High Profitability Forex 50 Day Moving Average Strategy (Best Moving Average Strategy for Intraday and Swing Trading). The 50EMA Forex Trading Strategy is one trading strategy that is so simple that you can use to trade using any currency pair in any pair timeframe.

You can substitute 50 exponential moving average (50 EMA) with other ema’s like 10, 20, or 30. ForexWOT 50 Day Moving Average Strategy is one of the easiest trading system with 50 EMA.

Forex 50 Day Moving Average Strategy

ForexWOT 50 Day Exponential Moving Average Strategy Is A Very Simple Forex Trading System Which is Very Easy To Understand And Implement.

Best Time Frames: 30 Minutes, H1, H4, and D1

Recommended Currency Pairs: Any

MetaTrader Trading Indicator

- Exponential Moving Average

- ++ Power

- ITMF SigAlert

- Volatility Quality

- PJ Over RSI

- Signal Trend

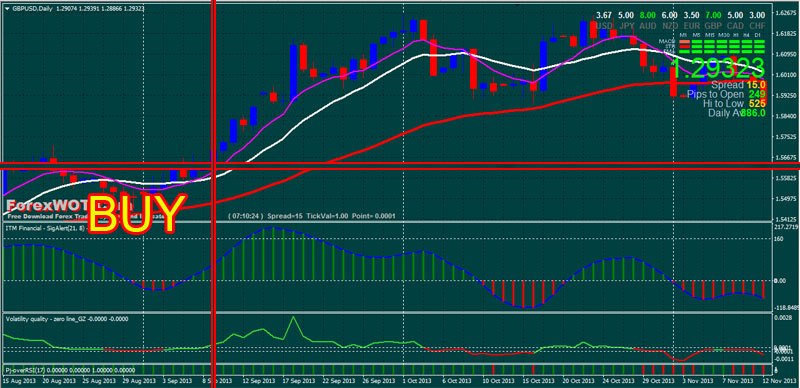

BUY Rules

- Price upward above 50 EMA

- 10 EMA above 20 EMA

- ITMF SigAlert green histogram and above 0 level

- Volatility Quality line green color and above 0 level

- Signal Tren green bars

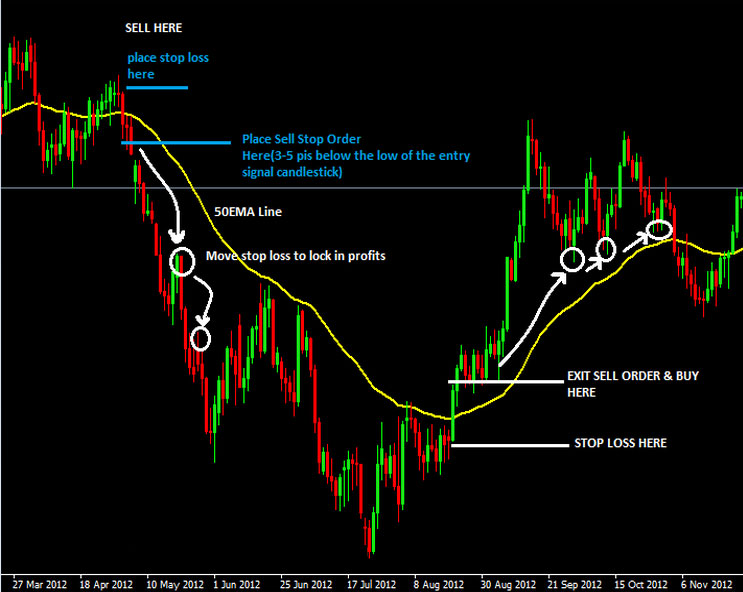

SELL Rules

- Price downward below 50 EMA

- 10 EMA below 20 EMA

- ITMF SigAlert red histogram and below 0 level

- Volatility Quality line red color and below 0 level

- Signal Tren red bars

EXIT Rules and Position Options

Fast Profit Target predetermind that depends by Currency pair and time frame (example: EUR/USD 30 min TF PT=150 pips, 60 min TF PT= 250 pips, 240 min TF PT= 400 pips, and D1 = 1500 pips) ;

Move stop loss to breakeven when price moves by the amount your risked. But in my experience with this is that you tend to get easily stopped out with a loss.

The best option is to wait until price forms those peaks and valleys of price swings and use these price swings to move stop loss to lock in more profits as price moves favourably. See chart below…