF 4TF Has indicator and Double CCI indicator.

The Heikin-Ashi Smoothed technique is used by technical traders to identify a given trend more easily. Hollow candles with no lower shadows are used to signal a strong uptrend, while filled candles with no higher shadow are used to identify a strong downtrend.

Trading NOTE:

Yen crosses are a whole different beast. Some yen crosses, such as GBP/JPY, are known to be action-packed and highly volatile. They can produce big, sharp moves and shower you with pips, but they can also chew you up and spit you out faster than you can say “Stopped out!”

As such, you have to be extra careful when trading these currency cross pairs.