High Accuracy USDJPY Daily Technical Trading – As one of the most popular currency pairs on the forex market, the USD/JPY is a versatile, high volume currency with many unique traits.

USD/JPY has exceptionally high market volume. It’s based on two of the largest and most active currencies in the world- trading USDJPY.

Because of its popularity, it is also supported by virtually all markets and brokers.

It’s easy to find trading tips and forex signals for this currency pair.

USD/JPY has long periods of stability along with volatility, and this creates a potential for forex traders.

Volatility within this currency pair is often driven by Asian market forces, making USD/JPY a gateway currency into the east.

The USD/JPY market is also very associated with commodities trading in Japan, which makes it easier for the currency to be predicted.

Traders can look at the current global market for exports and imports in order to identify potential trading strategies.

This makes the pair uniquely easy to research.

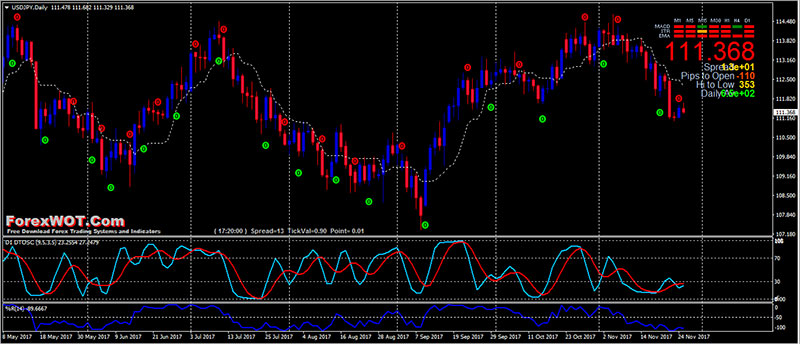

Some forex traders use the same trading system and strategy for all currencies, but this trading system works extremely well for USDJPY pair and daily time frame.

- Best Time Frame: Daily

- Best Currency Pairs: USDJPY

- Signal Trend

- Tenkan-Sen Ichimoku Kinko Hyo

- DT oscillator and Arrow

- Williams’ Percent Range

- DT oscillator bullish and green arrow

- Price upward above Tenkan-Sen Ichimoku Kinko Hyo line

- Williams’ Percent Range line upward and above -50 level

- DT oscillator bearish and red arrow

- Price downward below Tenkan-Sen Ichimoku Kinko Hyo line

- Williams’ Percent Range line downward and below -50 level

Below are three specific traits of USD JPY currency pair on forex you should know:

- When you trade Japanese YEN to USD you need to know that historically this currency pair has an incredibly powerful resistance level at 146 as well as the strong support level at 76.

- JPY holds the third position among all currency pairs on Forex: only USD and EUR are more volatile.

- The USD/JPY pair is much more dependent on the fundamental analysis rather than other major pairs.